The Living Sectors polls: sub-sector targeting and propositions

During our recent webinar, we asked the questions: “What are the top 3 sub-sectors within the Living Sectors that you are targeting over the next 18 months?” and “Which of the following investment propositions are you currently targeting for Living assets?” Here we share our analysis of the results.

2 minutes to read

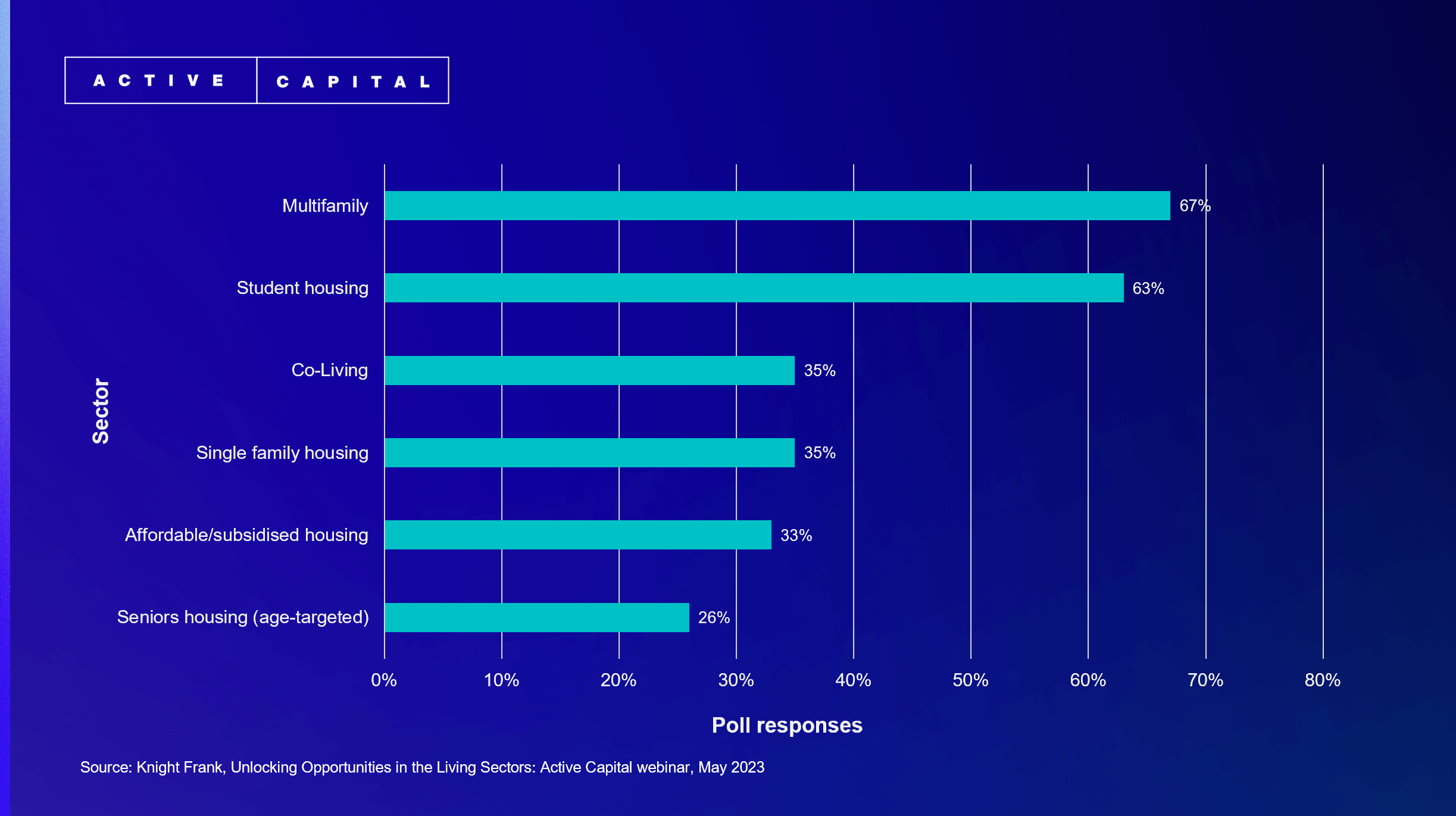

Q1: What are the top 3 sub-sectors within Living that you are targeting over the next 18 months?

(click to enlarge)

Key takeaways:

1. Multifamily and student markets topped the list

This reflects their relative maturity and ease of access in a number of global markets. Both offer investors strong opportunities given the stark imbalances between supply and demand.

2. Co-living and single family housing were identified as target sectors by more than a third of respondents

As the volume of institutional capital targeting rental sectors continues to rise, investors are looking for diversification by spreading their exposure across age groups, geographies and demographics.

3. While there are significant differences in market drivers, there are also synergies

This is particularly the case with construction and operations, making the decision to move across Living sectors more appealing.

