UK Cities DNA | The new case for UK Commercial Real Estate

The UK frequently ranks first or second as a destination for cross-border real estate investment, and with ongoing relative liquidity and an overt commitment to growth sectors, the UK continues to be a favourable real estate market.

4 minutes to read

Key takeaways

- The UK frequently ranks first or second as a destination for cross-border real estate investment across key sectors over the year to date.

- The UK’s ongoing relative liquidity is being driven as much through new and emerging factors as it is traditional strengths and selling points.

- New factors include exposure and commitment to growth sectors (e.g. technology, life sciences and green energy) and a pipeline of structural reform, infrastructure development and productivity improvement…

- …underscored by more established fundamentals, such as a solid legal framework, the English language, a beneficial time zone, favourable lease structures and a competitive tax regime.

A Relatively Resilient Market Amid Global Uncertainty

As global economic, financial and real estate landscapes continue to strive to break free from the shackles of a pandemic, elevated inflation, interest rates at a level unseen by a whole generation of decision-makers, and a slew of other structural shifts, investors are increasingly refocusing their attention on global real estate gateways, with the UK emerging as a prime destination.

The UK is continuing to attract the capital that is out there, catering to a range of objectives, from global diversification or wealth preservation, to exploiting cyclical opportunities.

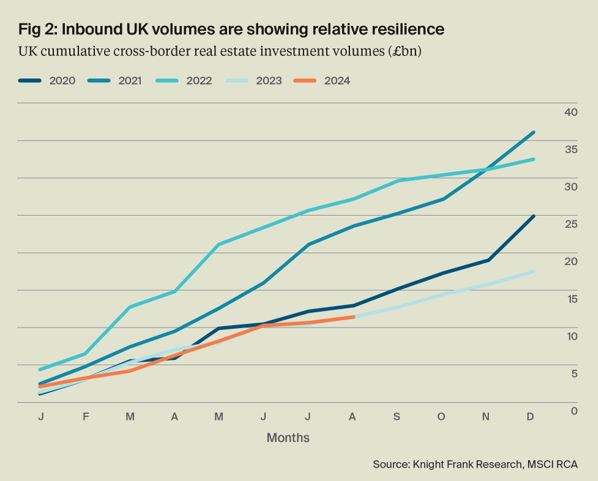

At the time of writing, the UK stands as the number one global destination for inbound capital. Except for a brief third place in 2018/2019, the UK has consistently ranked first or second as a destination for cross-border real estate investment. Additionally, over recent years an average of 55% of inbound capital has flowed to the regions, so it is not just London benefitting from this.

Business as usual?

Due to a global retrenchment in the appetite of US investors for cross-border investing, inbound UK activity over the year to date is roughly on a par with 2024, although this is better than the global picture where activity remains lower than recent years.

The UK’s “selling points”

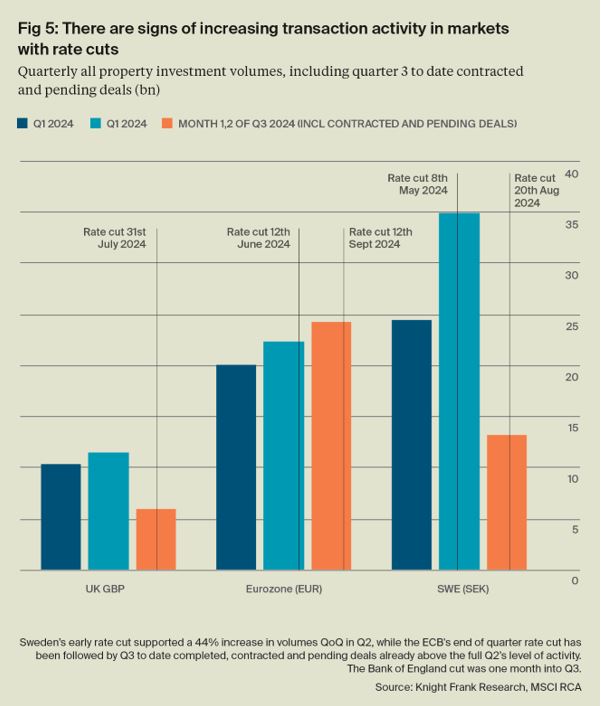

The UK’s legal frameworks, language and time zone, bridging the Americas and Asia, along with favourable lease structures all contribute to the UK’s draw, while the recent election was followed by a relative stability dividend in the financial markets. Combined with the Bank of England having implemented its rate cutting, we have additional tailwinds which are set to support UK commercial real estate.

For example, rate cuts in other markets are correlated with increased deal activity.

The need for a more detailed narrative

In order to find comfort in this recovery and assess the continued resilience of UK real estate, it is important to also assess what else might be underpinning future success particularly as new sectors, from data centres to the residential sectors and beyond develop and traditional sectors evolve.

The UK is well positioned to benefit from technology, life sciences and green energy, which are expanding sectors and bring with them a need for specialised real estate, from office spaces tailored for tech companies, to laboratories and manufacturing facilities for life sciences. This is supported by, for example the new governments recognition of the importance of data centres and plans to ease planning to develop these.

The UK is the second-largest cross-border market globally for the residential investment and therefore positioned well amid the significant proportion of investors wishing to access this sector.

UK commercial real estate as an opportunity for sustainability goals

The UK has more than 15,000 BREEAM New Construction certified projects, over 70% of which are out of London, providing opportunities for investors looking to ‘green’ their portfolios.

The UK financing arena: a diversified landscape

The UK’s financing landscape is one of the most diversified in the world, with a strong presence of both bank and non-bank lenders, the latter emerging following the Global Financial Crisis. This diversity provides at least in part a solution to the debt funding gap in a way that isn’t present in other countries with bank-led real estate lending.

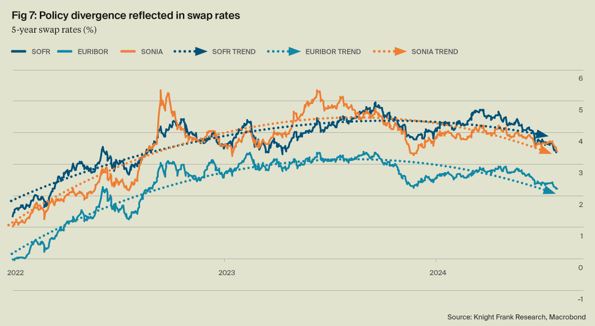

Moreover, we are also starting to see swap rates moderate, even if they remain higher than they were in 2019 / 2020 (assuming a typical 5-year loan term) – i.e. this gap is starting to wash through, becoming relatively more accretive.

Cyclical indicators

The UK is, by some margin, the largest recipient of cross-border Private Equity investment over the year to date ($5.3bn into the UK vs $1.5bn into Japan the next largest recipient) and more than half of this has been into the regions outside London, across predominantly the hotels and residential sectors, followed by the office, logistics and retail. PE is a leading indicator of cyclical recovery, positive for the UK.

Indeed, indications are that the UK commercial real estate sector, with its economic and financial tailwinds, amid thinner competition and signs of recovery, offers a window of opportunity for investors.