UK Cities DNA | to Refurb Refit Reposition or Repurpose

Retrofit? Refurbish? Reposition? There's no one-size-fits-all solution, but we have crunched the numbers and identified a range of factors which drive value, viability and the potential to drive short and long term performance.

4 minutes to read

Some assets fail. Period. Obsolescence may be the key driver behind this, and this may take on any number of guises.

How the situation arose is a secondary consideration to the remedial action required to restore value. Understanding and assessing obsolescence risks is key - and having the right strategy to remedy the issue.

There is no ‘one-size-fits-all’ solution to obsolete assets - there is a plethora of remedial options available. These fall broadly under three ‘re-’ headers - retrofit, refurbish or repurpose.

All our analysis comes with the caveat that there is great variation between assets.

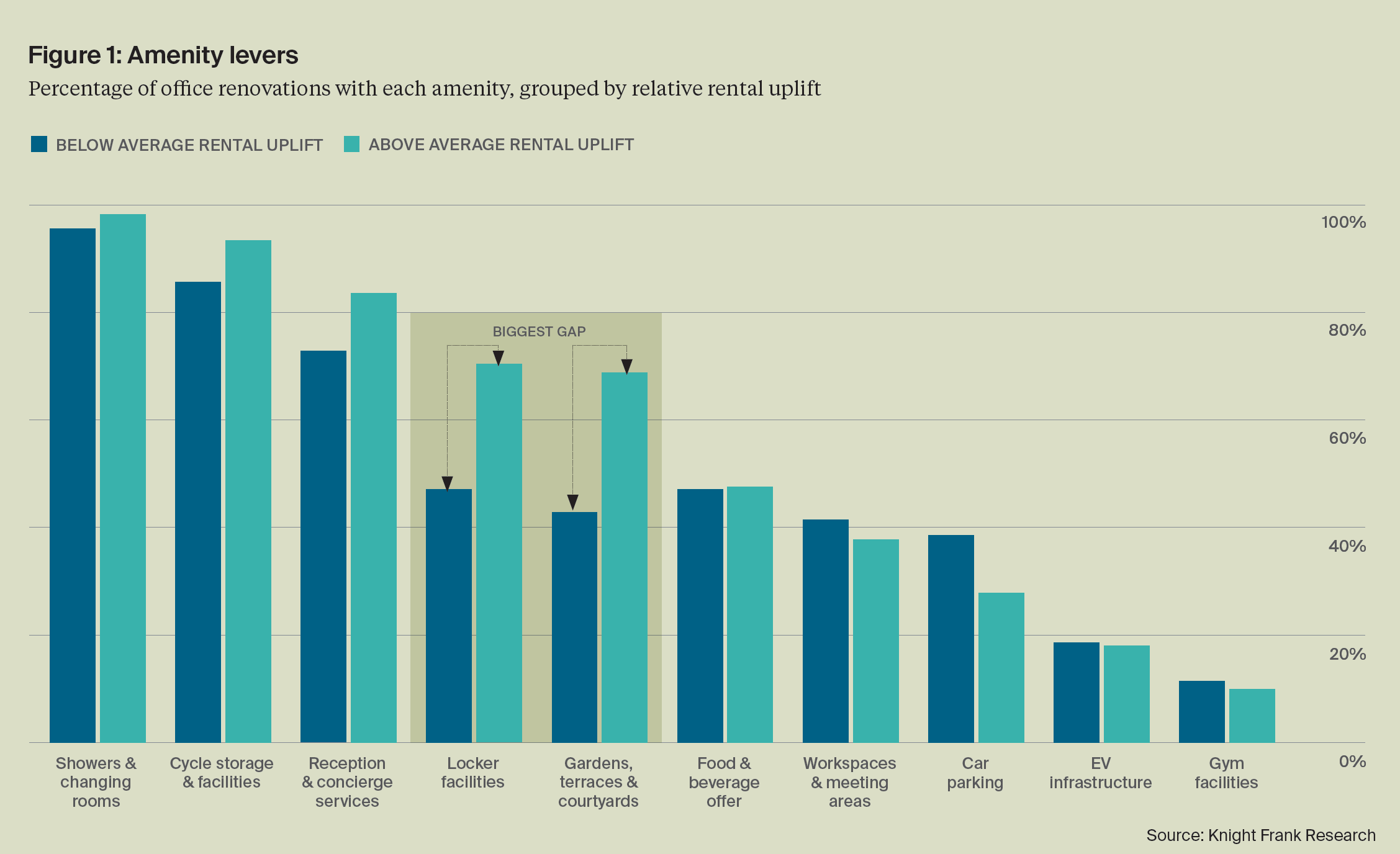

On average, an office retrofit/refurb from an EPC C and below to B and above saw the gap of rent relative to prime close by 18 percentage points. Amenity provision is also key and certain amenities correlate with higher uplifts.

Our analysis of average rents achieved for offices rated EPC C and below shows a widening gap relative to prime. The cost of inaction, or base case, is growing and is likely to continue doing so.

Rent is only one piece of the puzzle. ESG-focused improvements are likely to lower a property’s risk premium. This is a key component of yield, potentially supporting yield compression and enhancing value and performance.

