The cost of the post-pandemic office

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Sentiment in freefall

UK economic growth ran out of steam in March. The official measure of GDP shrank 0.1%, which caps a quarterly expansion of 0.8%. That could well mark the high point this year.

Consumer sentiment is "in freefall", according to Kay Neufeld, head of forecasting at the Centre for Economics and Business Research (Cebr). The Cebr/YouGov gauge of consumer sentiment fell for a fifth month in April to its lowest reading since November 2020. Sentiment around household finances - both in the past and in the future - is running at the lowest level since the survey began a decade ago.

Headwinds are building rapidly but there are relatively few signs of an impending property market slowdown at the moment. A net balance of +10% of respondents to the latest RICS Residential Market Survey reported a rise in new buyers’ enquiries in April, the eighth successive month in which the survey has returned a positive net balance. Respondents once again reported a subdued trend in listings. Knight Frank Head of UK Residential Research Tom Bill tells Yahoo Finance:

"Demand is now robust rather than fierce as the economic uncertainties mount but supply remains stubbornly low, which is largely the result of a vicious circle that means owners are holding back from listing because they cannot find anywhere to buy themselves."

Counter-cyclical real estate

With a recession on the cards, investors will naturally seek out deals that offer secure income, opportunities, a potential hedge against inflation, diversification, and so on... see Wednesday's note.

Residential Investments sectors, encompassing student housing, co-living, multifamily and single-family rental and seniors housing, are set for a period of rapid growth. Our latest survey of 54 leading investors who currently account for £76 billion in residential assets under management are on the hunt for deals. Some 80% of respondents are expecting to ‘significantly increase’ their exposure over the next five years.

In the short term, the survey suggests that residential investment volumes will top a record £16.5 billion in 2022, up from the £10.2 billion spent in 2021. An additional £75 billion has been earmarked to deploy across the sectors over the next five years, equivalent to a doubling of current committed capital.

The sectors aren't without challenges. A lack of operational stock was the most cited barrier for increasing investment, followed by competition from other investors, and the availability of development and funding opportunities. The survey returned some fascinating insights spanning the degree to which ESG is influencing investment strategies, a push to diversify into new markets and the changing manner in which debt markets view residential, all of which we'll return to in the coming weeks.

Land prices

Spikes in energy and commodity prices as a result of Russia's invasion of Ukraine are just beginning to feed into the price of UK construction materials - see Monday's note for more.

