How are pollution rules impacting housing delivery in England?

Plus nutrient credits and European deal cycles.

5 minutes to read

“The proportion of pollution arising from new housing stock is very small but the question being asked from us is, ‘Is it OK to take an already polluted system, and make it worse?’”

Natural England’s chief officer of strategy, Alan Law, made this comment in The Times a few months ago. But it is a quandary that is still reverberating around the UK residential development sector, with the release this week of a new report commissioned by the Home Builders Federation that suggests the occupancy of new homes accounts for less than one per cent of nitrogen and phosphorus emissions each year.

The addition of nutrient neutrality rules – which require that new housing developments in certain areas do not add more contaminants to rivers and streams – have weighed on an already constrained planning system.

They also made an appearance in the chancellor’s Autumn statement last week, with Jeremy Hunt pledging to spend £110 million this year and next to deliver high quality nutrient mitigation schemes.

This came after an attempt from the government to do away with the rules altogether, but it was defeated in the House of Lords in September after Labour led a rebellion against loosening the restrictions.

But will a step up in mitigation really unlock 40,000 homes as Hunt suggested? There are many moving parts here given the current market backdrop, but a funding injection for the UK’s entrepreneurial nutrient mitigation market is a positive step.

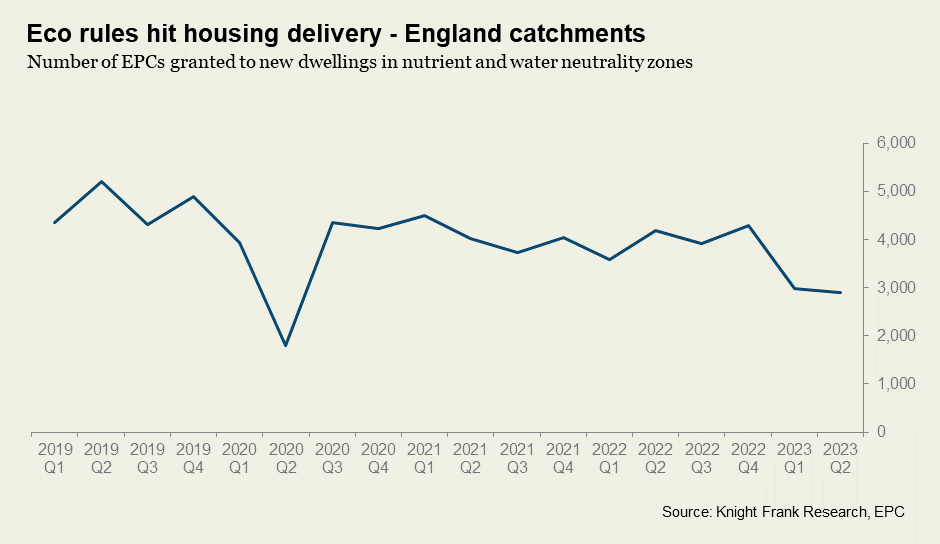

It is difficult to quantify exactly how many homes are held up, but completions – measured by the number of Energy Performance Certificates issued for new homes – are falling across the specific catchments, while new starts have plummeted in some of the local authorities affected.

In total, 74 local authorities are affected by nutrient neutrality, representing nearly a quarter of the total 300 plus authorities in England.

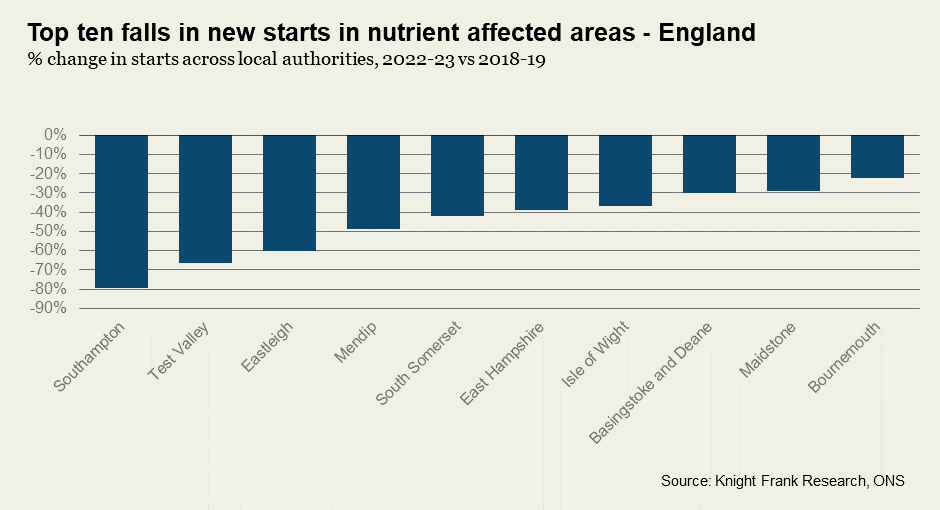

Out of the original 32 cohort affected since 2019 (a further 42 were added to Natural England’s list last year), nearly 70% are located in the South East.

To understand the impact so far on supply, we can look at completions in the catchment zones. Overall, new EPCs granted in these areas fell 40% in the first half of this year versus H1 2019 – just before the guidance was first introduced in June of that year. This is sharper than the 25% fall in EPCs granted across England during this period.

Planning approvals have also slowed. Half of the 2019 group have seen new housing approvals fall by over 30% between 2018, the year prior to Natural England issuing guidance, and last year.

While developers have been able to start building all homes in catchments approved prior to Natural England issuing guidance, since then they have had to either demonstrate nutrient neutrality in their planning submissions or it becomes a Grampian condition on approval. This means they cannot build until neutrality is achieved.

As a result, some local authorities in the region have seen a sharp fall in new housing starts.