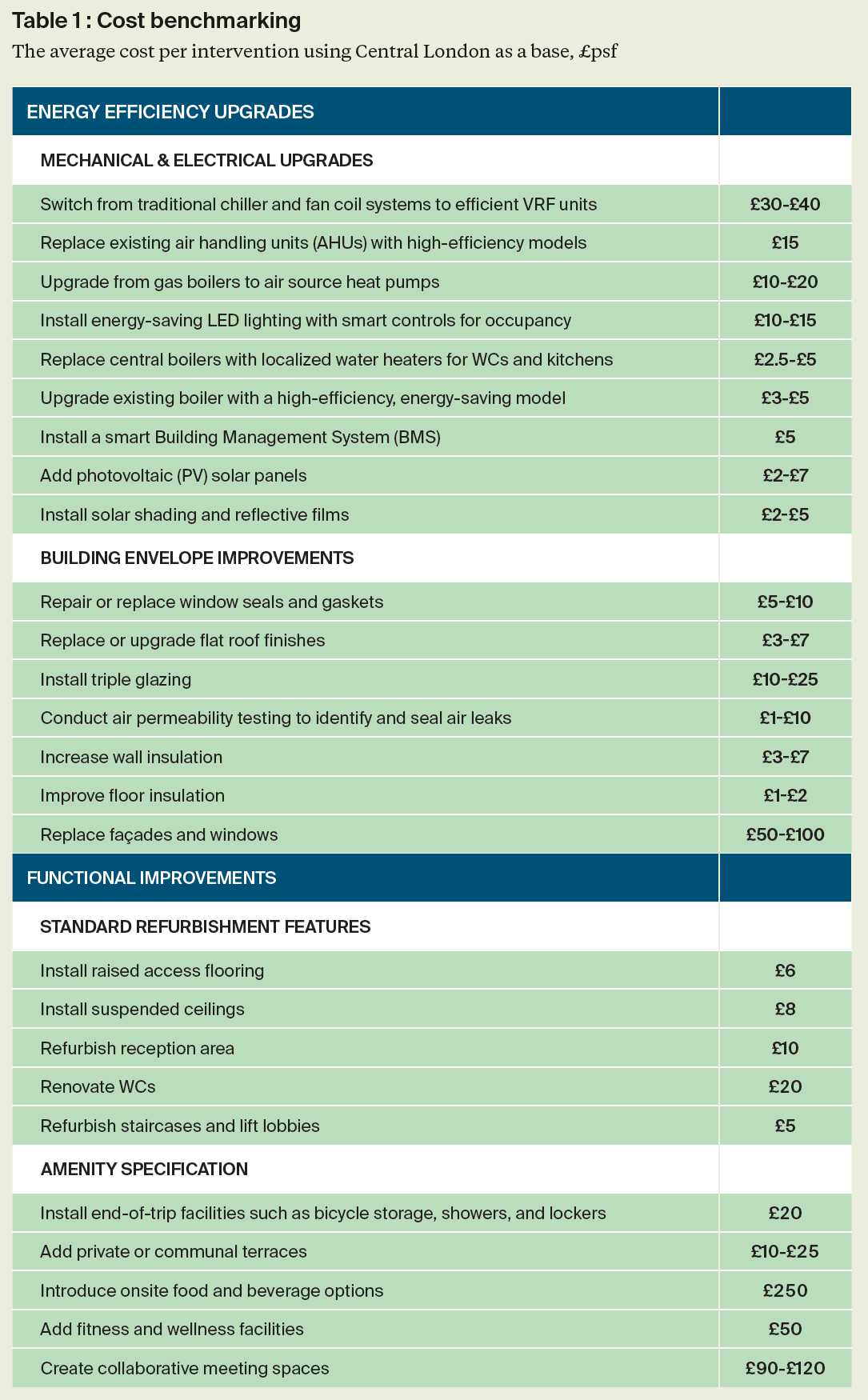

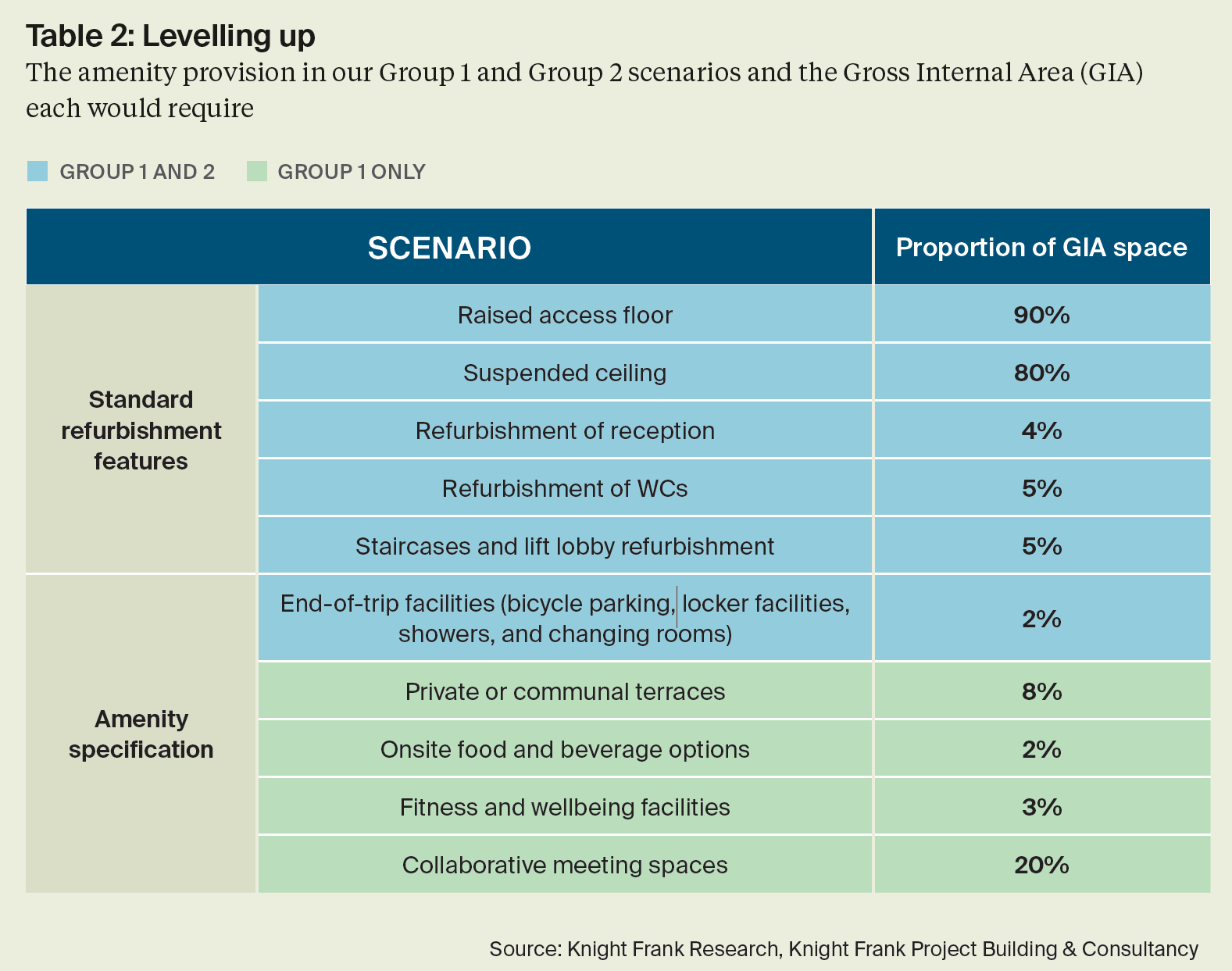

This upside will, of course, need to be balanced by cost implications and can be explored through a number of scenarios. A key one is upgrading to EPC B. Our hypothetical scenario of an EPC D-rated office building in London being upgraded to meet the potential EPC B minimum would cost £113 per square foot (psf). When layering on various amenity levels in our scenario, the cost rises to £268 psf.

To Refurb or Retrofit: The Property Manager View

A landlord with an obsolete asset has a difficult decision to make – to update the existing asset through a retrofit, or to completely overhaul with refurbishment. There are two fundamental considerations here - the first is disruption.

If retrofitting, the building will remain operational, but complex retrofits can cause significant interruptions. Refurbishing projects typically involve much more visible disruption. Planning and communication are key - the occupiers should be able to input and buy into the plans.

The second fundamental consideration is the comfort and functionality of the asset. Enhancing the usability of the space leads to higher levels of occupier satisfaction and increases the chances of attracting higher-quality occupiers. Careful consideration needs to be afforded as to how the amenities will function, and whether they will actually be used.

