Sales bounce back in France sport retail market

The sports market in France represents some twenty billion euro of expenditure and is dominated by the sale of sportswear.

5 minutes to read

Sport is a major sector of the global economy, between 2019 and 2021, Nike, for example, has seen its revenue grow by almost 20%, while Lululemon aims to double its revenue by 2025.

Sport is also a key sector for the retail real estate market, as although major brands and retailers are increasingly present on the web, their physical stores are also being maintained.

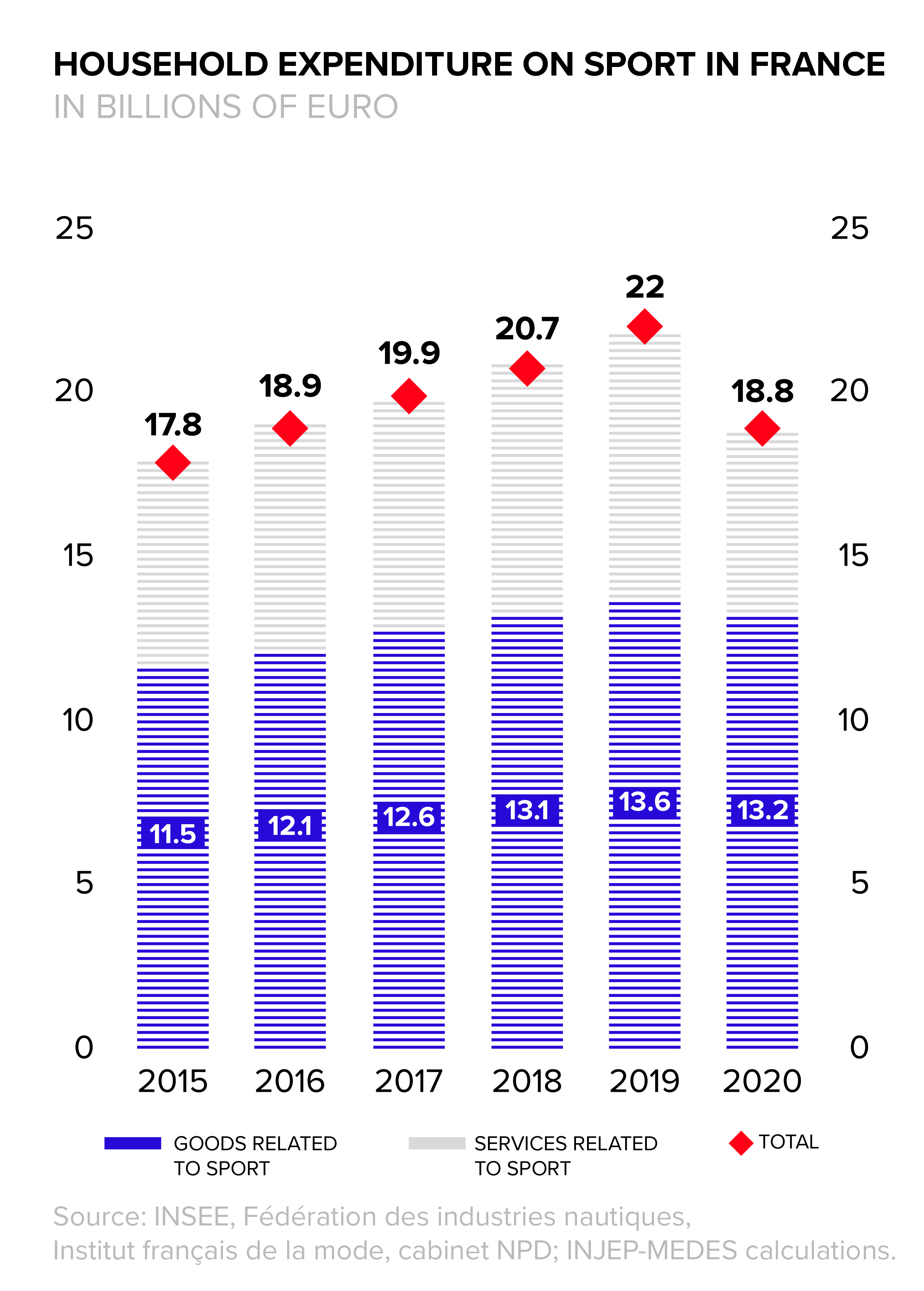

France sport market expenditure

The sports market in France represents some €20 billion of expenditure and is dominated by the sale of sportswear (around 60% of sales of sports-related goods).

This market continued to expand, pre-pandemic, until 2020, when activity declined, reflecting the impact on consumption of the health crisis and the lockdowns. Since then, sales have bounced back.

According to PROCOS, in 2022 (over the January to September period), sport was one of the rare sectors of specialised retail, along with food and household equipment, to do better than in 2019 for the same period (+7 points).

Courir also indicates that the number of visits to its shops in September 2022 was 15% higher than in the same period of the previous year.

Kantar gives a more mixed assessment. In the third quarter of 2022, sales of sports and sportswear were down by 10% compared to the same period a year earlier.

