Scrap stamp duty, says the OECD

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Eight in ten housebuilders think that a Labour government would create better conditions in the land and development market, according to a Knight Frank survey of 50 volume and SME housebuilders published this week. That's up from seven in ten three months ago.

That may well be the case. Labour's plans for the grey belt look sensible, particularly when you compare them to the various recent policy changes made by the government. The Conservative Party has long sought to walk a fine line between building enough homes in places that aspiring homeowners would like to live, while avoiding upsetting existing homeowners in rural constituencies that are wary of new development. The result, housebuilders repeatedly tell us, is a confused policy landscape full of delays.

However, there's only so much that a Labour government can do in the short term. Data compiled by the planning consultancy Lichfields and covered by the Times this morning suggests that many local authorities are taking advantage of Conservative policies that make it easier to block development. In the past few months, 15 local authorities have cut the number of homes they intend to build over the next decade by 10%. South Staffordshire has cut its annual target by more than 40%.

Housebuilding

Lichfields reckons there will be a shortfall of 11,000 new homes over the next five years in relation to predicted demand in the impacted areas. The Labour Party tells the Times that they will scrap the government's recent changes to planning policy if it wins the election, but that will require a lengthy consultation.

The combination of restrictive policies and uncertainty as to how it all might be amended over the next twelve months is not ideal for housebuilders trying to position themselves for the next cycle. Nevertheless, key indicators in our survey have turned more positive.

Nearly 40% of our respondents said site visits and reservations had increased during the past three months, which is the strongest reading since we first asked this question in late 2022. New development is picking up: half of respondents said that start volumes will increase next quarter, the strongest reading since the survey began in 2021.

Student housing

Nearly a quarter of our respondents said student developers were the most active land buyers in their regions in the first quarter, second only to the PLC housebuilders.

Indeed, investors view the sector favourably due to its counter-cyclical features and the prospect of good risk-adjusted returns. Our latest market update, out this week, shows that 21 deals completed during the first three months of 2024 with a combined value of £750 million. That's up substantially from the £148 million transacted during the same period last year, but its still down compared to 2022 and 2021.

The transactional evidence suggests that yields were stable this quarter having shifted by approximately 50-75 basis points from peak pricing. The increased cost of debt does continue to put pressure on deal structuring, particularly in the funding market. Consequently, we are seeing investors seeking alternative pathways to deploy capital as well as diversify their risk. While funding is available for prime assets in prime university towns and cities, for others - particularly those in more secondary locations – joint venture (JV) structures are proving more favourable.

Another call to scrap stamp duty

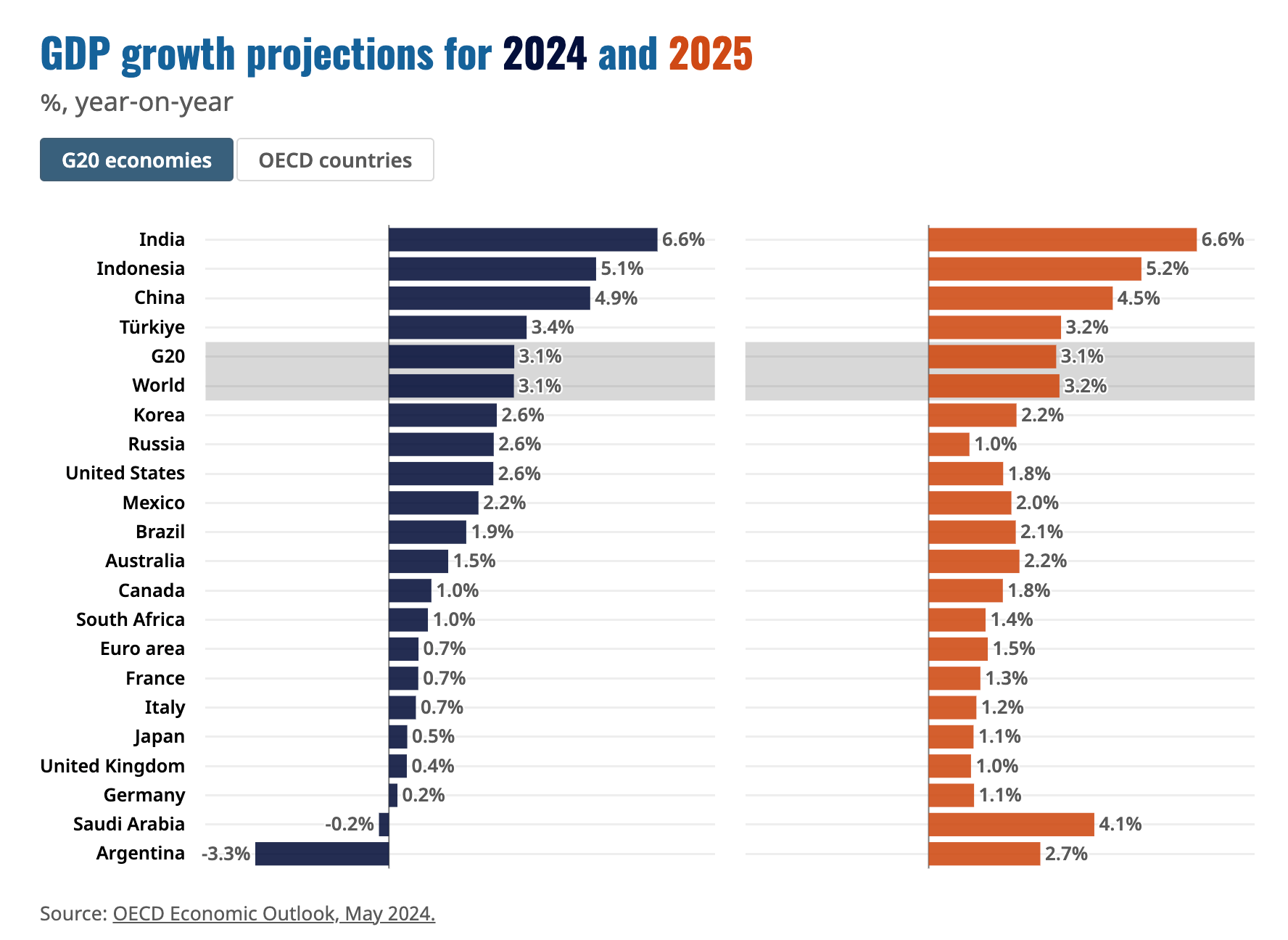

Global economic growth came in above 3% last year, despite the drag exerted by tighter financial conditions and conflicts in Europe and the Middle East. New forecasts from the OECD suggest we'll see that rate of growth maintained through 2024 and 2025.

The UK will underperform, because "sticky services price inflation and fiscal drag will continue to weigh on consumers’ purchasing power, soft external demand will constrain trade growth, and policy uncertainty will impede business investment." Interestingly, the group suggests that the government reforms property taxes, including a revaluation of council tax bands based on current values and scrapping stamp duty.

The OECD reckons the Bank of England will cut the base rate from its current peak of 5.25% to 3.75% by the end of 2025. The next decision, due next week, will be a hold. Financial markets are now only fully pricing in a first cut in September and a roughly 50/50 chance of a second move by the end of the year.

In other news...

Goldman Sachs ditches bonus cap for top London staff (Times), Europe's east will soon overtake club med for living standards (Bloomberg), and finally, commercial real estate lending plunges to lowest in a decade (Bloomberg).