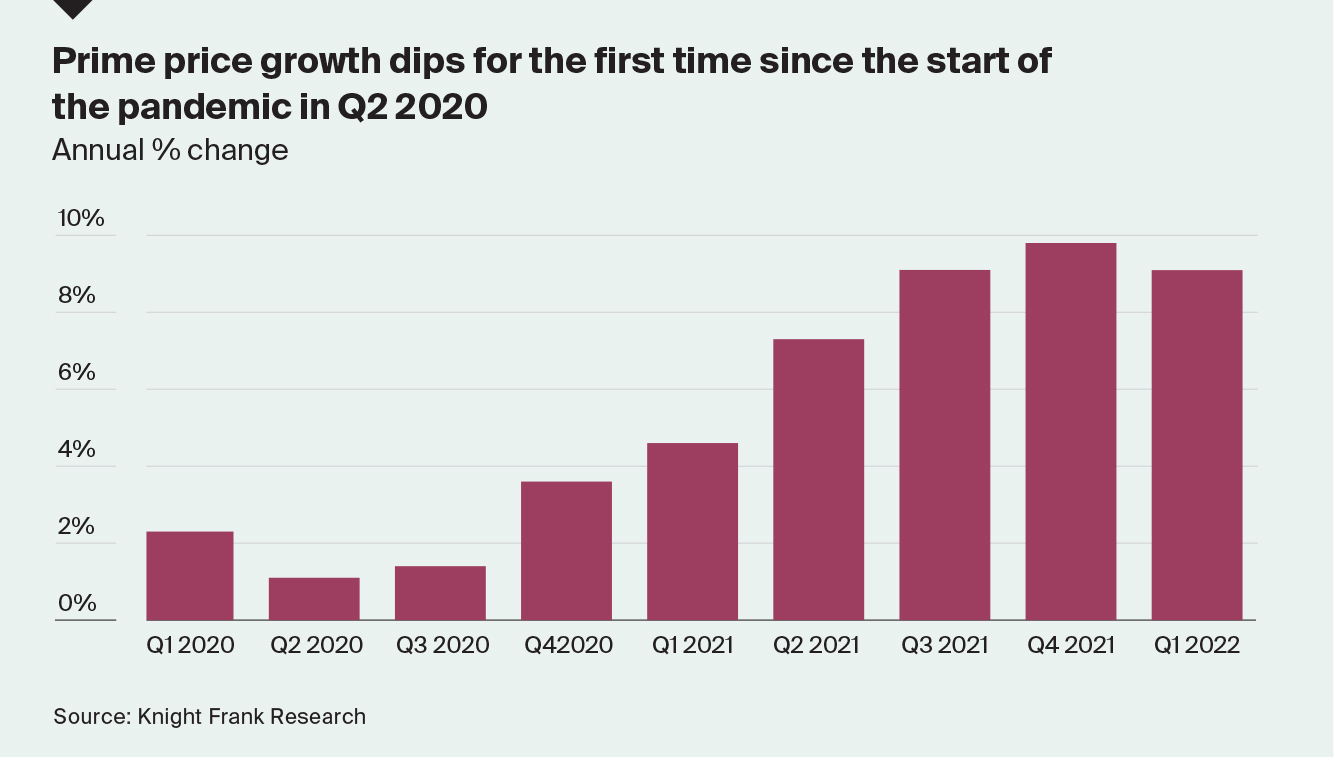

Prime price growth slows for the first time since the start of the pandemic

Prime price growth slowed for the first time since the start of the pandemic, although on average prime cities continue to register 9% annual growth.

2 minutes to read

What’s changed? There’s no denying the pandemic-induced boom is winding down. The macroeconomic climate looks very different with an end to asset purchases and tighter monetary policy now the order of the day. Inflationary pressures are fuelling a higher cost of living and rising mortgage rates are starting to weigh on buyer sentiment.

The biggest slowdowns over the last quarter were across Asia Pacific. Wellington, Guangzhou, Shanghai and Shenzhen saw their annual rates of growth slide by 17%, 15%, 8% and 7% respectively over the three month period.

New waves of Covid-19 and a zero-Covid policy in countries like China saw some housing markets halted in their tracks, while four rate hikes in New Zealand over the last six months have dampened buyer appetites.

Despite these mounting headwinds and the backdrop of slower economic growth – the IMF expects global GDP to average 3.6% in 2022, down from its previous estimate of 4.4% – governments are starting to intervene to cool house prices.

Canada’s foreign buyer ban, announced in March, comes at a time when prime prices (and sales) were already slowing. Prime price growth in Vancouver now sits at 8.8%, down from 15% a year ago.

