Monthly UK residential property market update – May 2021

Residential property market springs back in April after stamp duty holiday extension

4 minutes to read

With the stamp duty holiday extended until June and supply becoming squeezed in some markets, property prices picked up in April.

On a monthly basis, average UK house prices were 1.4% higher in April than March. This was the strongest monthly rise since September last year. It took annual growth in April to 8.2%, which is the strongest annual price growth rate in 5 years, according to Halifax.

Nationwide reported a similar upswing in April. The lender said that average UK prices had increased 2.1% from March, which was the biggest monthly rise since February 2004. It took the annual growth rate for April to 7.1%, up from 5.7% in March. April’s annual growth figure was only just below December 2020’s peak of 7.3%.

A separate survey by the lender found three-quarters of those considering or in the process of moving at the end of April would have done so even if the stamp duty holiday had come to an end.

Underlining how the property market has responded to the improving economic outlook, there was a record amount of net mortgage borrowing in March. The figure of £11.8 billion was the highest monthly total since records began in 1993.

While there were 82,700 mortgage approvals for a purchase in March, down from a peak of 103,100 in November, the number is strong compared to pre-pandemic levels. In February 2020, there were 73,000 approvals.

The provisional seasonally adjusted estimate of UK residential transactions in April 2021 is 117,860, according to HMRC. This was 35.7% lower than March 2021.

However, provisional non-seasonally adjusted and seasonally adjusted estimates for UK residential transactions in April 2021 were the highest April transactions totals during the previous 10 years demonstrating the current strength of demand in the property market.

The Bank of England, which maintained the base rate at 0.1% this month, has increased its economic forecast to take into account improving consumer confidence as the vaccine rollout and reopening of the economy continues.

It expects UK GDP growth of 7.25% this year up from 5%. This would see the UK economy surpass its pre-pandemic size in the final quarter of this year, rather than the first quarter of 2022 as previously expected.

With improving sentiment supporting high sales activity, parts of the UK property market face a supply shortage. The RICS April sentiment survey found +44 of contributors cited a pick-up in enquiries during the month. However, the net balance for new instructions was -4% in April, down from +21 in March. The average number of properties on estate agents’ books now stands at just 40, having briefly stood at 46 back in December.

An analysis of OnTheMarket data found a quarter fewer properties available for sale in England and Wales in March this year compared to 12 months ago. This is most acute in parts of the country that have experienced stronger demand due to successive lockdowns, such as south-west England.

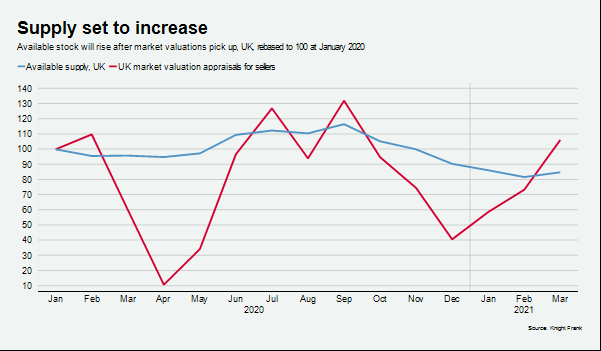

With the start of the year marked by doubts over new Covid variants, logistical challenges around home schooling and uncertainty over meeting the original March stamp duty deadline, sellers held off and the available stock went quickly as demand escalated in March. However, as the chart shows, this imbalance should begin to moderate.

Market valuation appraisals, a leading indicator of supply, are now rising.

Prime London Sales

The number of transactions in prime London property markets in March was among the highest in a decade.

The distortive effects of stamp duty meant there was a decline of 45% in April compared to March, LonRes data shows, but activity will remain strong during the rest of Q2.

The number of offers accepted in prime central and prime outer London reached its highest level in a decade in April. This suggests May and June are likely to experience numbers of exchanges that are comparable with March.

Prime London Sales Report: April

Prime London Lettings

Annual rental value declines in prime London property markets bottomed out in April.

The fall in prime central London was 13.3% over the 12-month period, which compared to 14.3% in March. In prime outer London, the annual decline was 9.4% in April versus 11.5% in March.

The improvement, which follows 12 months of widening declines, was expected following a monthly drop of 2.2% in April 2020 as the property market closed during the first national lockdown.

Prime London Lettings Report: April

Country market

The escape to the country trend drove annual price growth to its highest level since before the global financial crisis in the first three months of 2021, with prime regional prices up 6.7% in the year to March.

Strong demand for prime property outside of the capital and rural living in general, coupled with tightening supply, saw average prices increase by 2.8% in the first quarter of 2021. This was up from 1.7% in the fourth quarter of 2020.

In Scotland, property prices in Edinburgh recorded their strongest first-quarter performance in three years with an increase of 2.2%, as the Scottish capital also experienced high demand and tight supply in the first months of the year.

Prime Country House Index Q1 2021

Edinburgh City Index Q1 2021