Leading Indicators | Last week's BoE MPC decisions and what it means for UK CRE

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

BoE raised its interest rate to 1.75% and updated its forecasts

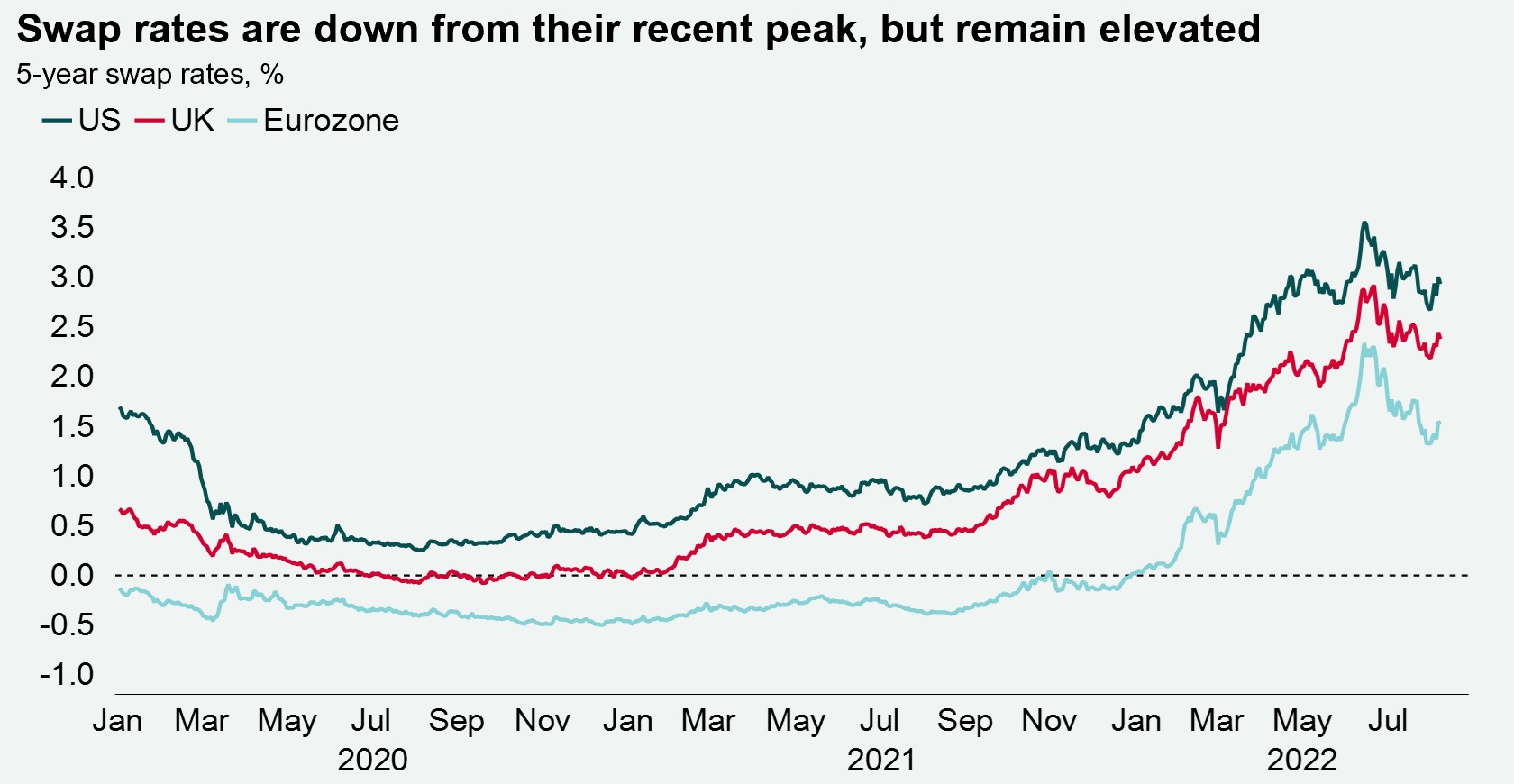

Last week, the Bank of England (BoE) increased its interest rate by 50bps to 1.75%, its highest level since December 2008, the central bank’s largest increase in 27-years and its sixth successive rate rise since December. The BoE now expect inflation to peak at 13.1% in Q4 2022 (10.2% previously forecast), with inflation forecast to pare back to its 2% target by Q3 2024 (previously Q2 2024). Lastly, the BoE expects the UK economy to enter into a recession in Q4 2022 which will last for five successive quarters. Despite the BoE’s announcements, the UK 5-year swap rate and 10-year gilt yield have been largely unaffected, currently at 2.35% and 1.96%, respectively.

Counter cyclical and lower beta real estate to receive more investor focus

Counter cyclical and lower beta real estate such as affordable housing, retirement living, discounters and food stores may see more focus as the rising cost of debt causes more polarisation within UK CRE. Investors will also look to target local levels of growth and resilience. More traditional, liquid sectors as well as those which capture structural changes from data centres to residential sectors, could also benefit. Investors will also look to target local levels of growth and resilience. Our global and UK innovation-led cities can help identify those local areas with a micro-growth location story.

UK CRE investment remained robust in Q2

Despite the more downbeat economic outlook, Q2 2022 saw some strong sector level performances in terms of UK commercial real estate investment. For example, both the specialist sectors and the industrial sector recorded their second strongest Q2 on record. Overall, UK CRE investment totalled £15.2bn in Q2, which was +39% above the Q2 LTA. Investors looking to hedge against inflation, capitalise on weaker sterling or even act before softer economics hit, could drive UK commercial real estate over the coming months.

Download the latest dashboard