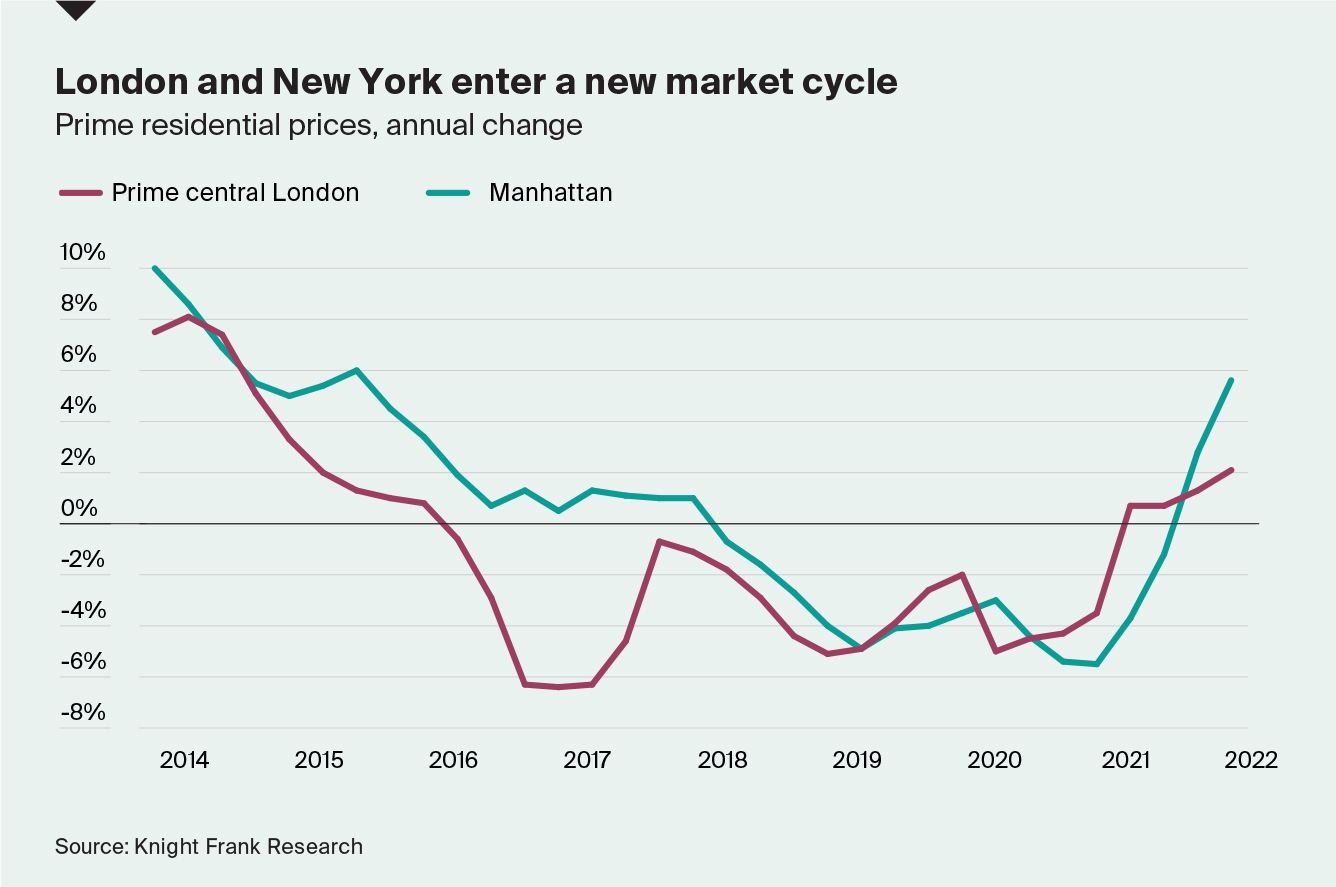

Prime prices in two of the world’s largest residential markets, London and New York, are rising at their fastest rate for seven and six years respectively.

At 2.1%, London is shaking off years of political uncertainty and tax changes with annual price growth expected to end the year at 3.5%.

At 5.6% annual growth, New York is following a similar trajectory. After six years of subdued activity sales increased 10% in Q1 2022 compared to Q1 2021.

The crisis in Ukraine and a weakening economic outlook for Europe are key challenges, but President Macron’s recent victory and a weaker euro may bolster interest from overseas, particularly from US dollar buyers, or those currencies pegged to the dollar. At the end of last year, a €1m property cost a US buyer $1,137,270, four months later the same property costs $1,070,780 as a result of currency shifts, almost 6% or $66,490 less.