Private retirement living market estimated to reach a value of £44bn by 2022

Driven by private sector development, investment into the UK later living market is currently at its highest level ever.

2 minutes to read

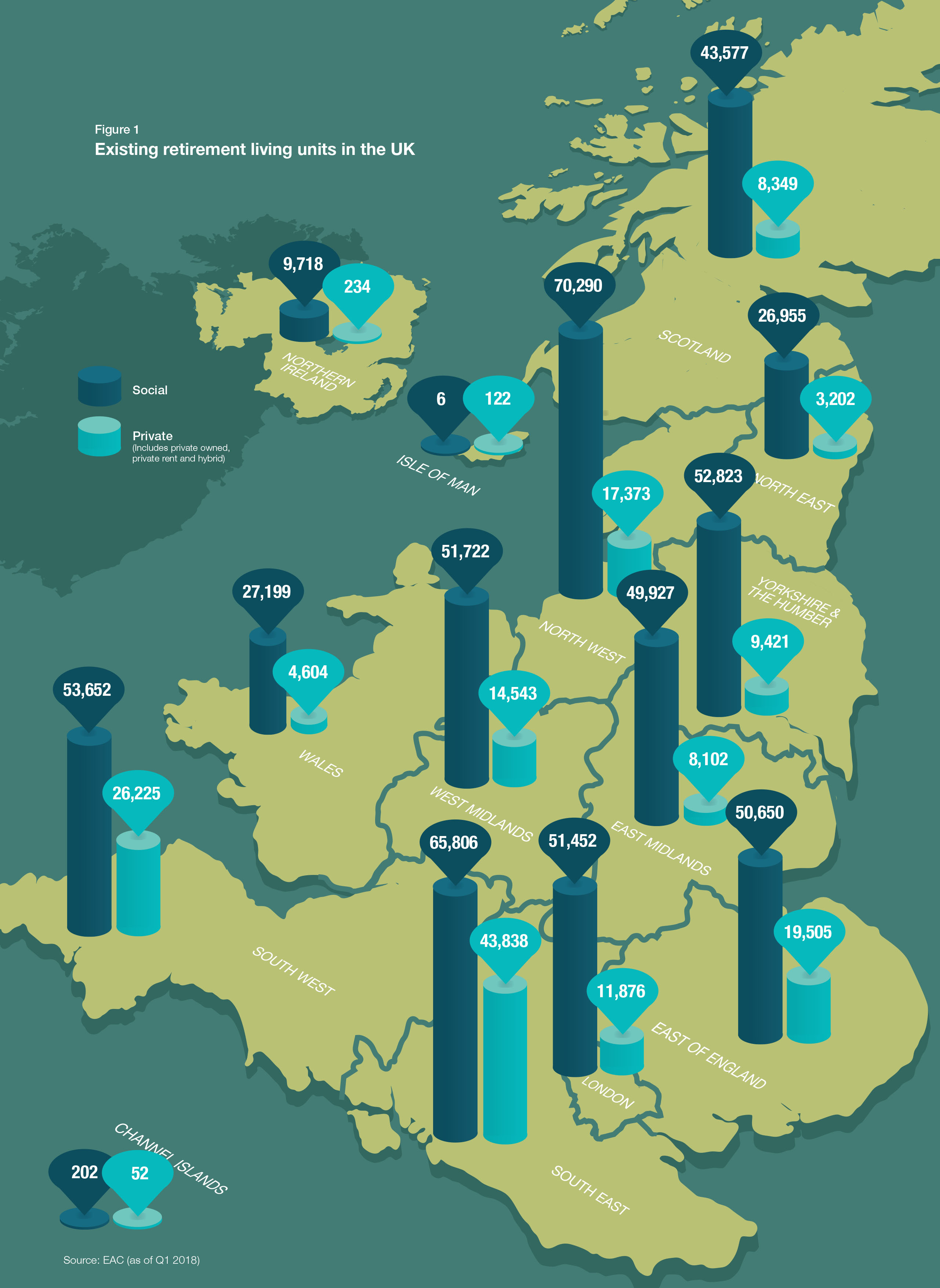

Our latest report from our Retirement mini-series examines the drivers of the retirement living market, what the supply market currently looks like, and what we forecast for the future. The key messages from the report are:

• We forecast that the total number of private Retirement Living units will increase by 30% between 2017-2022.

• Investment is being led by private sector development. We forecast that the private sector’s market cap will increase by 50% in value between 2017-2022, from £29bn to £44bn.

• Growth is being driven by the increase in older people and increased investment into the sector as it matures.

• Private development has accounted for 54% of all new retirement housing units delivered annually since 2000. Looking ahead to 2022, this is set to rise to 78% of total delivery

• There are currently 10 million people (18% of our nation’s population) over the age of 65 in England. This is forecasted to increase by 20% to 12 million people in 10 years.

Tom Scaife, Head of Retirement Housing at Knight Frank commented,

"Going forward we rapidly need every UK local authority to have a cohesive plan for the delivery of retirement living – so they can be held to account for meeting the needs of their constituents.

"The government has committed to help those at the beginning of the property ladder with initiatives such as the ‘Help-to-buy’ scheme and stamp duty relief for first time buyers. These initiatives and support should not be constrained to the beginning of the ladder – support should be available at all stages of the property life cycle."

“At a national level, a 20% allocation should be given for retirement living from the UK’s annual housing delivery target of 300,000 homes. Given that 18% of the population is over-65 (almost 12 million people), and that this age is predicted to increase by 20% over next ten years, it is imperative that the issue is addressed.”

To find out more, read the full report here

For more information on Retirement Living please contact Tom Scaife or contact: