Tight supply keeps global prime rental growth in double digits

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Prime rents

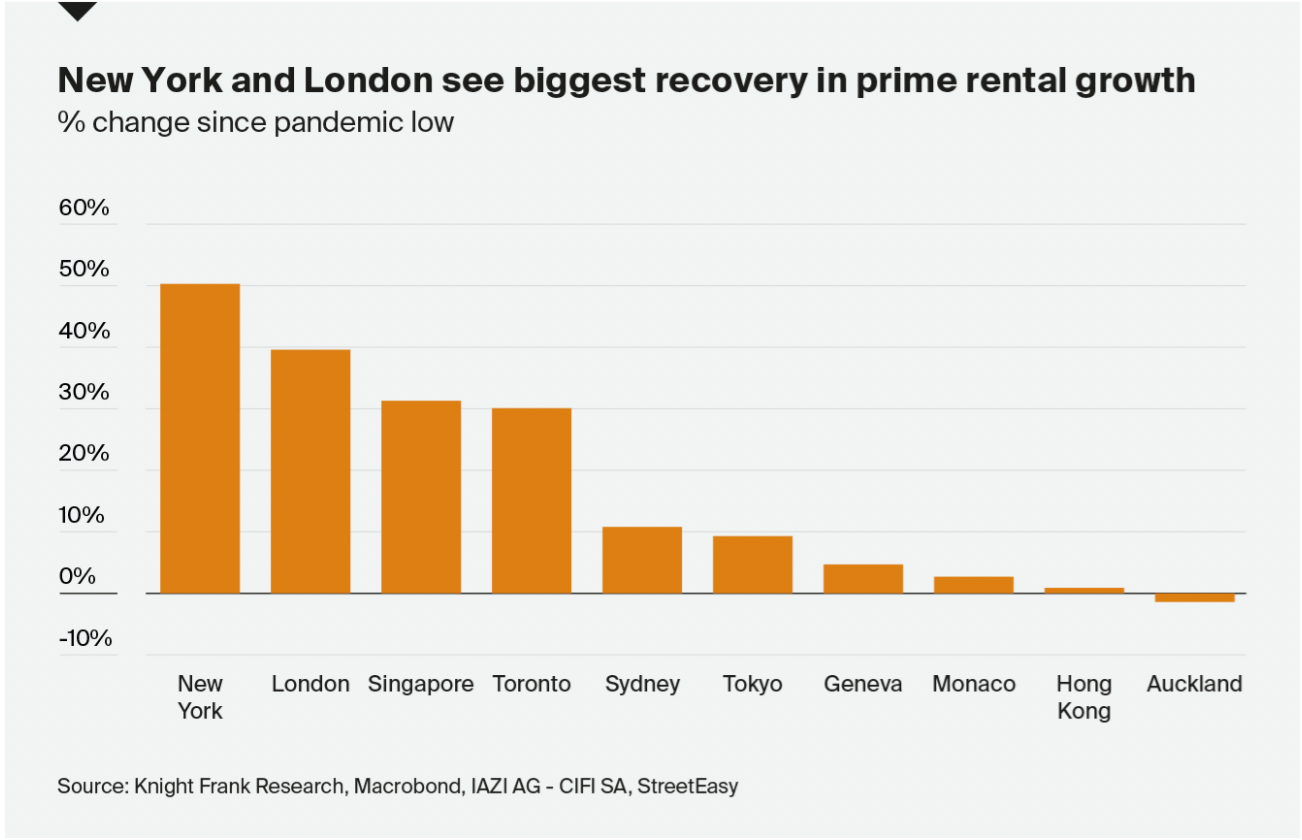

Growth in prime rentals across ten global cities eased to 10.2% during the year through Q3, down from a peak of 11.9% during the year through Q1.

New York and London top the rankings due in large part to a significant imbalance between supply and demand. The number of new prospective tenants in London, for example, was 60% above the five-year average in October, while new listings were down by about a third, according to Knight Frank data.

Singapore completes the top three - we talked about the city state's growing status as a leading regional wealth hub last week. The opening of borders along with the introduction of new visas to attract top talent from around the world has boosted demand. Plus, new rules announced in September mean those looking to sell their private home and purchase a non-subsidised Housing and Development Board (HDB) resale flat now have to wait 15 months. Many sellers are opting to rent in the interim.

Christmas markets

The year on an ending with a slew of challenging data. From house prices to mortgage lending and measures of new buyer demand, the mini-budget brought the annual seasonal slowdown forward a few weeks.

While lenders continue to cut rates on fixed rate mortgages, despite a rising base rate, many purchasers have opted to wait until the other side of Christmas to act. The best five year fixed rates will likely settle somewhere around 4.5% in January and remain in that region for some time. OBR forecasts published alongside the latest budget suggest that the average mortgage rate paid by homeowners could remain at 4.6% as far out as 2027.

Nationwide published its outlook this morning: "The risks are skewed to the downside, but there is still a good chance that we can achieve a relatively soft landing next year with activity stabilising modestly below pre-pandemic levels and house prices edging lower, perhaps by around 5%," says the lender's chief economist Robert Gardner.

First time buyers

Nationwide's outlook quantified the impact of rising mortgage rates on first-time buyers:

"When mortgage rates moved towards 6%, the monthly mortgage payment on a typical first-time buyer property (bought with a 20% deposit) increased to the equivalent of 45% of an average worker’s take-home pay. This was similar to the levels prevailing in 2007 on the eve of the financial crisis and well up from the c30% prevailing earlier in 2022, which was close to the long run average."

Mortgage rates might be falling, but first-time buyers are facing a difficult period regardless. The government yesterday opted to extend the Mortgage Guarantee Scheme to the end of December 2023. The scheme offers lenders the financial guarantees they need to provide mortgages up to 95% on homes worth up to £600,000. More than 24,000 buyers have used the scheme since its inception.

Meanwhile, according to the FT, the UK's six largest banks will begin lending on properties with cladding that are 11 metres or taller from January 9th.

In other news...

US home builder gloom persists, but some hope seen for next year (Reuters), US single-family housing starts drop in November (Reuters), the great green office crunch (FT), London crowned Rightmove’s most searched for 2022 location (Times), and finally, Air travel will not recover until 2025, says ACI Europe (Times).