4. A third of respondents noted an interest in affordable housing

Affordable housing can offer inflation-linked cash-flows and comes with strong ESG benefits.

5. More than a quarter of investors are planning to target the seniors housing market

While significant, the smaller figure likely reflects the more specialist nature of the sector. However, we expect that as the sector matures, it will be an area of significant growth in the coming years.

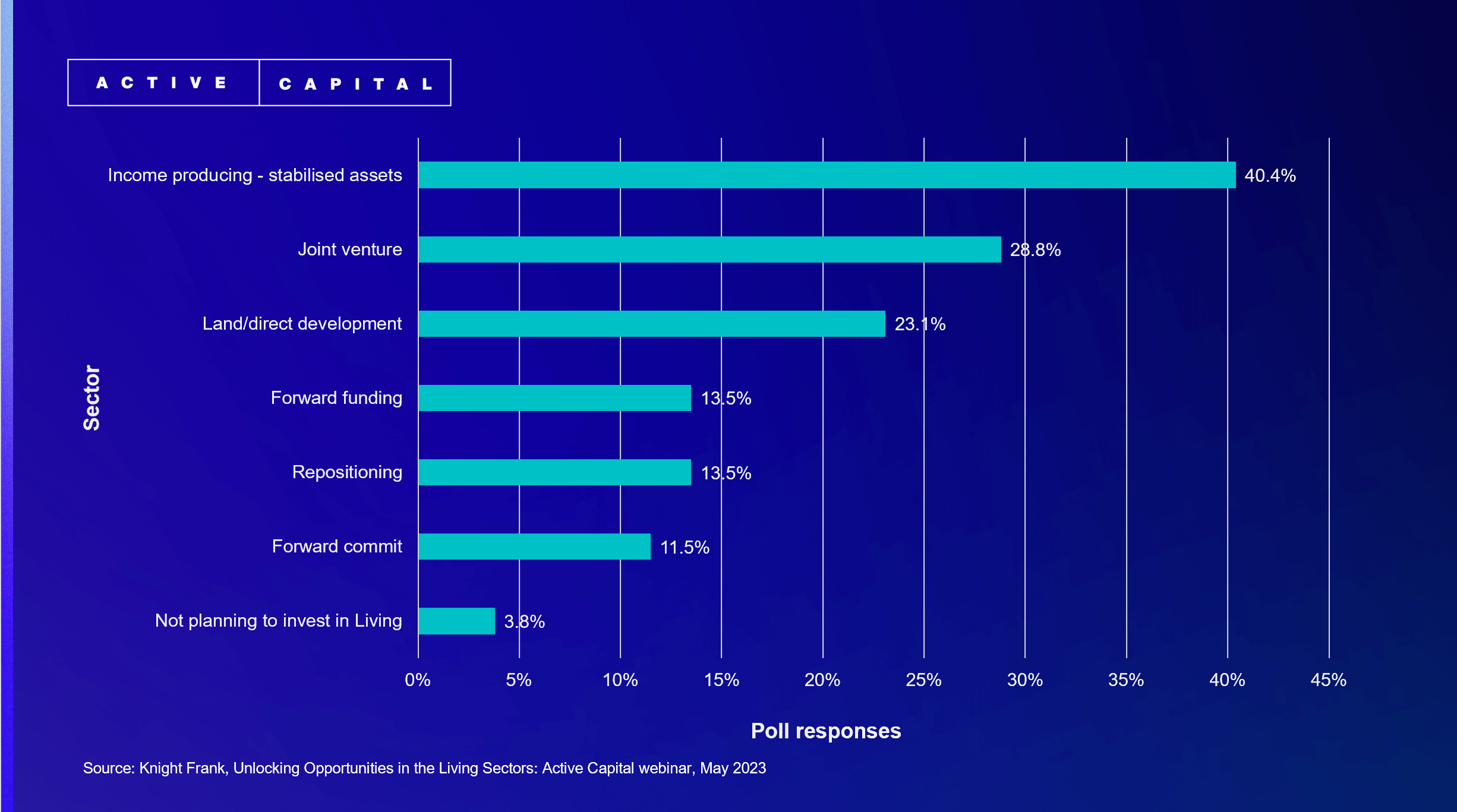

Q2: Which of the following investment propositions are you currently targeting for Living assets?

(click to enlarge)

Key takeaways:

1. Investors want scale and immediate income

This means that most investors are looking to acquire income producing stabilised assets. Given the significant volume of capital waiting to be deployed, this will drive competition for this type of stock when launched.

2. The availability of operational stock remains a barrier

Given the nascency of Living Sectors in a number of markets globally, the availability of operational stock remains a barrier to increasing investment.

3. There’s an imbalance between supply and demand

The result of the ongoing imbalance between supply and demand will be more investment into development projects, or more JV partnerships.

If you missed the latest webinar in our Active Capital series: Unlocking opportunities in the Living Sectors, you can watch on-demand.