Japanese commercial real estate transaction volumes surge to two-decade high

Japan has recently expanded its overseas investments after being inactive in the commercial real estate investment boom from 2021 to 2022.

6 minutes to read

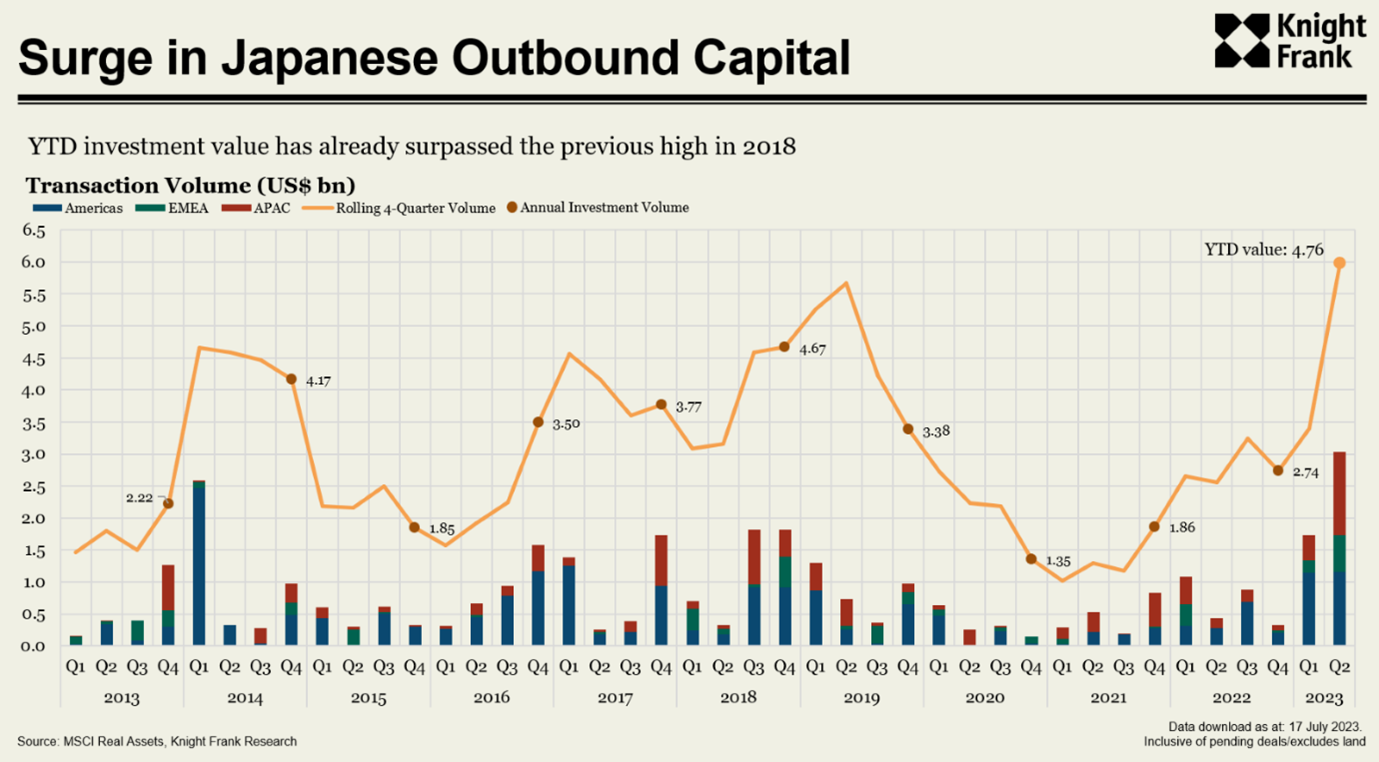

Commercial real estate (CRE) transaction volumes from Japan hit their highest half-yearly figure in two decades, rising to US$4.76 billion in the first half of 2023, more than double over the same period a year ago.

Notably, the second quarter exhibits a near six-fold (593%) increase, signalling a substantial upswing in Japanese investment abroad. Almost 30% of this investment goes into the Living Sector, which includes various real estate types where individuals reside at different stages of their lives, such as student housing, co-living spaces, multi-family properties, and senior living facilities.

