Global house prices shrug off higher interest rates

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

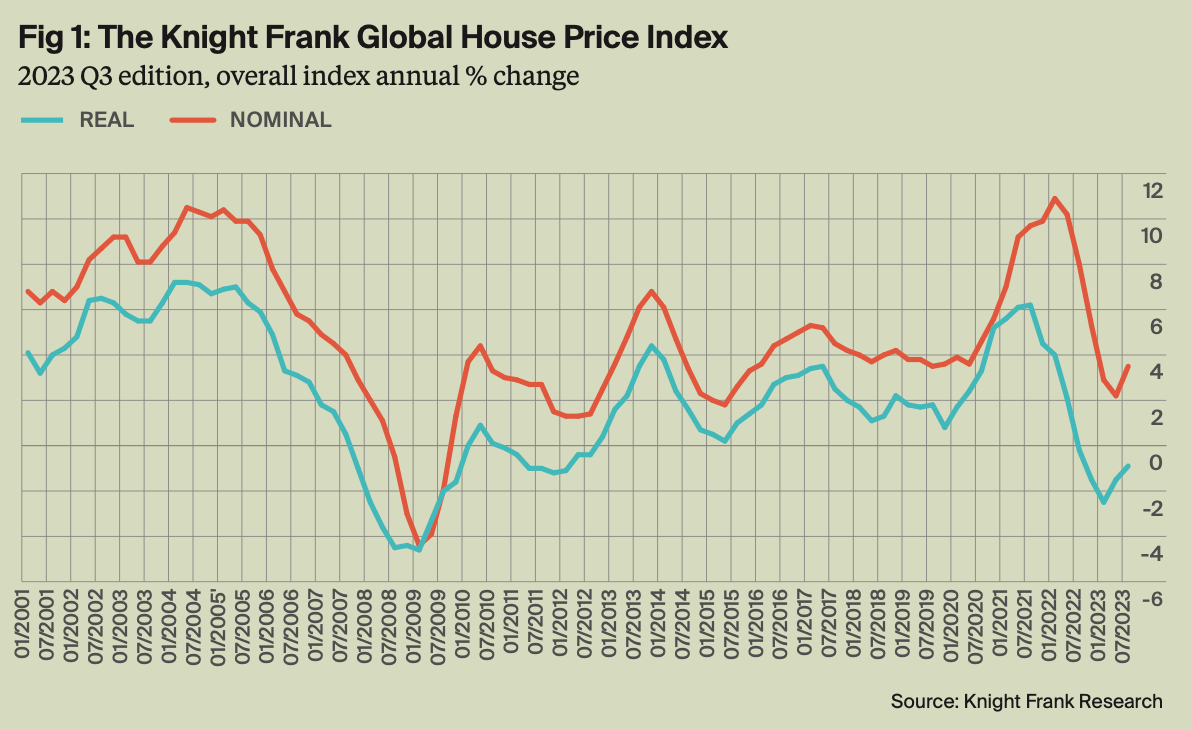

Global house prices continue to rise despite central banks' efforts to combat inflation through higher interest rates. Our Global House Price Index covering 56 key markets rose 3.5% during the year to September, up from 2.2% the previous quarter.

Limited stock availability, increased household savings, and robust wage growth are all underpinning values. Indeed, wage growth is now outpacing inflation in some countries, including the UK.

Transaction volumes present a different challenge. Sales have declined by 15% to 25% from their recent peaks across developed economies. Remarkably, values remain 3.5% above their previous peak, and the absence of a correction suggests that sluggish activity is likely to persist through 2024 and potentially well into 2025. Activity is anticipated to rebound only when rates are lowered substantially.

It's hard to know exactly when that will be, but we'll know more tomorrow night than we do this morning. The Federal Reserve will be the first of the major western central banks to publish rate decisions later today, followed by the European Central Bank and the Bank of England tomorrow. The Fed will also publish the latest dot plot recording each official's projection for the federal funds rate. Economists surveyed by Bloomberg expect the median projection will show two rate cuts next year and five more in 2025.

Swedish slump

Turkey has held the top spot in our rankings since Q1 2020 and once again sees the strongest growth on our ranking with an annual (89.2%) and quarterly (18.1%) increase.

The south-eastern corner of Europe dominates the top five spots of our rankings, with Greece (14.0%), Croatia (13.7) and North Macedonia (11.0%) all showing robust annual growth. Japan is the standout performer in the Asia-Pacific region, with 6.3% annual growth, followed by India (5.9%).

At the bottom of our ranking, we find Sweden (-11.1%), Slovakia (-10.1%), Finland (-9.6%), and Hong Kong (-8.7%) all experiencing falling prices. As Sweden tackles an economic recession and rising borrowing costs, housing prices in the Nordic nation have resumed a downward trajectory on an annual basis.

Price pinch

Prime rents in the 10 cities covered by our Prime Global Rental Index rose by 7.9% in the year to September. That's roughly three and a half times their long-term pre-pandemic trend.

That can't be sustained for long, and we're already seeing some markets touch the limits of affordability. In New York City, annual growth has dropped from its peak of nearly 40% in Q1 2022 to 2.4% this quarter. Rents actually declined 1.3% during the most recent three months.

To find out what's going on, I spoke to New York property guru Jonathan Miller for a new edition of Intelligence Talks, out this morning. The deceleration can partly be attributed to an improvement in new supply delivery following an extended period of limited stock availability, but there are also limitations on what tenants are able to pay. Jonathan has much more to say - listen here, or wherever you get your podcasts.

