Insight 5: London's Future Demand Profile

As demand-side momentum continues to build in the London office market, we assess the role of structural demand, active requirements and three specific sources of demand in sustaining the positive trajectory

10 minutes to read

As demand-side momentum continues to build in the London office market, we assess the role of structural demand, active requirements and three specific sources of demand in sustaining the positive trajectory.

Previous papers in The London Series have noted that the London office market is experiencing a steady increase in post-pandemic leasing volumes, expansionary demand, and a 10-year high in active demand. Occupiers seeking high-quality office space to support business transformation, enhance the workplace environment and experience, or react to the growing challenge of physical and functional obsolescence, are bringing renewed momentum to the market. We believe this momentum will be sustained during 2024, leading to an annual office take-up of 12m sq ft – an increase of 12% year-on-year and returning take-up to its long-term average. This positive forecast reflects the structural demand inherent in the market, the strength of current active demand, the next stage in the maturation of London’s tech sector and the emergence of three accretive sub-sectors.

Structural demand

Structural demand – demand that derives simply from the expiry of leases – is a significant component of our demand forecast. As we noted in paper 2 of the series, 28.3m sq ft of lease expiries will occur in the market over the period 2024-26.

"More than 900,000 sq ft of demand derives from two sub-sectors – IT Software and Media Production, Distribution and Broadcasting."

Whilst some occupiers will ‘kick the can down the road’ and renew or regear either because of a lack of certainty around their future needs, the cost-effectiveness or operational efficiency inherent in doing so, or the challenges of finding an alternative of the right quality, we do expect many occupiers to choose to exit on expiry. This assertion is grounded in data. Assessment of MSCI Lease Event Review data over the last ten years shows that, on average, 70% of occupiers in the City of London and West End chose to exit leases on expiry, compared to 30% who renewed or took on a new lease.

Applying this benchmark to the current market infers that 19.8m sq ft of office floor space will be vacated on lease expiry over the next three years. Taking this analysis further and using annual volumes of lease expiries suggests that 5.9m sq ft, 7.1m sq ft and 6.8m sq ft will be vacated over 2024, 2025 and 2026, respectively. Whilst this is a relatively blunt interpretation of a more complex market reality, our analysis does suggest that those occupiers with a structural need to transact will continue to underpin London’s future demand profile.

However, as paper 4 of the series showed, lease events are rarely the sole driver for a relocation. Other deal drivers, most notably expansion and response to building obsolescence, bring further momentum to the market. Outside of specific deal drivers, sectors and businesses will experience growth spurts, which will also fuel market demand. A fundamental question, therefore, is what industry sectors or sub-sectors will likely drive London’s demand side during 2024 and beyond?

Active demand

Those companies already with named requirements in the market will most likely drive demand over the next 12 months. On that basis, it makes sense to begin by exploring current active demand. The quantum of that demand is clear; there is 11.9m sq ft of demand deriving from 230 active requirements currently exploring market options to transact within the next 12 months.

A more granular analysis of these requirements points to two dynamics. First, 51 requirements – or 22% of all current requirements – seek more than 50,000 sq ft of office space. London continues to attract large-scale occupiers across all sectors. Second, 77% of all current active demand – or some 9.2m sq ft of requirements – derives from occupiers in three broad sector groups: financial services, professional services and technology, media and telecommunications (TMT).

In the case of financial services, there is more than 4m sq ft of active demand. Mainstream, large-scale banks continue to reset their London portfolios but are being joined by a rich seam of niche financial and FinTech occupiers in growth mode.

In professional services, law firms have been at the vanguard of recent market activity. They are now supplemented with activity from accountancy and consulting firms preparing for potential changes in their structure or seeking a further enhancement of their workplaces. There is currently over 3m sq ft of active demand from the professional services sector in the market but from a far broader church of occupiers.

More surprising, perhaps, is the almost 2m sq ft of active demand from the TMT sector. This figure belies the suggestion that London’s status as a hub for global tech is diminishing, given the recent downsizing of the tech titans who drove the last cycle. Instead, the nature of tech sector demand is changing.

Where next for the TMT sector?