Why has investment from Japan risen?

First, Japan is expected to end two decades of deflation. The annual inflation rate in July reached 3%, surpassing the Bank of Japan's target of 2% for 15 consecutive months, spurring increased consumption and investment by individuals and businesses. Such positive behaviour was one of the key drivers behind its better-than-expected second-quarter GDP expansion at an annualised 6%, which significantly exceeded economists' expectations and marked its third consecutive quarterly growth. For the whole year, many forecasts also alluded that Japan’s GDP growth will outperform that of the United States and other G7 nations, highlighting the resiliency of the Japanese economy.

Second, the Bank of Japan has maintained an accommodative monetary policy despite inflation consistently exceeding the 2% target. Although widely seen as a global outlier, the measure has worked well for its economy, encouraging borrowing, investment, and robust spending. Further, this cautious approach to rate hikes also benefitted the performance of Japanese stocks. The Nikkei 225 Index hit a 33-year high on June 5, 2023, and uplifting signs show that the stocks are finally edging in on their previous peak in December 1989.

Third, the Yen has plunged to a 20-year low against the greenback, triggering a significant divestment of US treasuries. In pursuit of greater resilience and higher yield, supported by low interest rates in Japan, real estate assets, such as the industrial and living sectors, are preferred. To illustrate, one of the notable transactions in Q2 involved Mitsubishi Estate and CEFC's significant acquisition of a 56% stake in Mirvac's Build-to-Rent (BTR) Portfolio for US$657 million. This highlights the deep pockets that Japanese investors possess and are ready to deploy into new economic sectors for portfolio diversification.

