Global Residential Outlook – 8 January 2021

Key takeaway

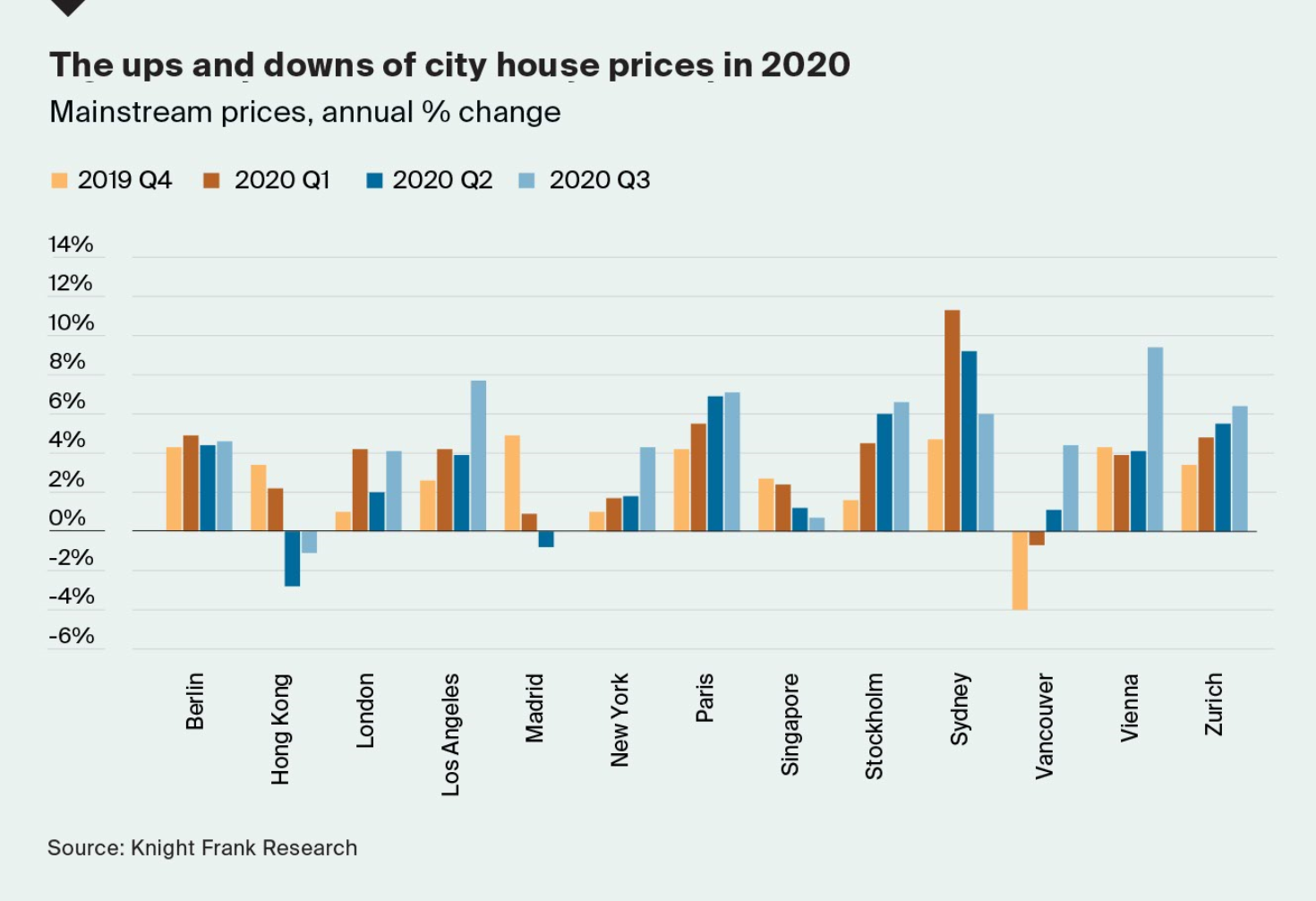

Knight Frank’s Global Residential Cities Index tracks the movement in average prices across 150 cities worldwide. Urban prices are proving resilient. The index's annual rate of growth increased by 4.7% in the year to Q3 2020, up from 4.1% in the 12 months to Q2 2020. Record low interest rates, huge fiscal stimulus measures as well as a release of pent up demand in Q3 are behind the uptick in price growth.

