UK housing market: lending outlook improves but risks will remain in 2024

Psychological milestones will be important for the property market as mortgage rates continue to fall.

3 minutes to read

There is no shortage of reasons for buyers and sellers to feel hesitant at the moment, as we explored last week.

Mortgage rates have tripled in three years, there is uncertainty over where the bank rate will peak, the political temperature is rising ahead of a general election, and there are two overseas military conflicts taking place. Sentiment has been sapped to the extent that the seasonal autumn bounce in the UK housing market was non-existent this year.

Last week, the Office for National Statistics said that transaction numbers had fallen to the point that it had become more difficult to create its monthly price index.

However, despite a 20% drop in trading volumes, more positive signs have begun to emerge over the last seven days.

Most notably, inflation fell by more than expected, declining to 4.6% from 6.7%. Underlying inflation, which has been driven by a strong jobs market and is the Bank of England’s (BoE) biggest headache, also beat expectations by cooling to 5.7%.

That is undiluted good news for anyone buying or re-mortgaging as the BoE’s task of taming inflation by raising rates feels closer to completion.

The BoE could even start cutting rates as soon as next February, said influential Wall Street bank Goldman Sachs last week. Admittedly this would be in response to a weaker-than-expected economy, but Q2 next year was the most likely time for a cut, the bank said.

Inflation dropping under 5% underlined the importance of psychological milestones in financial markets, something that has become increasingly apparent for anyone buying or re-mortgaging.

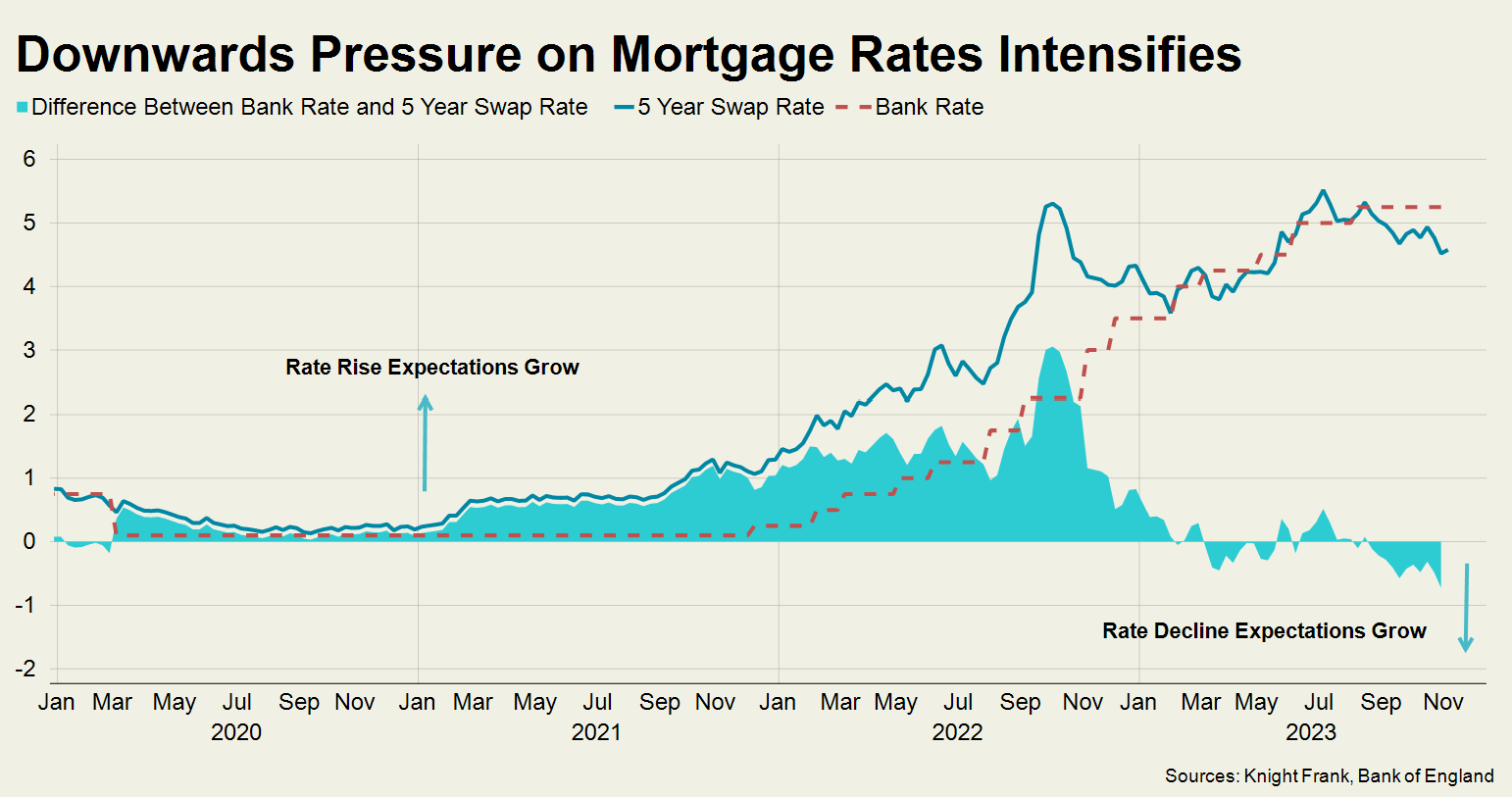

The cheapest five-year fixed-rate mortgages have fallen from just over 5% to almost 4.5% in two months.

With the five-year swap rate not much lower than that, margins are getting thin for lenders keen to do business in a low-volume housing market, said Simon Gammon, head of Knight Frank Finance.

“The recent rate drops show lenders are feeling more positive about the outlook and there is an impact beyond the cut. Lower rates mean lenders have more opportunities to help borrowers which itself will lead to a more liquid and competitive lending market.”

So, there are glimmers of hope ahead of this week’s Autumn Statement, which may contain measures to support the housing market. There has been speculation around a stamp duty cut and an extension of the mortgage guarantee scheme, as we discussed here.

The fact the five-year swap rate is currently lower than the bank rate (as the chart below shows) demonstrates that financial markets believe the direction of travel for borrowing costs is down.

As mortgage costs fall, a seasonal bounce next spring gets more likely.

That said, while economic uncertainty recedes, political and geopolitical risks remain.

A general election campaign tends to create a national mood of uncertainty while any escalation of the conflict in the Middle East could prove inflationary if energy markets are rattled, which would put upwards pressure on rates again.

The outlook for the UK housing market is certainly improving but next year won’t be hurdle-free.

Photo by Scott Graham on Unsplash

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here