International residential update - 22 July

Welcome to this the first in a new monthly series of international updates identifying the latest data and trends influencing residential markets globally.

3 minutes to read

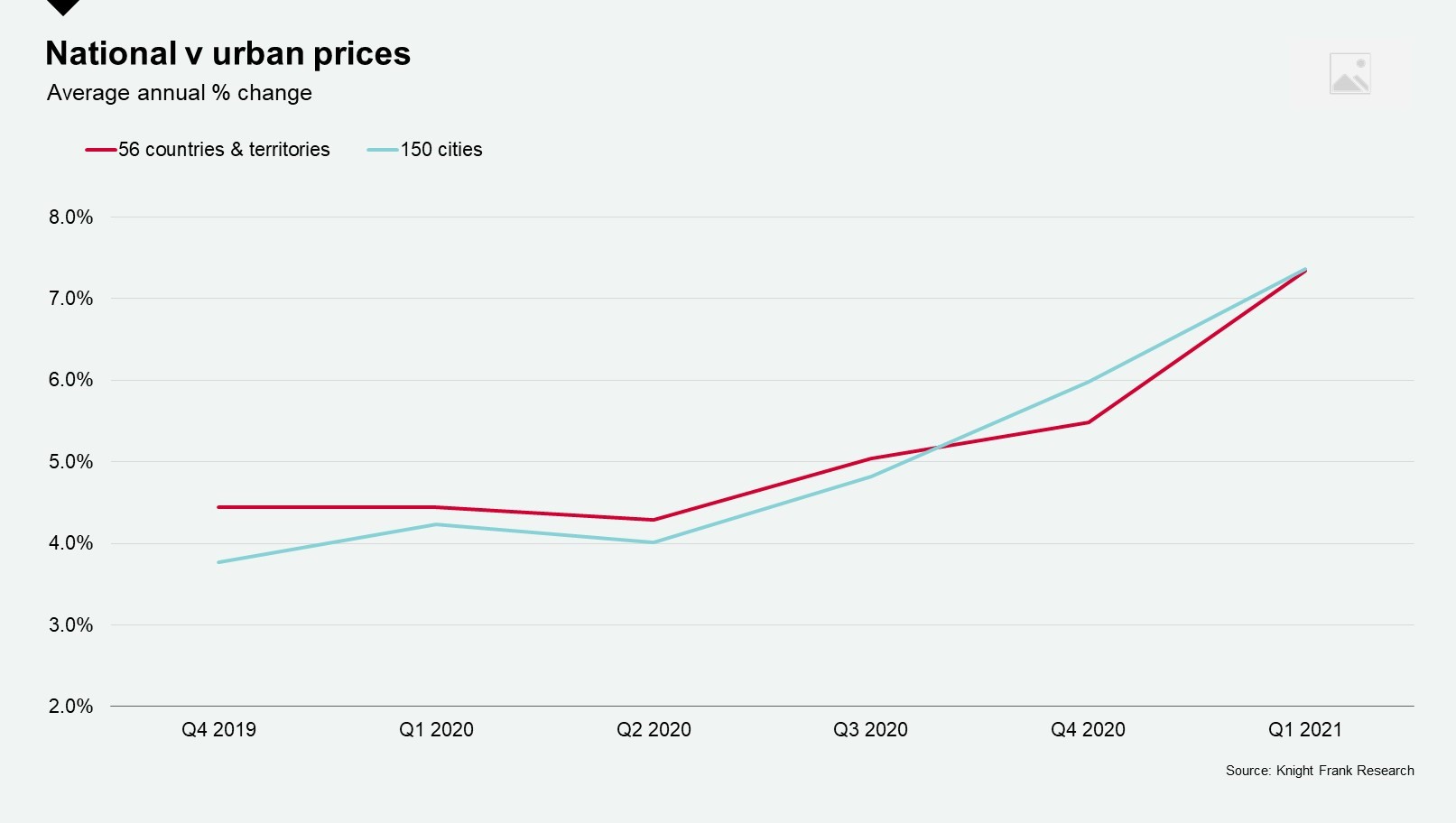

Cities are now outperforming national housing markets. Last week I published the latest edition of Knight Frank’s Global Residential Cities Index which confirmed that average prices across 150 cities are rising at their fastest rate since 2007. Forty-three cities are now registering annual price growth above 10%, up from just one a year ago.

Far from underperforming their national housing markets, as many expected a year ago, cities are now outpacing them….just.

Across 150 cities prices increased by 7.4% on average in the year to Q1 2021, the comparable figure across 56 countries and territories was 7.3%.

The index results are backed up by Oxford Economics’ latest Global Cities findings: “We are still mostly sceptical whether healthy cities will experience major losses of people, work or real estate demand. But the pandemic may have slightly speeded up the shift to smart cities, intelligent buildings, artificial intelligence and the network economy.”.

Bubble talk is likely to recede as central banks keep a close eye on house prices and policymakers start to intervene. First it was New Zealand, then the ECB, now Singapore has announced it is ‘highly vigilant’ on house prices.

To date, 22 central banks have raised interest rates this year according to Central Bank News and that figure is likely to shift higher.

However, although New Zealand has announced it may raise interest rates as early as August, for key global economies the move towards tighter monetary policy will be a slow and gradual one.

The US Federal Reserve currently envisages two rates rises in 2023. As Bloomberg put it, it will be more ‘subtle evolution than revolution’, but the rising cost of debt is likely to be a restraining influence for some homeowners.

It’s not just higher interest rates that might influence buyer sentiment, as governments step back from their pandemic-triggered stimulus measures, incomes will be less protected. All eyes are on Canada and New Zealand which are amongst the first to taper their support measures.

A shortage of stock in key prime markets, alongside tighter lending rules and upbeat unemployment forecasts were amongst the other reasons I cited to The Sunday Times as to why bubbles will slowly deflate rather than burst as in 2008.

A willingness on the part of Governments to intervene either via tax or housing policy is another reason house price growth is unlikely to go unchecked.

Below is a summary of the key cooling measures we’ve seen announced to date in 2021 and with China mulling over a national property tax, and CGT proposals pending in the US and the UK, expect this list to grow.

Provence and the French Alps were France’s prime hotspots in the last 18 months. The new Prime France Report confirms the extent to which French buyers have compensated for the absence of overseas buyers since the start of the pandemic, with many opting for a rural or mountain retreat as a primary or secondary residence.

Despite the challenging backdrop, notable sales have been agreed across France’s prime destinations from Mougins and Super Cannes on the Cote d’Azur to Chamonix in the Alps. Paris saw an uptick in cash buyers with many looking to the capital’s real estate as a means of wealth preservation at the start of the crisis as stock markets volatility increased.

In other news…

Hong Kong’s story of resilience continues, Sydney’s luxury homes sales were the highest on record in Q1, my colleague Martin Wong gives his take on what impact China’s ban on skyscrapers will have on the market, and finally Mumbai and its wider state is blazing a trail, offering women homebuyers a 1% stamp duty discount to encourage more women to buy and invest in real estate.