Increase in borrowing costs weighs on UK residential property market sentiment

Activity subdued as bank rate reaches 15-year high of 5%.

4 minutes to read

The publication of ‘hot’ inflation data in May provided the UK residential property market with pause for thought, with expectations of where UK interest rates would peak revised up.

While the latest data was a pleasant surprise, with headline inflation falling by more than economists had expected from 8.7% in May to 7.9% in June, the Bank of England will want to see a sustained decline before it decides interest rates are high enough.

Against this backdrop and ahead of the latest data, the Bank of England made its biggest move since February in June, pushing the bank rate up by half a point to 5%, which is its highest level since September 2008.

The uncertain environment means buyers are finding it hard to plan, with borrowing costs now as high as they were in the wake of last year’s mini-Budget and this is weighing on sentiment.

According to the RICS sentiment survey, the net balance of new buyer enquiries, where a reading below zero signals a contraction, fell to -45% in June, down from a reading of -20% last month. That's an eight-month low. The metric of newly agreed sales dropped to -34%, from -8% last month. That's the lowest since December.

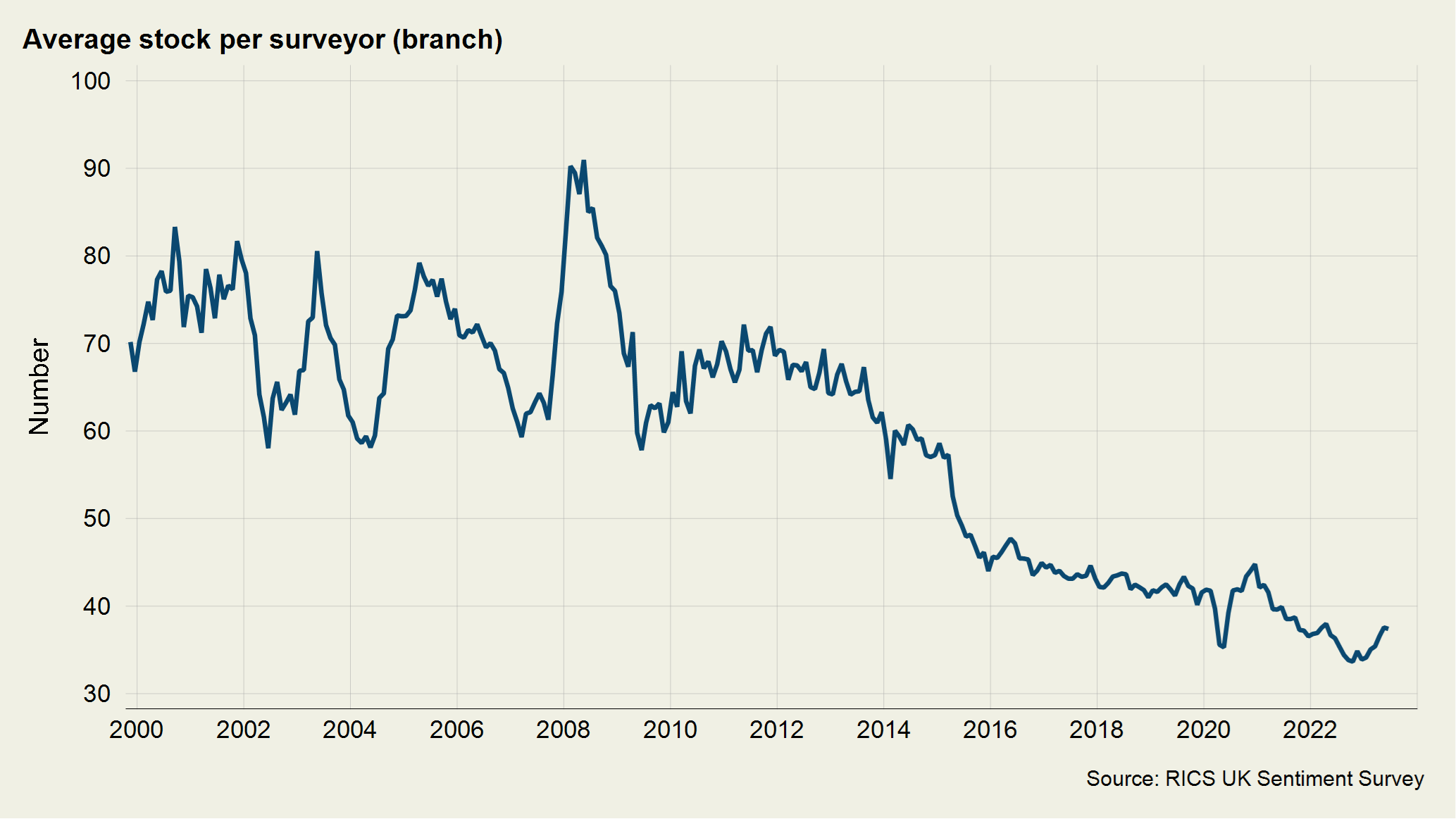

Having picked up slightly during May, new sales instructions held more or less steady in June. Though the current level of inventory is slightly higher than that reported at the end of last year (with a similar pattern in prime markets), the average number of homes available for purchase remains low relative to long run averages (see chart).

A net balance of -31% of survey participants expect sales will decline over the twelve-month time horizon, said RICS.

Depleted levels of stock will persist, which along with strong wage growth, low unemployment, the forbearance of lenders and the availability of long term fixed rate mortgages, is why we think will be a significant factor limiting national price falls to about 10% during the next two years.

House prices stable

For now, house prices are enjoying a period of relative stability, having registered their largest declines in the months after the mini-Budget. Both lenders Nationwide and Halifax said the monthly change in the average UK property price in June was 0.1%.

It means the average UK property price, which according to the lenders peaked in August 2022, has declined by 4.1% (Nationwide) and 2.7% (Halifax) respectively.