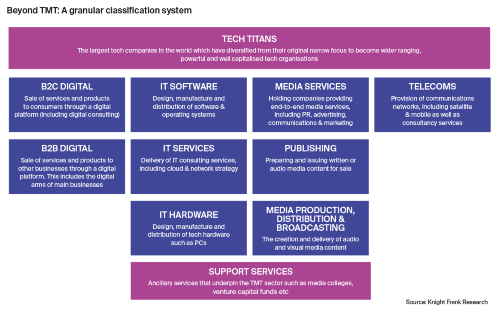

The challenge with broad sector classifications, such as TMT, is that nuance and subtle changes in the true dynamos of the sector can often be lost. Given this, we have devised a more granular classification of the TMT sector to determine the current demand dynamic.

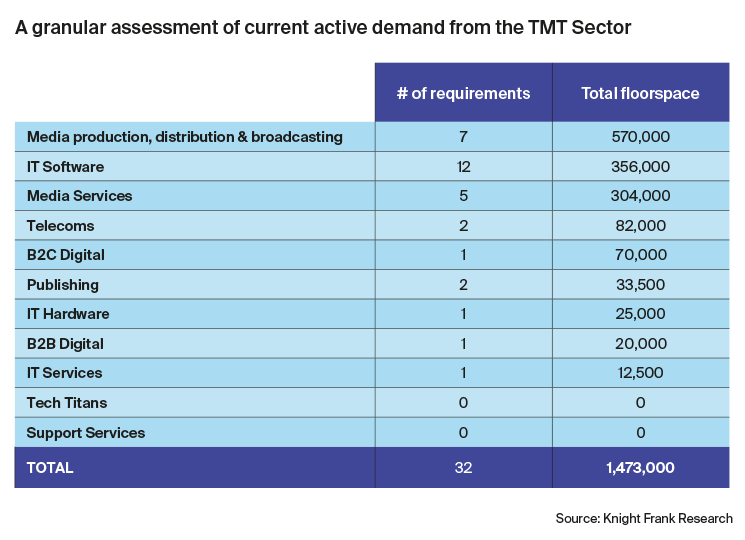

Applying this granular classification to current active demand provides a clearer view of those elements of the TMT sector that are stimulating the market. More than 900,000 sq ft of demand derives from two sub-sectors – IT Software and Media Production, Distribution and Broadcasting. The latter is the source of 7 requirements that collectively account for more than half a million sq ft of that potential demand. The seemingly insatiable consumer appetite for content and the explosion of new delivery channels for its distribution explain this dynamic.

This is not to suggest that the more traditional components of the TMT sector are no longer relevant. IT software is the tech sub-sector generating the greatest number of requirements – with 12 current requirements and a combined need of more than 350,000 sq ft. This demand corresponds with the growth and potential of Software-as-a-Service business models, as recognised by venture capital (VC) investors.

VC funding enables companies to hire more talent, expand their operations, and further advance their products and services. This can generate demand for new or additional office space and, in some instances, specialist real estate. At a global level, London is packing quite a punch. It is one of the foremost destinations for VC funding in the world, attracting £10.5bn of funds in 2023 alone, according to PitchBook.

Our analysis shows a strong correlation between venture capital investment and headcount growth within London’s TMT sectors. Companies from these fields that received Series B or more advanced funding in 2020 saw an average employee growth of 102% from 2021 to 2023.

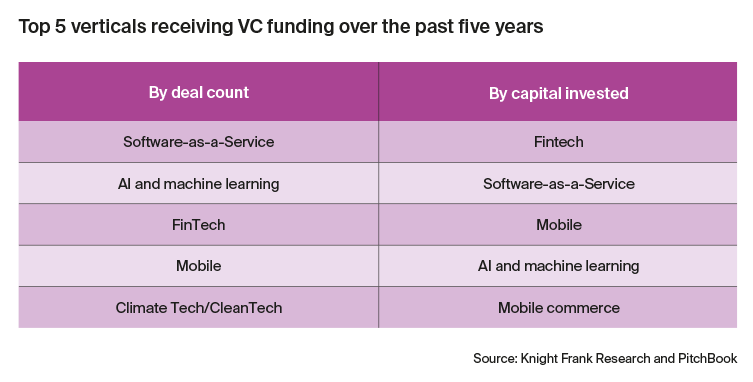

Furthermore, analysis of VC funding flows allows the identification of those sub-sectors or ‘verticals’ that have seen sustained investment. Over the past five years, analysis of VC investment trends reveals that the software sub-sector has been predominant, representing 74% of total funding and 78% of all deals within the TMT industries.