Something resembling normality has also returned to the prime central London lettings market, according to the latest index from Tom Bill. Quarterly growth in prime central and outer London has fallen to 1% from more than 2.5% throughout most of 2023. There were 3.7 new prospective tenants for every rental property listed in prime London postcodes last month, down from 5.1 in November 2022.

Mortgage arrears

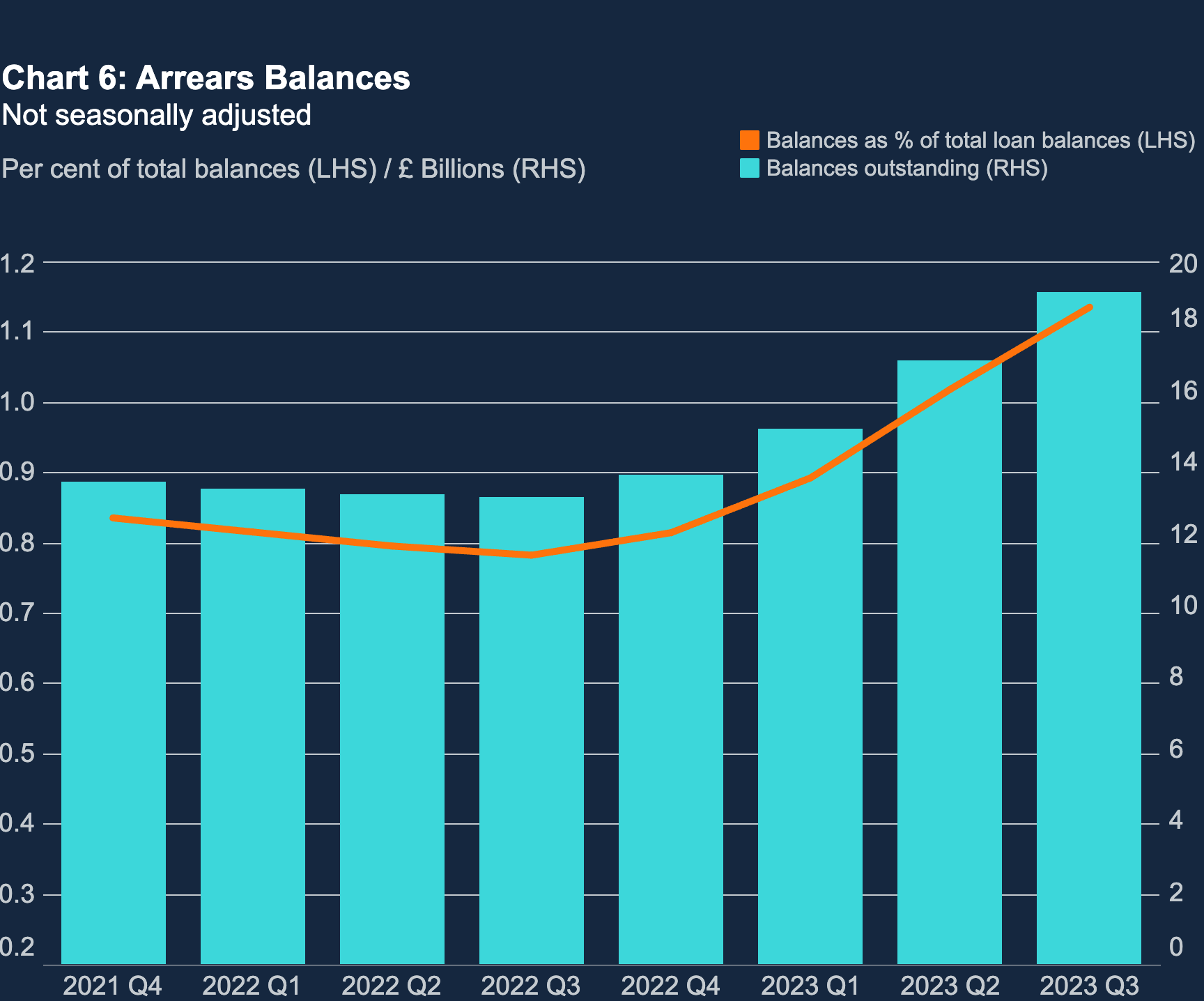

UK mortgage arrears hit a six-year high in the three months to September, according to Bank of England figures out yesterday (see chart).

Years of high inflation and rising interest rates pushed the value of outstanding mortgage balances in arrears to £18.8 billion, up 11.4% compared to the previous quarter. Whilst those figures might look alarming, it only represents a small slice of total mortgage debt - the proportion of total loan balances with arrears relative to all outstanding mortgage balances is running at just 1.14%.

UK Finance expects mortgage arrears to rise from 105,600 by the end of 2023 to 128,800 by the end of 2024, which is still low by historic standards. Regulations introduced after the financial crisis to underpin the stability of the mortgage market are working as they should. Repossessions are also extremely low by historic norms.

The Financial Conduct Authority has “made it clear that it wants lenders to support borrowers where it’s possible . . . whether by offering term extensions or periods of interest-only payments”, Simon Gammon of Knight Frank Finance tells the FT.

In other news...

From our team - Andrew Shirley on tree planting targets, Flora Harley on ESG in the city, and Will Matthews on why commercial real estate investment is likely to pick up next year.

Elsewhere - asset managers snap up sterling as UK inflation concerns linger (FT).

Image by Yuri from Pixabay