30-year mortgages, the unravelling of Zero Covid and the wealthy flock to Dubai

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

You can fix for 30 years

Insurer Rothesay will soon join the small but growing roster of companies offering mortgage borrowers the chance to fix their interest rate for decades.

According to a report in this morning's FT, the company will soon offer 25- and 30-year fixed-rate deals to borrowers. We touched on this back in March, when Habito started offering fixed rate mortgages with terms between 10 and 40 years for borrowers with deposits of at least 10%. It's unclear exactly how the pricing will stack up in Rothesay's products, but Habito's rates at the time of launch were between 2.99% and 5.35% with a £1,995 product fee.

The announcement comes at a time when investors are anticipating the fastest round of interest rate rises for a century. However, we're only just seeing the withdrawal of mortgage products at sub-1% rates and any hikes are likely to be slow and steady.

Zero Covid

In recent months we've seen the gradual unravelling of 'Zero Covid' strategies, most notably in New Zealand and Australia. As the world opens up, pressure is building on those still holding out.

Hong Kong still has one of the world's strictest quarantine policies, with incoming travellers expected to quarantine for at least three weeks. That's putting its status as a global financial hub at risk, according to the Asia Securities Industry & Financial Markets Association, which represents most of the global banks and asset managers in Hong Kong. The group said almost half of its members are contemplating moving staff or functions away from the city due to uncertainty over when quarantine restrictions will be lifted.

The warning comes at an important moment for Hong Kong's office market. Prime rents in Hong Kong SAR have been declining since 2018, but the market appears to have turned a corner in Q3 2021 with a rebound in leasing momentum. That is in part due to pragmatism among landlords and the vacancy rate in Hong Kong is now falling.

Residential investments

Institutional investment continues to flow into the UK seniors housing market, with more than £800 million spent in the first nine months of the year – up a huge 73% on comparable 2020 levels.

Rising investment reflects strong demand from investors to gain a foothold in a sector which, at its core, is underpinned by solid long-term demographic change. People are living longer, and are healthier in their old age than ever before.

The surge is also part of a broader push into the Residential Investments sectors, which includes student accommodation and PRS. Together, they give investors access to consumers from the moment they start university into old age. According to this morning's Times, Goldman Sachs will plough another £200m into the PRS sector, with a deal to buy 700 family homes from Urban & Civic.

Dubai

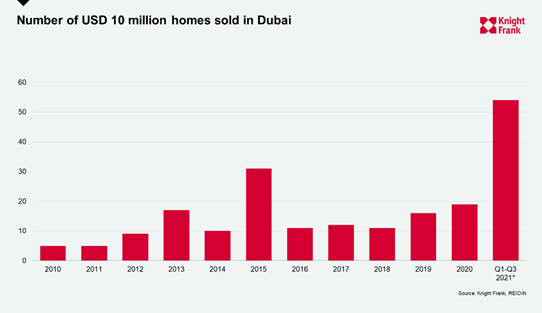

Dubai's rapid response to the pandemic means it has been on the receiving end of an influx of the world's wealthy. The number of $10m plus homes sold currently stands at 54, smashing the previous record of 31, set back in 2015, according to the latest data from Faisal Durrani.

In other news...

Tom Bill explains why International buyers are back, but it’s not business as usual.

Stephen Springham unpicks the latest retail sales data from the ONS.

Elsewhere - Rare Michael Jordan Nikes sold for $1.47m at auction (Bloomberg), US Democrats mull a billionaire tax (Reuters), competition ruling could boost the City of London (Times), Barratt tests every option for modern home from A to Z (Times), Evergrande resumes work on projects in southern China (FT), and finally, China expands property tax trials in next step of ‘common prosperity’ drive (FT).

Photo by Ruslan Bardash on Unsplash