Asset classes most favoured by Japanese outbound capital

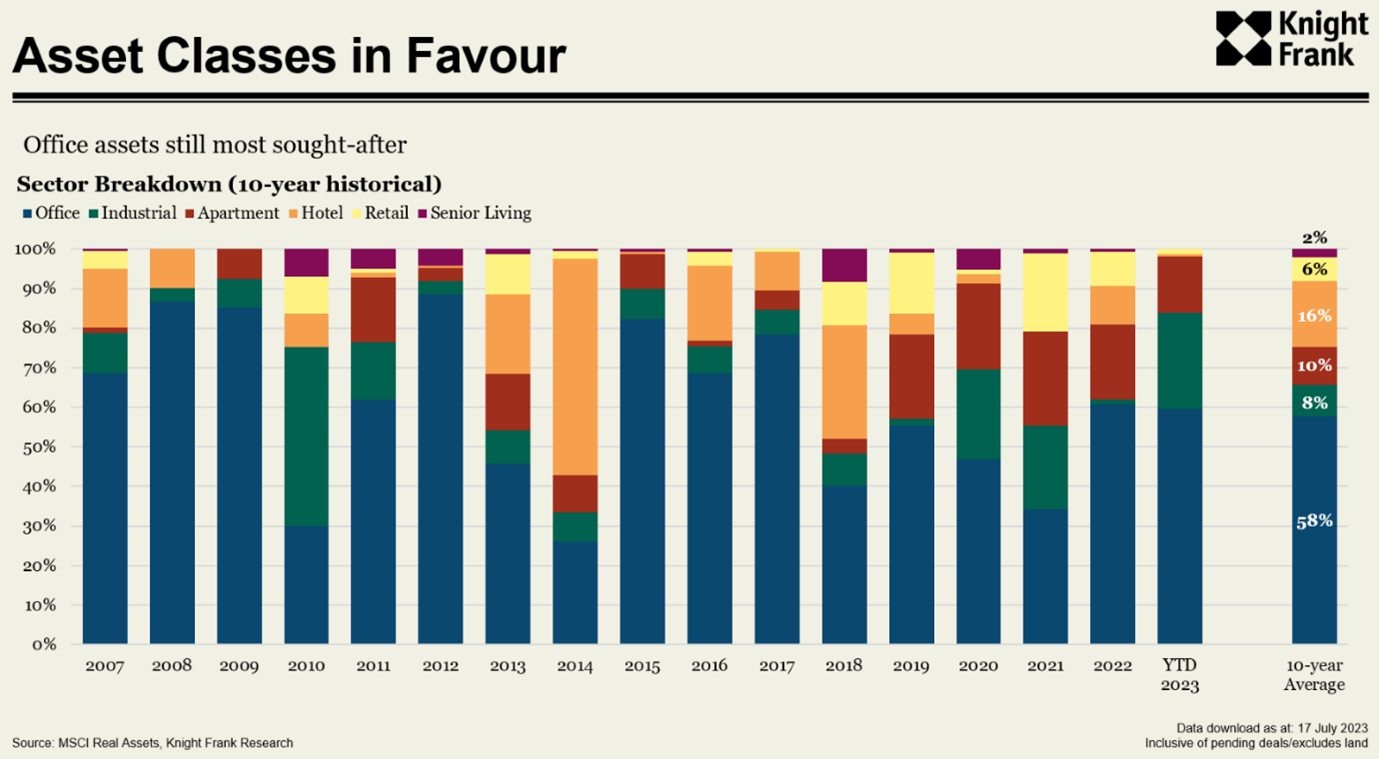

Office sector investment

From a sector standpoint, offices continue to be the most coveted asset class among Japanese investors, which is unsurprising, considering that offices constitute the most significant global investment market. Often hailed as a secure asset class due to its consistent demand and steady cash flow, investors have actively pursued these trophy assets to enhance their portfolios. Japanese investors are no exception to this trend. However, the landscape is transforming due to new work arrangements such as hybrid working and work-from-anywhere. This change has significantly impacted the office sector, particularly in the US, where climbing vacancy rates reflect employees' widespread embrace of remote work.

Unlike the global retreat from office investments, Japanese investors actively deploy capital into the sector. 2023 has already witnessed several significant, high-profile office transactions.

Unfazed by the US office market slowdown, Mori Trust, a Japanese corporation specialising in real estate development and investment, ventured into New York City's office market. In June 2023, it acquired a 49.9% stake in 245 Park Avenue, valued at US$2 billion. This transaction is a significant office investment amidst the pause in US CRE activities due to the FED's rate hikes. It was pivotal in offering price discovery as investors navigated the complexities of valuing office assets amid the era of hybrid work arrangements and elevated borrowing costs.

Elsewhere, Japanese investors were also active in the UK, Australia, and Singapore office markets, securing stakes in these assets through independent acquisitions or engaging in joint ventures.

A feature that might have motivated Japanese investors to engage in these transactions is the presence of asset enhancement initiatives (AEIs). Some office assets transacted have undergone or are currently undergoing AEIs, significantly augmenting their attractiveness to occupiers. This holds particular significance in a market where tenants and employees anticipate amenity-rich, modern, and high-quality spaces that are also conveniently accessible. By buying into such assets, Japanese investors can rest assured about receiving promising returns these buildings stand out from their competitors.

For instance, 245 Park Avenue, a 198-meter skyscraper in New York City, is currently undergoing an extensive series of upgrades. These include the installation of a new lobby, the establishment of an amenities centre, the introduction of new elevator cabs, and the addition of a full-service restaurant, among other enhancements. Enticed by the enhanced amenities, Swedish private equity firm EQT Partners committed to a 15-year lease within the building. This demonstrates that, even amid a somewhat subdued outlook for the office sector, opportunities still prevail.