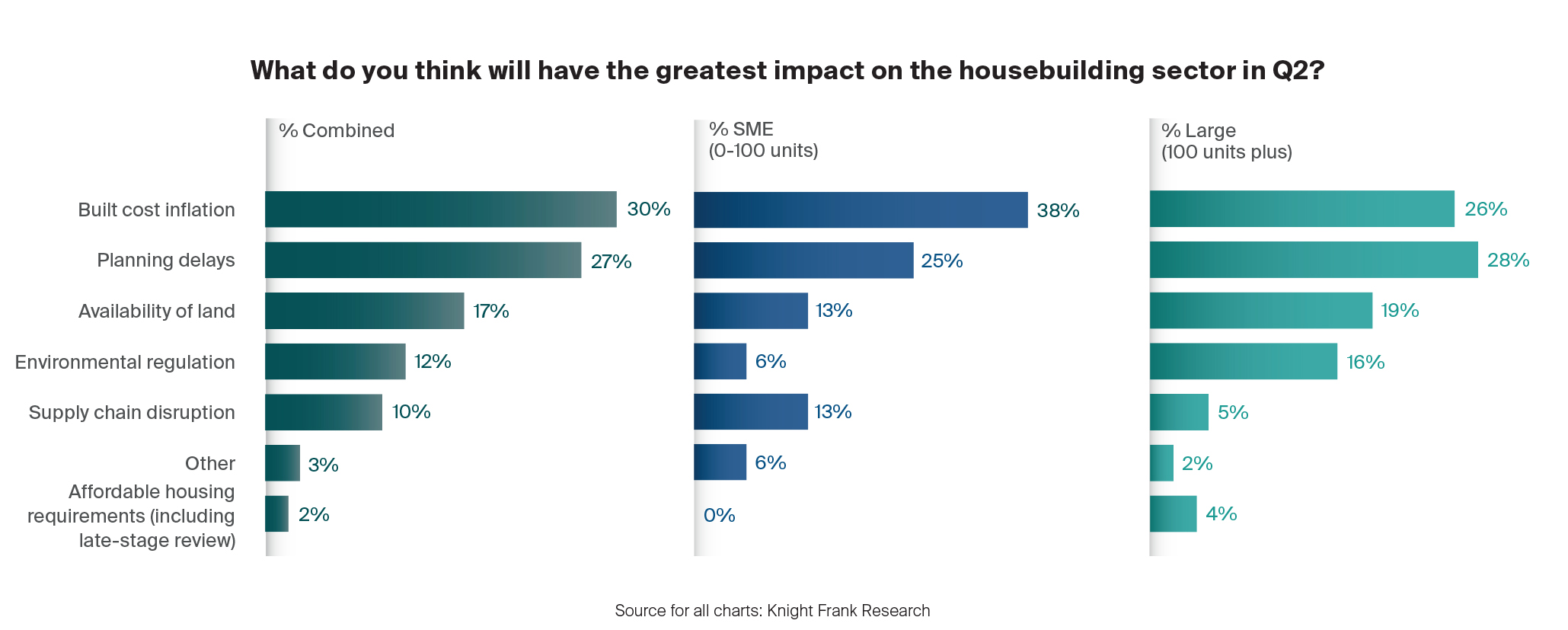

Price spikes are now heavily impacting sentiment among housebuilders. In our fifth residential development survey of volume and SME housebuilders, 40% of respondents said they believe ‘build cost inflation’ and ‘supply chain disruption’ will have the biggest impact on the sector in Q2, with over a quarter citing planning delays as another key issue (see chart).

Land availability is poor and getting worse. Some 85% of respondents said that land availability was either ‘limited’ or ‘very limited’ in the first quarter of 2022, up from 70% in Q4 2021. Against this backdrop, the majority expect land prices to either rise (47%) or stay the same (44%) next quarter.

It's been a big week for housing policy, perhaps more so for what isn't going to happen than what is. In this week's Intelligence Talks podcast, Anna Ward is joined by Knight Frank’s heads of planning and energy – Stuart Baillie and David Goatman. They discuss the impact of shelving comprehensive planning reform and giving local residents more say over development, and assess government plans to toughen up net zero rules - housebuilders must reduce carbon emissions in new homes by 30% from next month. Listen here, or wherever you get your podcasts.

The new office

The provision of amenities in large office buildings has improved rapidly in the most recent five years. Best practice now extends beyond end-of-trip facilities such as showers and changing rooms to include smart technologies, healthcare and spaces that support mental wellbeing.

During the post-pandemic era we expect to see new forms of amenity emerge that reflect changing business agendas and the new contract between employee and employer, particularly when it comes to sanctuary and learning spaces to support up-skilling and re-skilling.

Knight Frank this week released its M25 office market report for 2022, named 'Navigating the property lifecycle'. The report includes a case study from Knight Frank’s Building Consultancy team that maps out the costs of a hypothetical office refurbishment project in 2017 vs 2022. The subject building spans ground, first and second floors, measuring 50,000 sq ft net (62,500 sq ft gross). It features a brickwork façade, three lifts, and a four-pipe fan coil heating/cooling system and mechanical ventilation. The building has an EPC rating of D with no current environmental accreditations.

In 2017, the cost of refurbishing to modern standards equated to £104 psf. But by 2022, this cost has risen +66% to £175 psf. This is because in addition to the +16% increase in tender prices, an additional £3.4m of costs were identified to achieve newer 2022 standards, including improving the EPC rating from D to B, £650,000 worth of enhancements, including replacement of the building management system to better monitor energy consumption, and £1 million for development of quality amenity space in line with current occupier demand, including provision of outdoor and wellbeing space.

In other news...

Elsewhere - Bank of England interest rate could hit 4% or more, ex-policymakers warn (Reuters), BoE is not yet done with rate hikes, Ramsden says (Reuters), Chinese property developer Sunac defaults as lockdowns hit house sales (FT), WeWork narrows quarterly losses (FT), China rate cut in focus as zero Covid takes its toll (Bloomberg), and finally, US mortgage rates rise to their highest level since summer 2009 (Bloomberg).