Asia-Pacific prime office rents remain stable in Q3 2023

Vacancies continue to rise 0.4 percentage points quarter-on-quarter to 14.4%

4 minutes to read

Knight Frank’s research team and local experts have analysed the latest occupier activity in Asia-Pacific in the third quarter of 2023. While prime office rents in the region remain stable, vacancies continue to rise 0.4 percentage points quarter-on-quarter to 14.4%.

In this article, we look at prime office rents and vacancy rates from cities across Asia-Pacific in more detail.

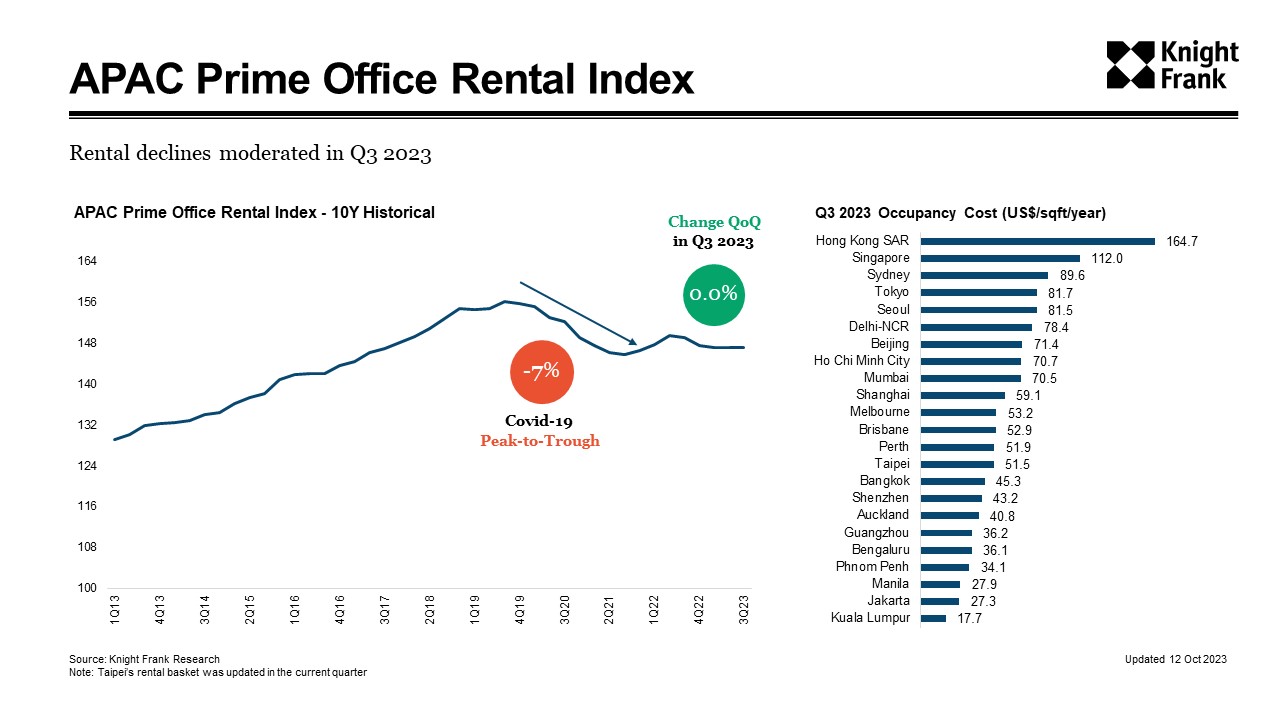

Rental declines moderated in Q3 2023

Asia-Pacific recorded a moderate decline in office rental, dropping 1.3% from the previous year, which is a slight improvement from the 1.5% drop in Q2 2023.

On a quarter-on-quarter (QoQ) basis, average prime office rents across the region remained steady, as declines in the Chinese Mainland markets moderated, partially offset by rental growth in most other developed markets.

15 of the 23 tracked cities reported stable-to-increasing rents, similar to Q2 2023.