Property transactions remain subdued with 80,020 in May, 27% lower than May 2022 and 3% lower than April 2023. Mortgage approvals for home purchase, a leading indicator of future supply, increased from 49,000 in April to 50,500 in May. However, they remain 24% lower than the 66,175 in the same month a year ago.

The mismatch between supply and demand continued in the lettings market in June, according to RICS, keeping upwards pressure on rental values. A headline net balance of +40% of respondents saw an increase in tenant demand during the month. At the same time, the net balance for landlord instructions sunk to -36% (the most negative reading since May 2020).

Prime London Sales

The air continued to slowly come out of the prime London property market in June. Mortgage costs have spiked and speculation around falling prices has mounted but has there been any impact on the prime London market over the last month?

Yes, but not a particularly dramatic one. The economic mood has darkened but the market is far from grinding to a halt. The number of new prospective buyers in London over the most recent four-week period was 24% above the five-year average.

The resilience is perhaps no surprise given that around half of sales inside zone 1 are typically in cash, as well as greater levels of affluence, the relatively weak pound and the fact overseas travel is returning to pre-Covid levels.

Prime London Sales Report - July

Prime London Lettings

The story of low supply in the prime London lettings market appears to be coming to an end. The primary cause is the recent uncertainty in the sales market, which means more owners are letting out their property after failing to achieve their asking price.

On the supply side, the combined number of lettings listings in PCL and POL was the second highest level since September 2021, Rightmove data shows.

As a result of the imbalance between supply and demand becoming less pronounced, annual rental value growth in PCL fell to 14.4% in June, the lowest level since October 2021. In prime outer London, a figure of 12% was the lowest over the same time period.

Prime London Lettings Report - July

Country market

Activity remained subdued in the Country market, albeit the metrics for offers and exchanges in June were the strongest they’ve been this year.

Offers made in June were down 15.9% versus the five-year average (excluding 2020) up from -17.3% in May, while exchanges were 15.8% lower in the same period compared with -25% in May.

New instructions for sale were up 10% versus the five-year average in June, the fifth positive reading in a row. The amount of property for sale supply in the Country market is now at its highest level since September 2020, albeit 5% below the pre-pandemic average for 2019.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here