Leading Indicators | OPEC+ Oil Cuts | UK MEES Regulation | Population Growth

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Below are the highlights from our Leading Indicators dashboard, with key economic and financial metrics updated weekly.

Download the dashboard for in-depth analysis into commodities, trade, equities and more.

OPEC+ cuts oil output

The OPEC+ group agreed to cut oil output by c.1m barrels per day (bpd) starting in May, which will take the total cut to c.3% of global supply, reflecting reductions previously agreed in October. Following the announcement, oil prices increased by over 8%, with Brent Crude and the West Texas Intermediate (WTI) hitting as high as $86.44 and $81.69 per barrel, respectively. Some economists expect the output cut to add to global inflationary pressures, which could see interest rates higher for longer. However, others have argued that given a likely US recession and the limited global impact from China reopening, higher oil prices may weigh more on growth, than halt the broad disinflation process currently in progress. Indeed, US inflation has fallen to its lowest level since September 2021, while German inflation is at a 7-month low.

MEES regulation comes into effect

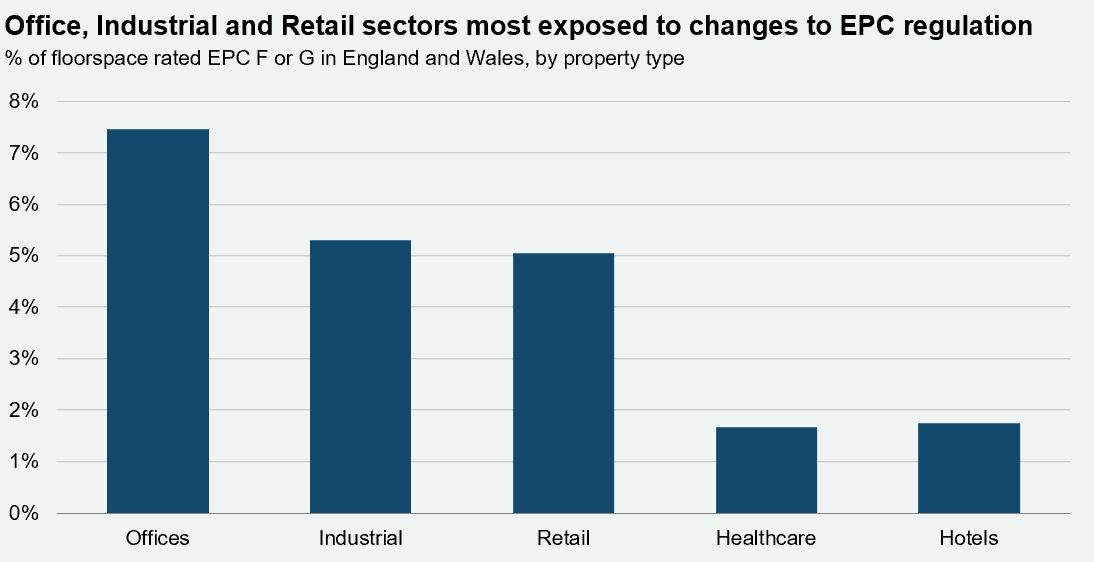

From April 1, all tenanted commercial property buildings in England and Wales, needed to have an EPC rating of at least an E under the Minimum Energy Efficiency Standards (MEES). We estimate that c.5% of commercial floorspace or c.364m sq ft falls below the MEES threshold in England and Wales. Landlords whose buildings are rented out, but fall short of the new regulations could risk being named and shamed and face a fine of up to £150k. However, some will not be subject to the regulation, due to owner-occupation or other exemptions. Whilst not yet in law, there has been a further consultation on increasing the minimum EPC requirement to C by 2027 and B by 2030. If this were to occur, by 2027, we estimate that c.7m sq ft of institutional grade office leases in London are at risk of obsolescence, due to near-term lease expiries.

What will population growth mean for CRE?

It took the global population 12 years to grow from 7bn to 8bn and the World Bank expects it to take a further 15 years to reach 9bn, indicating a moderating pace of growth. Of the largest global economies, India (+20%), the US (+13%), the UK (+5%) and France (+4%) are all expected to see population growth by 2050, according to Oxford Economics. Meanwhile population decline is forecast for Japan (-16%), China (-8%), Italy (-6%) and Germany (-2%). By 2050, the gap in the working age population between the UK and Germany is estimated to contract by -55% to just 5m, from c.12m currently. Population growth will likely have knock on implications for the commercial real estate occupier markets, across all sectors.

Download the latest dashboard here