Among the leading verticals, Software-as-a-Service (SaaS) is particularly prominent. Financial Technology (FinTech) and Artificial Intelligence (AI), including machine learning, are also significant verticals. Highlighting the strength in AI,the first paper in the London Series established that London is a hub for over 2,000 AI companies employing 70,000 people.

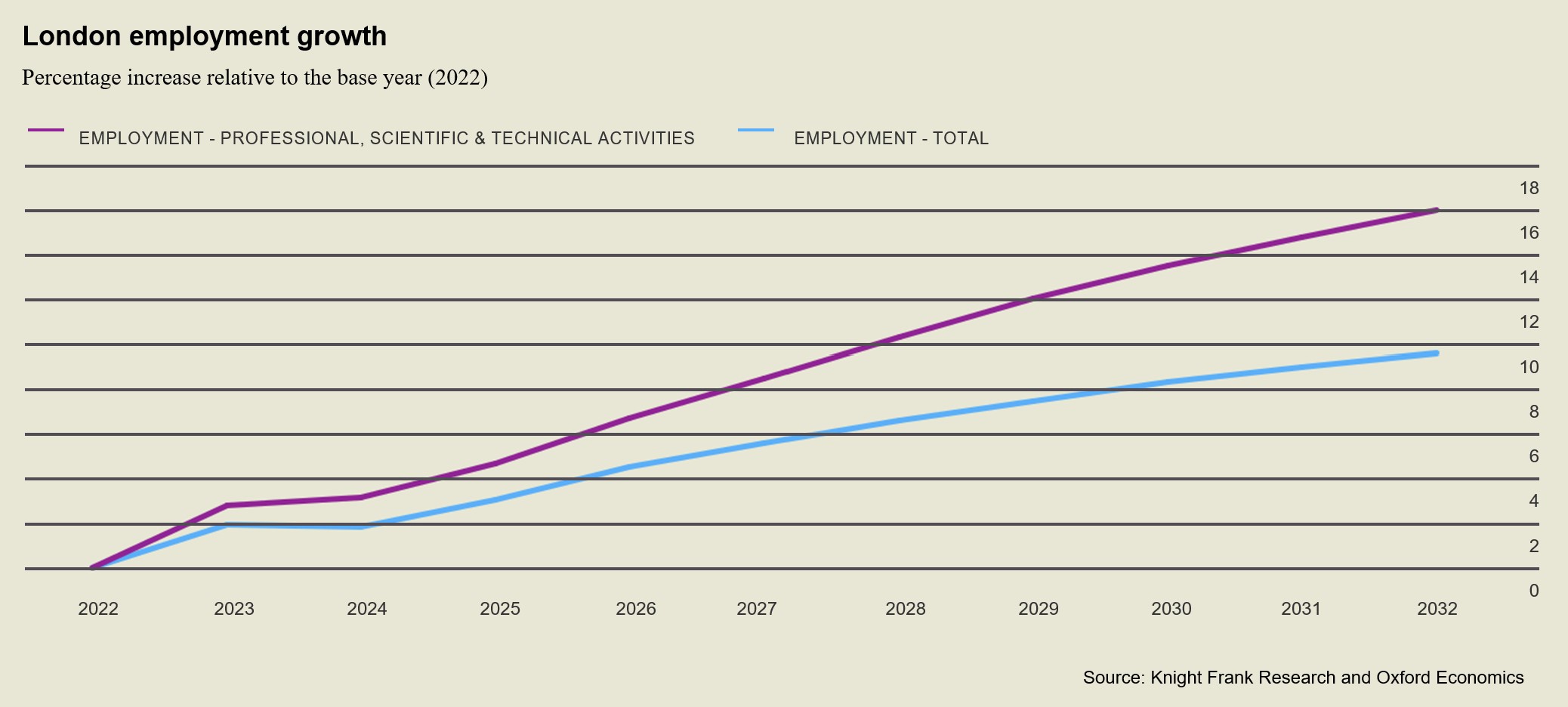

London’s TMT sector is innovating and evolving. It displays a growing diversity of occupiers, new high-growth areas, and is influencing the evolution of more established industry sectors. Accordingly, London’s future employment growth is forecast to be led by the technology and scientific sectors, which will outstrip the overall employment growth rate in the capital. While the TMT sector is changing, it will remain a mainstay of London’s growth and, hence, its future office demand.

