Rising business sentiment carries a sting in the tail

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Housebuilding

The new homes market continues to improve following a low in activity following last autumns ill fated mini-budget.

Persimmon on Wednesday said trading in recent weeks had offered encouraging signs, with visitor numbers up, cancellation levels normalising and sales rates improving. Net private sales per outlet hit 0.62 in the first quarter, up from 0.30 in Q4. Similarly Taylor Wimpey on Thursday said it had "seen continued recovery in demand from the low levels experienced towards the end of 2022, supported by good mortgage availability, and have seen an incremental improvement in sales rate as the Spring selling season has progressed."

Both shifted to defensive positions as they moved into 2023. Taylor Wimpey said its key priority was "value over volume", while Persimmon said its build rates in the first quarter were down 30% compared to the same period a year earlier.

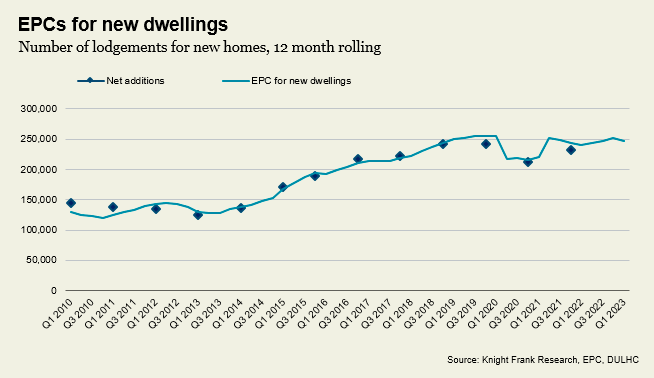

That's consistent with a pretty meaningful drop in housebuilding and the economic picture is only part of the story. The removal of mandatory housing targets and the various interventions by Natural England could see annual net additions fall from 233k last year to below 120k homes per annum in the coming years, the Home Builders Federation warned last month.

The number of Energy Performance Certificates allocated to new homes, a good leading indicator for housebuilding, fell 10% to 53,000 in Q1, according to official figures published yesterday.

Rising student numbers

The UK's higher education sector is expanding rapidly. There are currently 2.2 million full-time students, according to the latest data from Higher Education Statistics Agency (HESA). That's up by 4% year-on-year and by 26% over the last decade.

UCAS applicants hit almost 750,000 in 2021, also a record. Of these, there were over 560,000 acceptances – the second-highest number on record. UCAS is predicting that by the end of the decade there could be up to a million higher education applicants in a single year. Our own forecasts point to total undergraduate numbers increasing by 263,000 over that same time.

That will put pressure on an already undersupplied student housing market, as well as putting the quality and value of that accommodation under the spotlight.

This week we published our fourth annual survey of current students and new applications, in partnership with UCAS. The 20,000 responses offer insights into the importance of brand, cost, the impact of accommodation on wellbeing and whether or not students would be willing to pay a premium for key features. You can read our five key takeaways, or download the full report.

Business sentiment

We've been tracking various indicators suggesting the economy is proving resilient in the face of higher interest rates, from surveys of consumers and chief financial officers, to purchasing managers.

Another comes from Lloyds this morning. The survey of 1,200 businesses between April 3 and 16 puts morale at an 11-month high. The outlook of firms' optimism about the wider economy improved by five points to 28%.

As with many of the comparable surveys, there are worrying signs of inflation. More than half of companies surveyed by Lloyds intend to raise their prices in the coming 12 months - that's despite easing cost pressures. Wage growth hit a seven-month high, with nearly a third of businesses expecting pay to increase by at least 3%.

The US economy

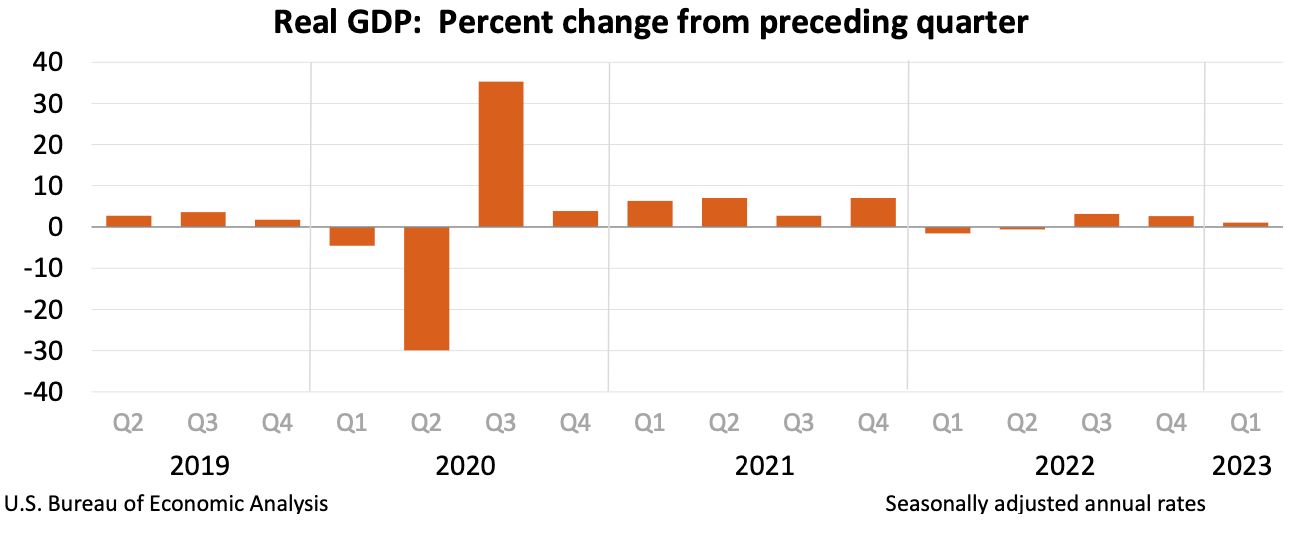

The US economy expanded 1.1% in the first quarter, down sharply from the 2.6% growth in the final quarter and well below economists' expectations of 2% growth, according to official figures published yesterday.

The figures suggest that the effects of higher interest rates are now starting to take hold, but there are still various aspects of the data that will fuel caution at the Federal Reserve. Consumer spending, for example, remains particularly strong. The Fed is expected to deliver another quarter-point hike next week to bring the Federal Funds Rate to a target range of 5.00% - 5.25%.

The 30-year fixed-rate mortgage increased modestly for the second straight week, according to Freddie Mac data published yesterday. That should "gently decline over the course of 2023", the group said. We covered signs of a turnaround in the US housing market on Wednesday.

In other news...

The UK country market closed the price gap with prime central London by a fifth during the pandemic, writes Chris Druce.

Elsewhere - Goldman Sachs raises its forecast for BoE rates peak to 5% (Reuters), European commercial real estate dealmaking falls to 11-year low (FT), Singapore home prices rise for a twelve straight quarter (Bloomberg) after hiking stamp duty for overseas buyers to 60% (FT), and finally, the commuter belt is back (Times).