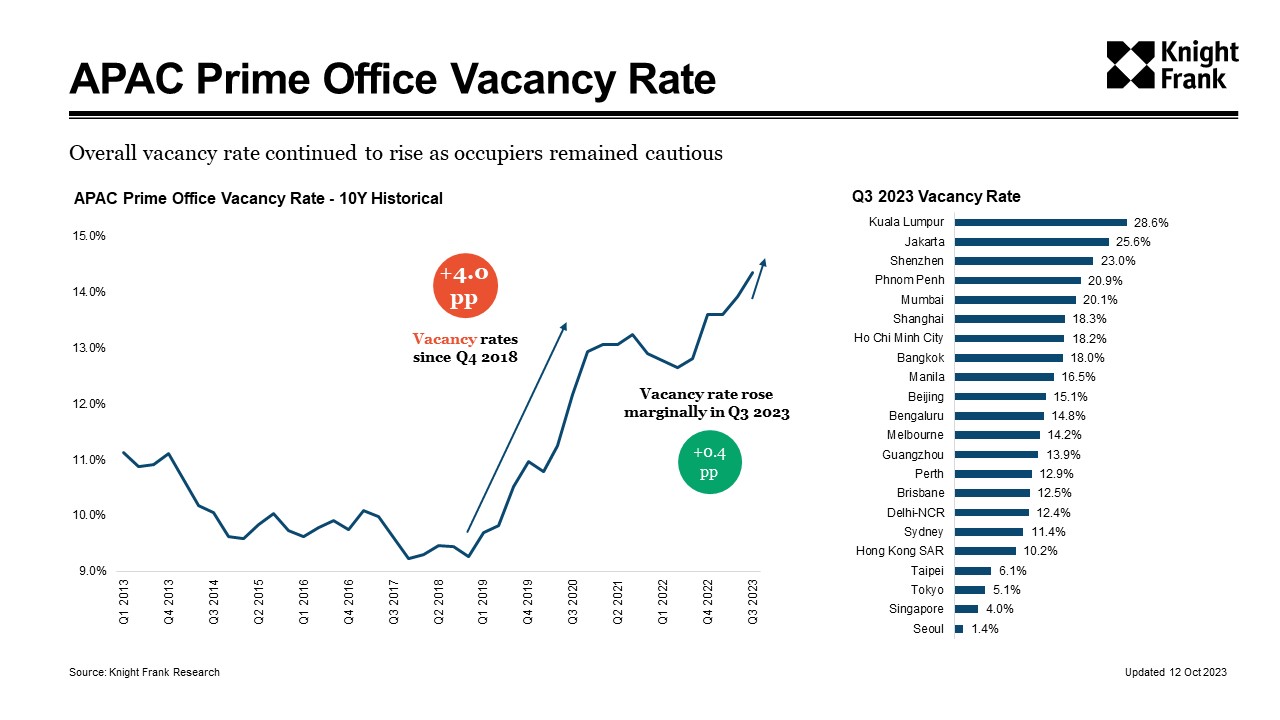

Overall vacancy rate continued to rise as occupiers remained cautious

Vacancies continue to increase marginally by 0.4 ppt quarterly to 14.4%, sustaining a trend that has seen the metric continually breach record highs since Q3 2022.

With a more muted completion pipeline at just over a million square meters during the quarter, down about 75% from Q2 2023, absorption is lagging completions in the region. Monetary tightening, inflationary pressures, and geopolitical events continue to weigh on economic sentiment, as occupiers remained cautious, taking longer to consider space requirements. With the implementation of hybrid work schedules, occupier strategies have decoupled from mere headcount considerations.

A snapshot of the region

Oceania Office Market

A two-speed rent market is emerging in Australia, with the country's resource-driven markets – Brisbane and Perth – benefitting from a commodity sector resurgence. Leasing activity in Brisbane was also elevated by demand from government occupiers. As a result, rents rose, with Brisbane the only Australian city to record a year-on-year decline in average incentives in the third quarter.

Southeast Asia Office Market

Double-digit vacancies weighed on offices in Southeast Asia’s emerging markets. During the quarter, the delivery of over 85,000 square metres in Ho Chi Minh City lifted vacancy rates to over 18%, from under 5% in the second quarter. Located within the still-developing commercial hub of Thu Duc City, take-up of new supply across two buildings has remained slow, which dragged average prime rents down by over 2%. Rents in Manila also fell as its Business Process Outsourcing sector re-aligns space requirements with hybrid work schedules.

East Asia Office Market

Chinese Mainland office markets still grapple with challenging economic conditions and elevated supply, as rents across its first-tiered cities softened from a year ago. Notably, vacancy rates in Guangzhou and Shenzhen have risen to levels exceeding those observed during the stringent zero-Covid policy period. However, the decline in rental rates has slowed down, particularly in Beijing, where prices have stabilised on a Q0Q basis.

In this tenant-friendly environment, occupiers have taken the opportunity to negotiate more favourable leasing terms. Conversely, Hong Kong has been affected by sluggish demand from Chinese corporations, with vacancies reaching double digits for the first time. The Central market in the territory is also experiencing decentralization pressures as tenants focus on cost savings and operational efficiency.

Elsewhere in East Asia, markets are on firmer ground. Tokyo’s market has coped with new supply additions, supported by strong corporate demand, while limited supply in Seoul and Taipei will continue to foster rental growth.

South Asia Office Market

Demand for office space in India’s largest occupier markets remained strong—leases covering more than 700,000 square metres of leases were signed during the quarter. The predominant driver of this demand has been the increased activity of occupiers setting up Global Capability Centres (GCC), which made up for slower demand from flex space operators. According to IT trade body Nasscom, India is expected to see a significant increase in the number of GCCs, surpassing 2,500 by the end of the decade, up from the current 1,580, coinciding with a labour force set to more than double to 4.4 million.

Despite the surge in transaction volumes, rental rates have remained steady across the three primary occupier markets. Landlords have directed their attention toward maximizing occupancy levels. With the office market's positive momentum and the improvement in physical occupancy rates, transaction volumes are expected to maintain their robust performance throughout the calendar year.