Betting big on Single Family Housing

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Seismic changes are underway in the UK rental market.

People are generally renting for longer and until later in their lives. Almost a third of renters have been at the current address for more than five years. That prevents properties from cycling back to the market, increasing pressure on supply. Meanwhile, higher mortgage rates and a shifting tax and regulatory landscape have prompted many private landlords to rationalise their portfolios, weighing further on the availability of rental homes.

Few sectors enjoy tailwinds like these and investors want a piece of the action. Investors spent a record £1.9 billion acquiring or funding more than 6,200 Single Family Homes (SFH) last year, up fivefold from £388 million in 2022.

Scaling up

This has further to run. Investors need scale and housebuilders have been through a challenging period, so bulk deals make sense. Yesterday, Vistry announced it had struck a deal with Blackstone and Regis to deliver approximately 1,750 homes for £580 million. Leaf Living will manage the portfolio, which is concentrated in the south east and will largely be delivered during the next two years.

Housebuilders have started incorporating forward sales models into longer-term business plans as a way of diversifying income streams. Vistry's partnerships strategy includes pre-selling circa 65% of all homes. An uptick in partnerships and JVs have the potential to have a significant impact on SFH supply - the top five housebuilders alone have a combined land bank of more than 350,000 plots. If 30% of these were sold to SFH investors it would add over 100,000 homes to the sector.

"Institutional private capital can play an important role in providing high quality housing stock across the UK, particularly in the private rented sector which is significantly undersupplied today," said James Seppala, Head of European Real Estate at Blackstone. "Partnerships such as these can meaningfully accelerate the delivery of new homes and help alleviate structural undersupply across the sector."

New homes

These conditions won't last forever. Housebuilder sales rates are incrementally improving as mortgage finance becomes more favourable.