3 minutes to read

Need to Know:

With cases rising across much of Europe we summarise the latest lockdown measures:

- Germany has extended its nationwide lockdown until the end of January, shops and restaurants are to remain closed and travel limited to 15km radius.

- Although there is no nationwide lockdown in France a curfew is in place and this has been tightened in 15 departments in the east and south-east.

- Italy was in lockdown over Christmas which was due to end on 6 January and has now been extended to 15th.

- Spain is in a partial lockdown, it has imposed regional restrictions, with Catalonia among the strictest.

- Portugal has extended its state of emergency until 15 January and there are rising case numbers in the Algarve.

- The Swiss government is in consultation with cantons to extend coronavirus measures, including the continued closure of bars, restaurants, gyms and museums, until the end of February.

- The UK entered its third nationwide lockdown on Wednesday with schools now closed and news that one in 50 people have coronavirus. The housing market remains open for business howver with viewings and trsanctions permissible. A post-Brexit honeymoon for the pound is fading, with the currency off to the worst start to the year among G-10 peers according to Bloomberg, meaning discounts persist for UK property for some overseas buyers.

Vaccine latest:

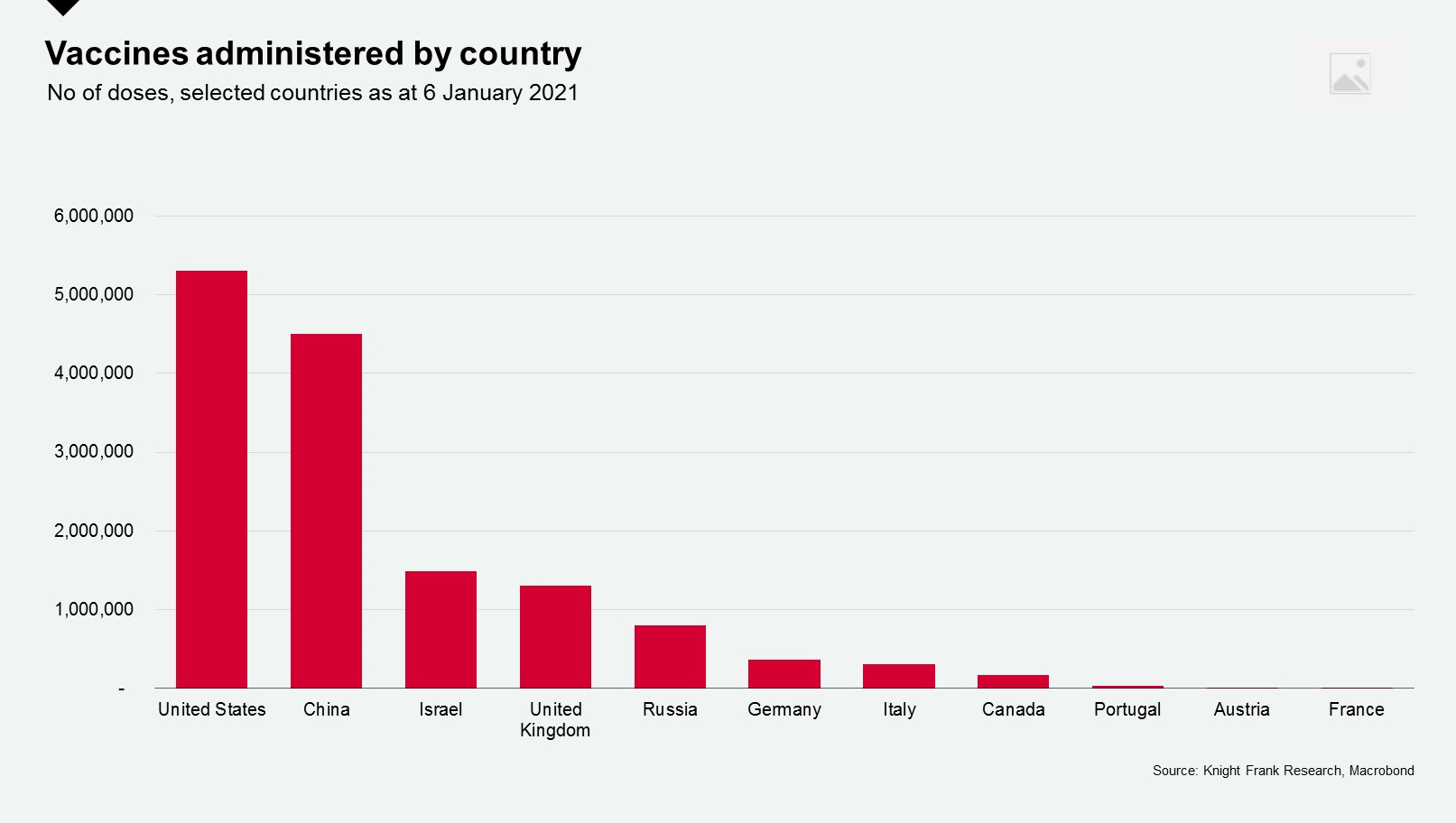

- More than 15.9 million doses have been administred across 37 countries. Europe’s rollout has been notably sluggish. The chart below shows a breakdown by country with Israel a key frontrunner having vaccinated 14% of its population.

- Bloomberg is tracking the development of nine of the globe’s most promising vaccines. A total of seven vaccines are now available for public use, in limited quantities, in dozens of countries. The EU has approved the Moderna vaccine this week.

Residential Digest

Europe

- Portugal has announced plans to change its Golden Visa Investment scheme from 1 July 2021 giving non-EU investors a narrow window to invest in cities such as Lisbon and Porto. From this date the initiative will look to attract foreign investment to low-density regions only.

- Chris Druce provides an update on what the UK’s new lockdown means for the housing market and Tom Bill sets out the outlook for the UK property market against a conflicting backdrop – the roll out of two vaccines, a last-minute Brexit deal and the threat of a new variant.

Asia Pacific

- Knight Frank’s new Asia Pacific Outlook Report sets out the direction of travel for prime residential markets across the region with the improvement in sales volumes evident between March and October 2020. Cities across Mainland China, India and New Zealand are currently registering the strongest levels of activity.

