Strong momentum for UK hotel investment in 2023

A subdued level of hotel investment in 2022 contrasted with the strong growth and recovery of trading performance.

3 minutes to read

The UK hotel sector remained resilient and reinforced and its ability to bounce back.

There were vastly changing circumstances in 2022, with a robust first half of the year accounting for 70% of the total annual investment. But the effects of the war in Ukraine, combined with worsening economic headwinds and domestic political turmoil all proved too strong during the second half of the year, suppressing deal volumes significantly.

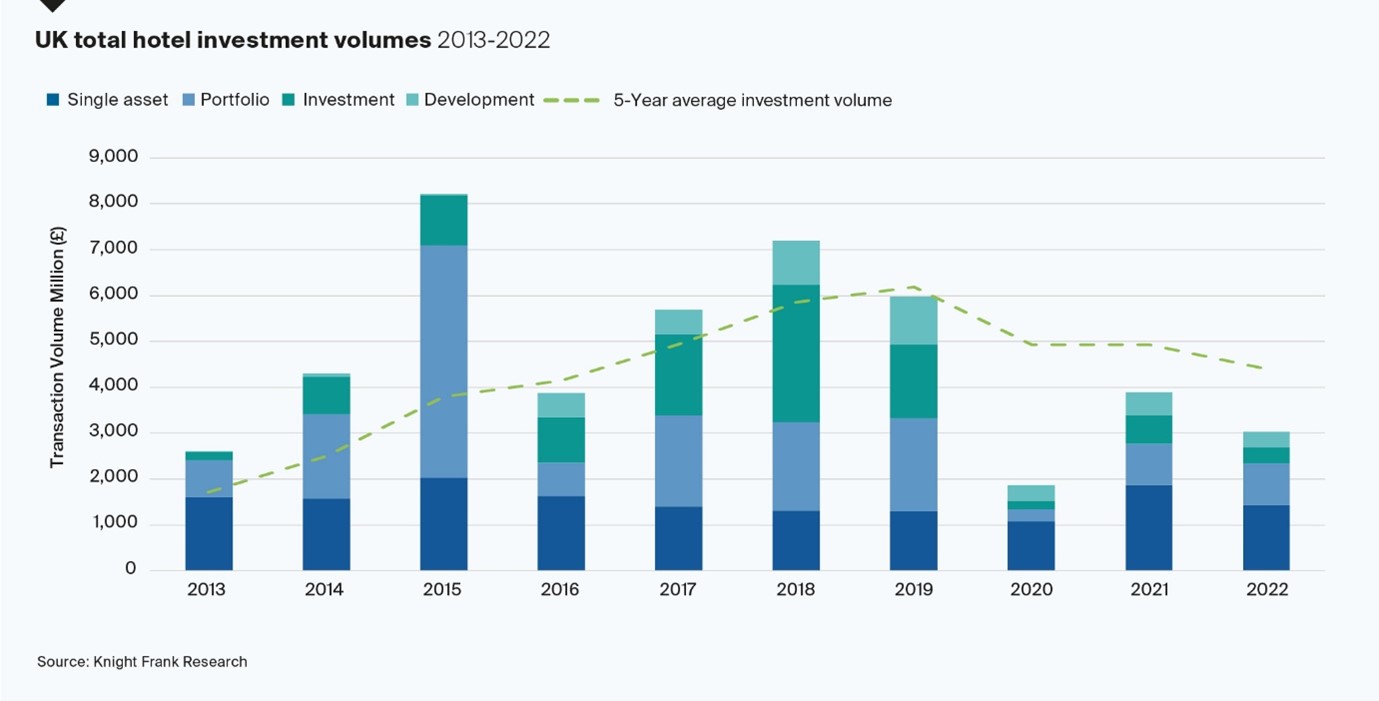

£3 billion of UK hotel investment in 2022 was 31% below the five-year average and 22% below the previous 12 months investment levels.

In 2022, there were fewer sizeable assets that transacted but by contrast there was an increase in the volume of lower valued stock, with some 76% of single asset hotels transacting below £10 million, at an average lot size of £4.3 million.

Already at the start of 2023, there are signs that the UK hotel investment market is becoming more settled, with various deals having recently completed. With interest rates potentially reaching or near their peak, there is a greater sense of urgency for investors to get back to more normal levels of investment activity.

The weight of capital seeking to target the hotel sector is expected to drive increasing transactional volumes, particularly during the second half of the year. There remains no shortage of buyers seeking hotels which offer value add opportunities. With many hoteliers having benefitted from robust trading off the back of a strong leisure market, more stock is likely to come available as exit strategies are deployed.

2023 Transactions include:

- The £53 million acquisition by Pandox of the 232-room Queens Hotel in Leeds.

- Dalata’s £44 million purchase of a newly-built 192-bedroom hotel, to open later in the year as the Maldron Hotel London, Finsbury Park.

- Fattal Hotel Group’s acquisition of the 201-room Grand Hotel Brighton.

- Macdonald Ansty Hall sold off a guide price of £9.75 million, to the Exclusive Collection.

Henry Jackson, Knight Frank, Head of Hotel Agency, said: "As confidence in the direction of the UK economy is further restored, there will come a greater urgency and decisiveness to execute a transaction. Currently, a heightened level of price sensitivity continues, yet the lack of quality branded stock available, may serve to increase competition for assets, thereby protecting or even driving-up values in the short-term. Narrowing the gap between buyer and seller expectations, as well as securing affordable and sufficient debt to reach a positive outcome for both parties, remain key challenges.

Philippa Goldstein, Senior Analyst, Head of Hotel Research at Knight Frank, adds: "We do not anticipate a significant volume of distressed assets coming to the market, particularly with ongoing government contracts in place and the rebase of business rates serving to help alleviate the hike in energy costs. Hotel transactional volumes are expected to remain constrained during the first six months of 2023. Where opportunities do arise, those buyers not dependent on debt to execute a transaction, are likely to be most active. Those deals which do complete, are likely to be from buyers often driven by emotive reasons, or familiar with the market, often with a long-term play."