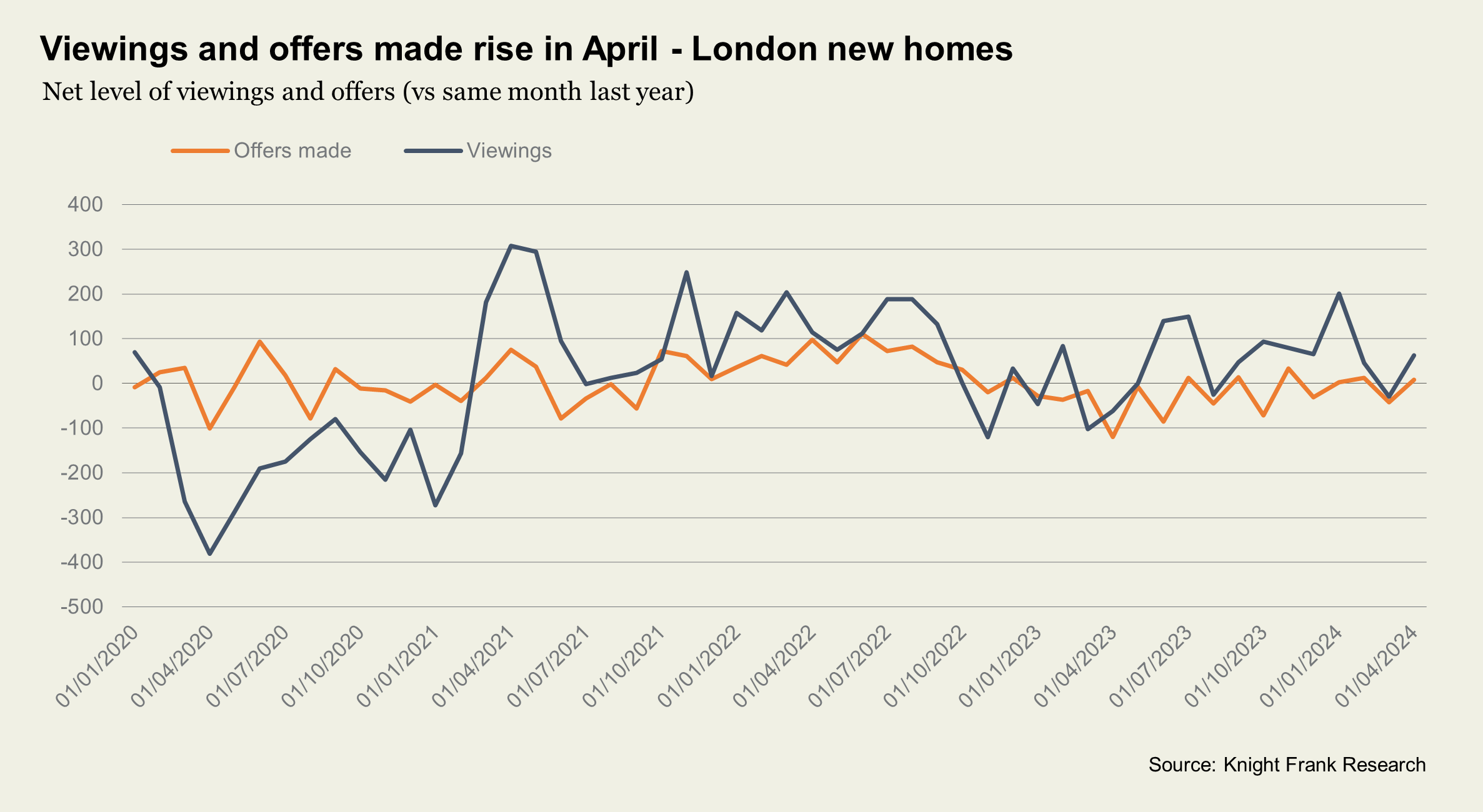

Anna Ward takes the pulse of the London new homes market this morning. In April, the total number of offers made on new homes in the capital rose 9% compared with a year earlier, while viewings were up 17%, Knight Frank data shows. In early 2024, the net volume of viewings and offers made has largely been positive against 2023, other than a dip in March when inflation rose at a stronger rate than expected (see chart).

The number of prospective buyers registering their interest in purchasing a new home last month in London increased by around 15-20% compared to April 2023 for the mid-to-upper markets. The most popular price points are either £750,000 up to £1 million or £2m plus.

The London Series

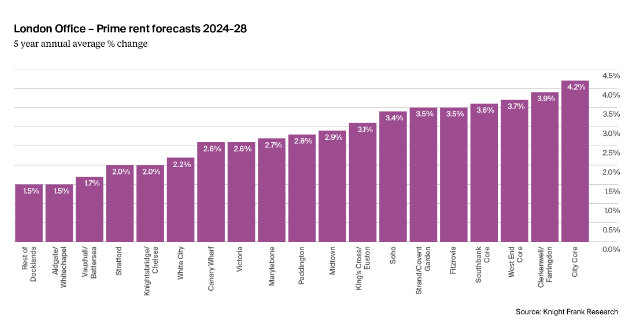

Occupiers have become more discerning with regards to how they view best-in class offices, so Knight Frank has adjusted the quality criteria it uses to determine prime rents. This change has resulted in an uplift to prime rents in almost three-quarters of submarkets in London - see the analysis from Shabab Qadar.

We have also revisited our five year forecasts for prime rents, given the improved near-term outlook for occupier demand and a development pipeline that remains below average.

As the rate environment hopefully becomes more favourable later this year, we expect to see businesses grow in confidence and commit to expansion and relocation plans. This will boost demand for highly sustainable, amenity rich, and centrally located offices. Furthermore, with 28.3m sq ft of lease expiries occurring between now and 2026, and potential under-supply of prime space in core submarkets, we expect growth to spill over into other non-core submarkets.

Over the next five years, we expect the strongest average annual growth in the City and Southbank to be in the City Core (4.2%), Clerkenwell/ Farringdon (3.9%), and Southbank Core (3.6%). In the West End, we expect the highest growth in prime rents in the West End Core (3.7%), Fitzrovia (3.5%) and Strand/Covent Garden (3.5%).

In other news...

The huge fiscal challenges faced by an incoming government (Resolution Foundation), ECB rate cut to breathe fresh life into Eurozone economy (FT), Tories plan big cuts to inheritance tax, predicts George Osborne (FT) why commercial property values have hit the floor (Times), and finally, bond traders pile into fresh bets on faster pace of fed cuts (Bloomberg).