Stagflation concerns, global growth, and UK CRE returns at 12 year high

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

From inflation to stagflation?

UK inflation reached its highest level since 1992 at 7.0% in the year to March, up from 6.2% in February. There was a similar story in the US, with inflation topping 8.5%, its strongest level in four decades. With inflation necessitating higher interest rates, there has been greater focus on the potential for recession. Goldman Sachs recently estimated a 35% chance of a US recession in the next two years. For balance, other investment banks remain more optimistic. However, it is significant that the potential for US recession in the medium term is now a debate.

Global economic outlook eases

The World Bank has downgraded its global economic outlook, forecasting GDP to grow 3.2% in 2022, down from its 4.1% forecast in January. A combination of the Ukraine/Russia conflict and surging food and energy prices have contributed to this downward revision.

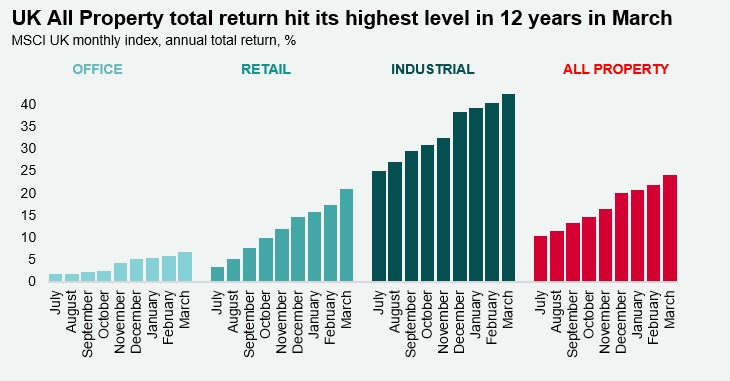

All UK property total return hits a 12 year high in March

In the 12-months to March, All UK property recorded a 24.1% total return, with Industrial (42.6%) and Retail Warehouses (33.4%) seeing particularly strong returns over the year.

Download the latest Dashboard