Operational costs are invariably the main driving factor in the decision-making process, inevitably hinging on balancing initial costs versus long-term savings. Retrofitting generally has high initial outlay, but also has potential for long-term savings through lower operational budgets.

To Refurbish or Repurpose: The Building Consultant View

What are the practical considerations? The main driver is for the project to be economically viable - striking a tricky equilibrium between market trends, user expectations and financial constraints, as well as regulatory challenges. The key is to not let unrealistic project goals prevent a viable scheme.

With the three ’res’, there are some key practical considerations facing the industry:

Legislative:

With the tightening of legislation on demolition, the refurbishment and repurposing of existing buildings reduces waste and carbon emissions, certainly compared to a re-development project.

For example, Knight Frank is currently undertaking a refurbishment project on an asset constructed in 2003. Due to insufficient base build design information, surveys and laboratory assessments have had to be undertaken to prove the design intent under the original Fire Strategy - reverting to regulations when the building was constructed is now very challenging.

Physical requirements:

In order to achieve EPC B rating and above, significant intervention will usually be required. However, the necessary level of intervention can only be assessed on a building-by-building basis and is often dependent on the age of construction.

Above all else, a Sustainability Strategy needs to be developed from the outset, with clear targets that can be measured against to demonstrate value.

Functional:

Refurbishment or repurposing projects often involve more intrusive works – this needs to be assessed in detail to review the sequencing of the project events. If the building can remain part-occupied during the project, then a strong communication plan is essential.

Common denominators

Each ‘re’ has its own merits, risks and rewards and the viability will vary dramatically by project and asset.

Whether retrofitting, refurbishing or repurposing, thorough and effective contingency planning is essential. Risks need to be considered at the outset, to ensure the project is viable and unexpected costs and delays are mitigated.

Each asset is unique, each project is different - there are no ‘one-size-fits-all’ solutions.