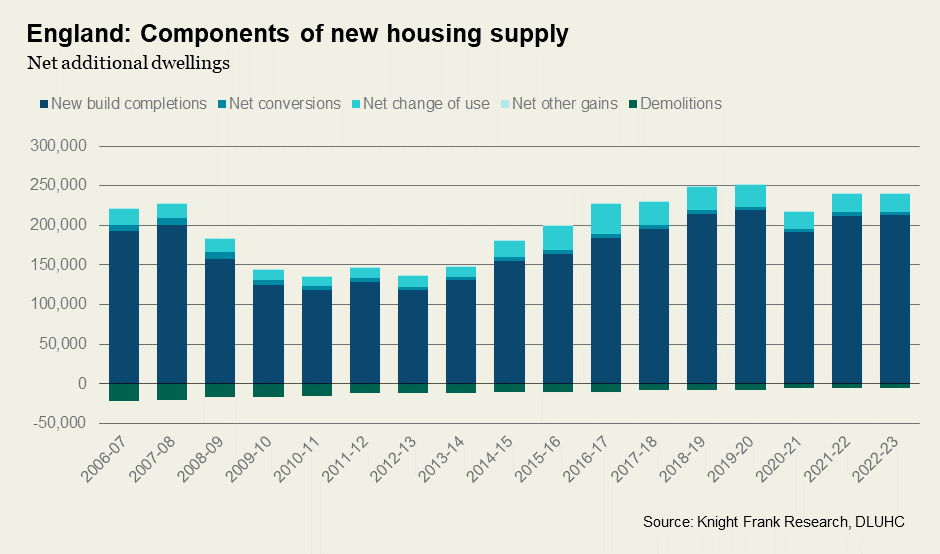

This comes at a time when national housing supply is under pressure.

The government this week released its latest net additions data for England for the year to March 2023. Overall, net output was flat compared to the previous period, but bear in mind we are now in November and we would expect the supply crunch to show up in the next set of data to March 2024.

Of course, there are plenty of other factors slowing down housing development, not least the downturn in the sales market and elevated build and finance costs – as highlighted by our new report on the South East development market.

But clearly, nutrient neutrality is playing a part in holding up new homes in affected areas. It is therefore an issue of national importance and one that will be closely watched as we get closer to the next general election.

Nutrient credits

I spoke to Knight Frank rural surveyor Steph Small and Irwin Mitchell partner Sam Knight in a new Intelligence Talks podcast to find out more about the nutrient mitigation market, which the government just announced fresh funding for.

Natural England has established its own nutrient mitigation scheme; however, this is currently only available to developers in the Tees catchment in the North East of England and there is a limited number of credits available.

For those developers unable to access this scheme, the only other option is the embryonic private market or relying on their own mitigation methods from wetlands to sustainable urban drainage.

The government is aiming to both expand the Natural England programme and speed up the development of private sector schemes.

Steph and Sam explain why mitigation options are not straightforward and highlight that the greatest shift will be when water companies upgrade wastewater treatment works to reduce harmful nutrient pollution.

But this is still some way off, with the government proposing the upgrades are completed by 2030.

Have a listen here.

European horizons

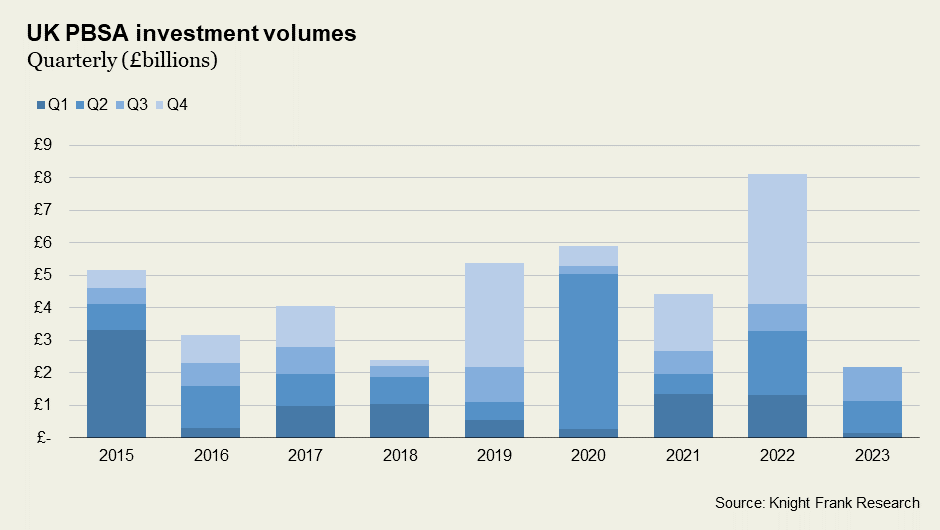

This week, Blackstone announced plans to make further real estate investments across Europe, including student housing, warehouses and data centres.

Speaking on the side-lines of the UK’s Global Investment Summit, which saw Rishi Sunak unveil £29.5 billion in investment for sectors including housing and infrastructure, Blackstone chief executive Stephen Schwarzman said: “The deal business is not totally in mothballs and these things start again…I think we’re more on that side of the cycle, although it has been somewhat dreary for a year.”

Overall, investors have earmarked more than €22bn for the European living sector over the next five years. Almost four in five investors plan to significantly increase their exposure to the sector in the coming years, according to our latest Knight Frank European Living Sectors Investor Survey.

In the UK, the student sector has remained one of the most liquid property markets over the past 12 months due to the strength of the country’s higher education and a rising shortage of beds. In our latest market update, Katie O’Neill writes that just over £1 billion traded hands across 20 transactions in the third quarter in the UK, up 23% on the comparable period last year.

Photo by Jaye Proverbs on Unsplash