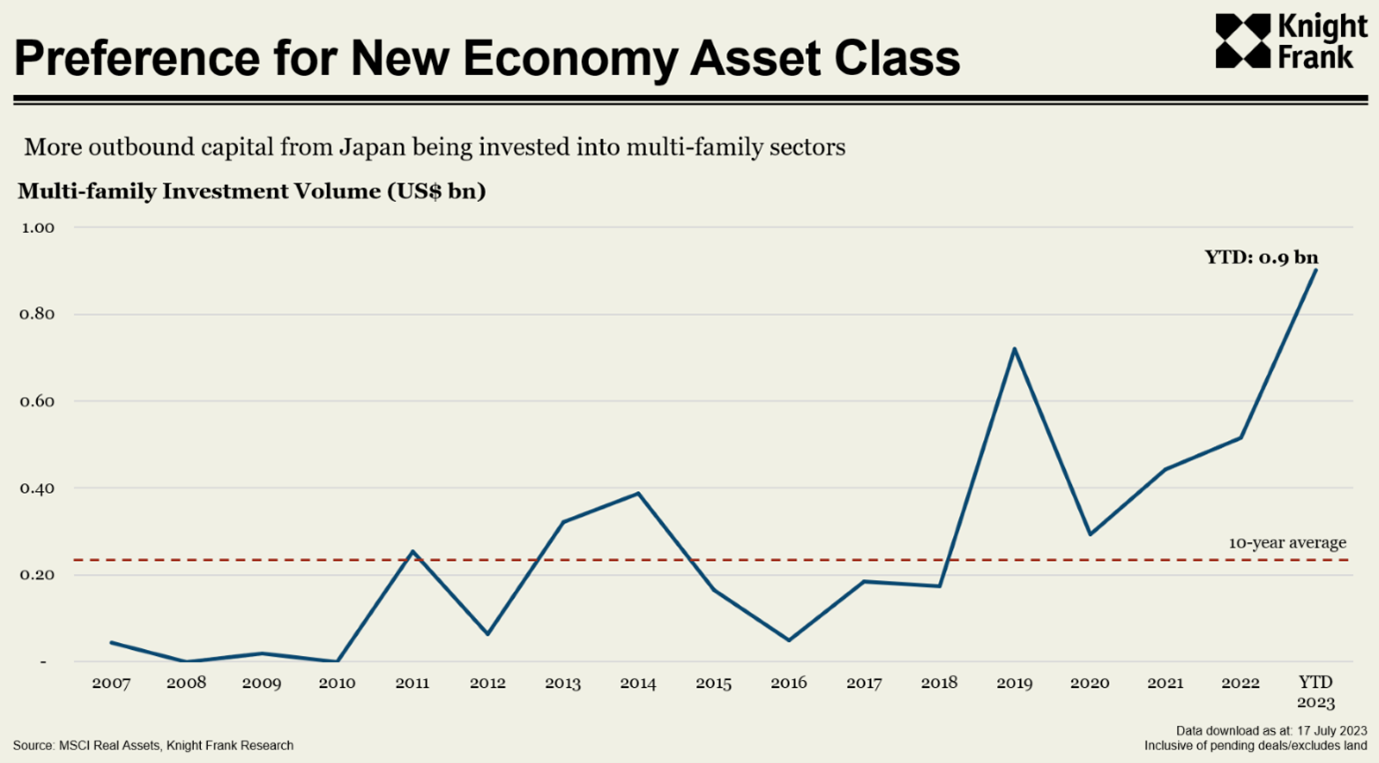

Multi-family investment

Aside from office, investment into multi-family assets by Japanese outbound capital seems to be garnering pace. Investment volume surged almost 12 times for the past 10 years – from a mere US$44 million in 2007 to US$516 million in 2022 – in line with global trend.

With a rich history in multi-family project development, Japan stands as the sole mature market for multi-family properties in the APAC region, boasting the highest transaction volumes. Its deep experience in developing and managing institutional-grade assets offered Japanese investors insights into the optimal way to invest in this sector. Over the past decade, the Japanese multi-family sector has garnered heightened interest from international investors. This surge in attention has led to a sharp increase in domestic competition. Japanese investors have expanded their horizons, leveraging their expertise to seek more lucrative opportunities beyond their home market.

The multi-family sector (or living sectors in general) boasts defensive characteristics that capitalise on macro factors such as demographic and lifestyle shifts, which interest investors seeking secure options. Amid periods of economic instability, multi-family housing offers income resiliency and acts as an inflation hedge as demand for rental properties rises. Additionally, skyrocketing residential prices force households to rent rather than purchase, further cementing demand.

Despite positive indicators within the domestic market, the Bank of Japan remained resolute in its commitment to maintaining ultra-loose interest rates. This stance was reinforced by the continued relaxation of yield curve control, which in turn contributed to the ongoing weakness of the Yen.

To broaden their portfolio beyond Japanese real estate and to capitalise on evolving demographics and lifestyle trends, particularly in emerging markets, venturing into the global multi-family sector offers a strategic opportunity. This move can potentially strengthen the investment portfolio over the long term. Additionally, with ongoing discussions about the potential further weakening of the Yen, the probability of higher profits from repatriated overseas investment increases.