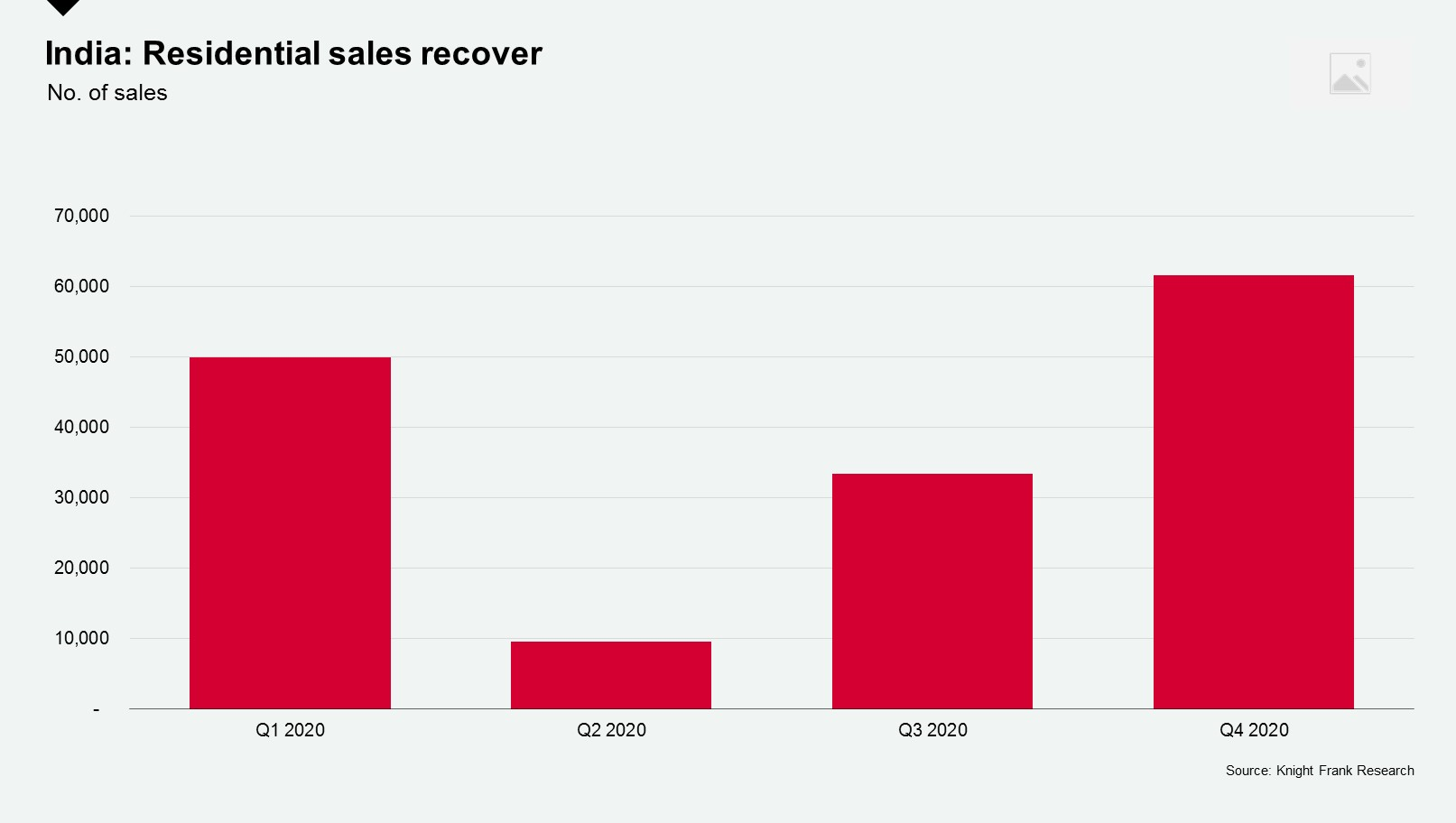

- In India, residential sales recovered in the second half of 2020. According to the new India Real Estate Report, the resumption of economic activity, reduced likelihood of further stringent lockdowns and the increased chance of the availability of a viable vaccine in 2021 allayed some of the fears associated with the pandemic. Developers also pursued aggressive sales strategies by being extremely flexible on prices.

North America

- Manhattan registered 17 sales above $4 million in the week after Christmas, the largest number recorded that week since 2006. Townhouses accounted for seven of the sales, the highest proportion of weekly sales since the end of January 2020.

- Palm Beach continues to break records a trend we highlighted last year, with 20 sales completed above $20 million in 2020, up from 10 in 2019. Agents report heightened demand due to job relocations – some Wall Street firms and hedge funds relocating to Florida – the state’s benign tax system and pent-up demand as a result of the pandemic.

Africa

- 32% of Kenyan buyers are more likely to move in the next 12 months as a result of the pandemic according to the new Kenya Buyer Survey. The report takes a deeper dive into the data gleaned from Knight Frank’s Global Buyer Survey. Some 77% of Kenyan buyers expect to work from home and 68% are more likely to want a property with a large garden.

For further information on any of the datasets or research reports highlighted please contact Kate Everett-Allen