Three accretive sources of demand for London

Strong employment growth in the technology and scientific sectors also aligns with three emergent sectors – life sciences, education and climate tech, that will constitute a more significant proportion of London’s future pool of occupiers.

Life Sciences

Given changing demographics, advances in science and the pressing need to intervene medically, either as a response to the pandemic or to lessen the effects of a wide range of diseases, the life sciences sector has received enormous attention. This focus is translating into growing occupational demand. Current demand in London from the life sciences sector exceeds 750,000 sq ft.ii This volume reflects the strength and diversity of London’s existing life sciences ecosystem, which benefits from world-class universities, research institutes and established strengths in high-growth niches such as AI-powered drug discovery.

Indeed, London’s universities collectively produce a spin-out company for every £35.5m invested in R&D. This compares favourably to Boston (£60.4m), Los Angeles (£42.6m) or New York City (£54.5m). Furthermore, London attracts significant investment from domestic and international sources. London is the headquarters location of 40% of the UK life science companies that secured VC investment in 2023, whilst large pharma companies are gravitating towards London, as shown by GSK taking 140,000 sq ft at The Earnshaw for their new headquarters and MSD making a similar commitment in King’s Cross.

Funding continues to flow into the capital, though at rates somewhat reduced from pandemic peaks. London received £1.3bn in VC funding for life sciences in 2023, representing 63% of all funds flowing into the Golden Triangle (Cambridge-London-Oxford) over the same period. The London component of the triangle is becoming ever more powerful. Analysis of these funding flows reveals that investor interest continues to shift towards more complex innovations and away from conventional small molecule therapies. Specifically, leading areas attracting VC backing include AI-driven drug discovery platforms and advanced cell and gene therapies.

One specific area to monitor is the convergence between the tech and life sciences sector – MedTech. Here, investor interest is shifting from conventional medical devices towards advanced connected technologies that collect health data. Examples include digital health solutions for remote patient monitoring and telemedicine, health apps, point-of-care rapid testing for non-laboratory environments, AI decision-making tools and medical technologies relating to precision medicine.

"London’s future employment growth is forecast to be led by the technology and scientific sectors, which will outstrip the overall employment growth rate in the capital."

Education

The collision between previously distinct or separate sectors is a growing trend. Tech and innovation-led sectors increasingly intersect across thematic or impact domains, such as climate change, healthcare, diversity, and inclusion. Occupiers from various sectors and sub-sectors seek to converge within ecosystems to address these critical areas collaboratively. The lynchpin of these ecosystems is often universities and other educational institutions – a second source of accretive demand for London.

There are currently 6 named active requirements from educational institutions collectively seeking almost a quarter of a million sq ft of office space in core London locations. This follows 383,111 sq ft of take-up during 2023 from the education sector, including almost 100,000 sq ft let at Portsoken Street to Northeastern University, which has grown its London presence 22-fold over five years.

As well as their pivotal role in ecosystems, education sector occupiers from across the world are growing and evolving their offer as academia becomes more exposed to commercial forces, seeks to develop more robust joint ventures and alliances with businesses, and as prospective students (and often their employers) become focused on life-long and more flexible forms of learning. These factors bring education into urban centres, closer to prospective students and commercial partners.

"London received £1.3bn in VC funding for life sciences in 2023, representing 63% of all funds flowing into the famed Golden Triangle (Cambridge-London-Oxford) over the same period."

Climate Techiii

A final area of future demand to carefully monitor is the climate tech sector. London is rapidly becoming the European powerhouse in the sector. London & Partners analysis has found that London climate tech start-ups raised more than $3.5bn in venture capital during 2023, up from $2.2bn in 2022. London has seen sustained investment capital and now ranks number two globally for climate tech investment behind Stockholm.

London is already witnessing inward investment flows from climate tech companies, with the sub-sector constituting 23% of all Foreign Direct Investment (FDI) into London during 2023 – double the proportion seen in 2022. Furthermore, unique postings featuring either a green skill or job title accounted for 46,500 or 3% of London’s total job postings in 2023. As the climate crisis continues to capture attention, and society, governments, and business grapple with the means of mitigating its effects, companies innovating in the climate tech space will be thrust further into the spotlight and onto a high-growth trajectory.

View the London Series homepage