However, it is consumption as a whole that has stalled since the summer due to rising prices. While not necessarily indicating a downturn, SAD Marketing also noted a slowdown in sales of sporting goods, up 23.6% over the 12 months to the end of October 2022 but up "only" 7.5% during the period from October 2021 to October 2022.

Paris retail market

Paris is benefiting from its status as a streetwear stronghold and from favourable conditions linked to the rise in spending on sports and the return of international tourists after Covid restrictions were lifted.

The upcoming 2024 Summer Olympics are also contributing to the current momentum. The importance of the Paris market is also illustrated by the arrival of new major players. In 2022 the first NBA store in France opened on Boulevard Saint-Michel in Paris and several LIDS stores in Paris shopping centres.

Global sports retail

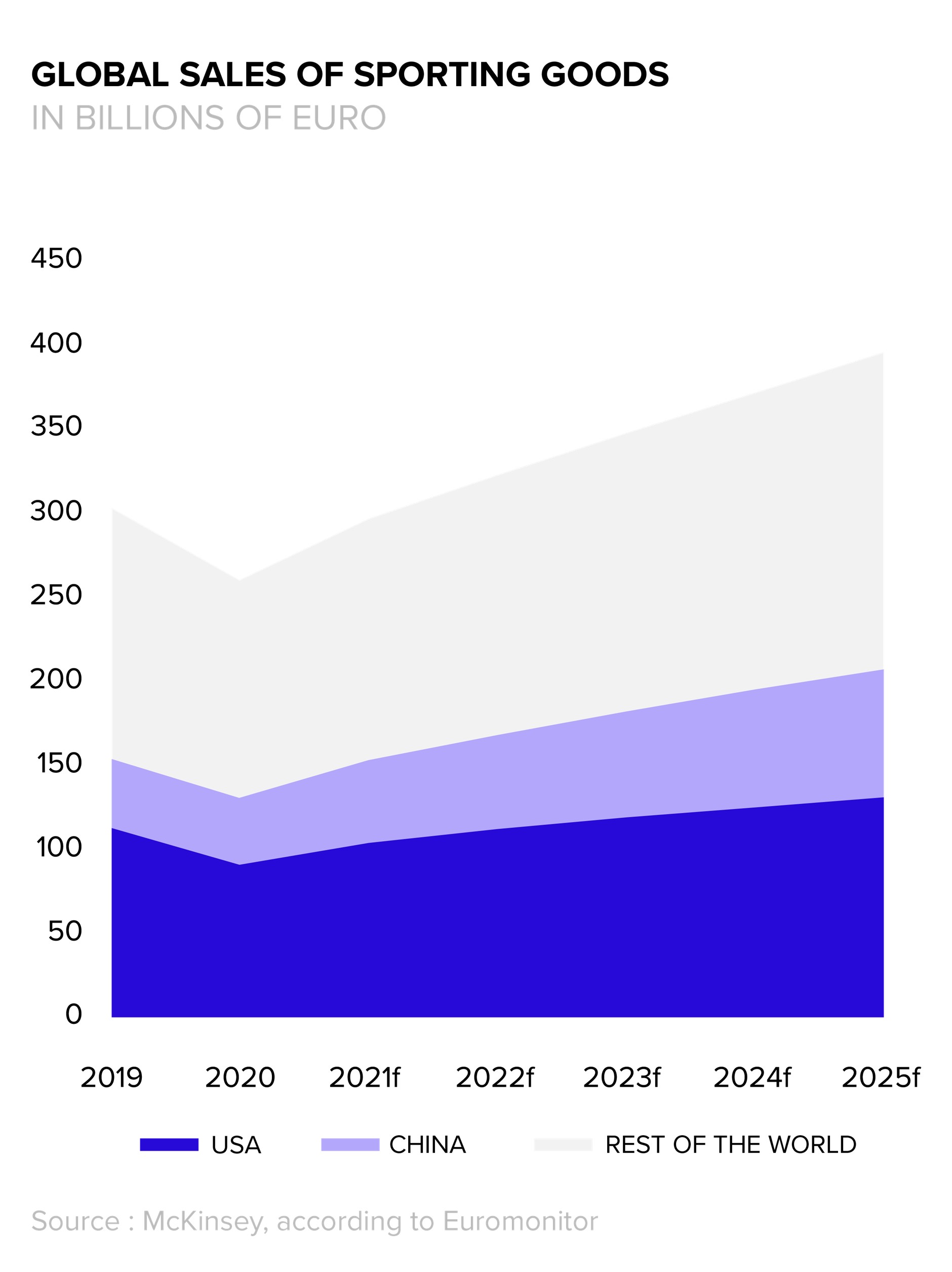

After the 2020 crash, the sports sector returned to growth in 2021 and is expected to exceed its pre-Covid activity level in 2022. By 2025, global sporting goods sales could reach nearly €400 billion, up 30% from 2019.

The athleisure trend, which derives its name from the combination of the words athlete and leisure, and consists of wearing clothes originally designed for sports, is gaining new traction. According to Euromonitor, sales of athleisure items increased by 42% worldwide between 2016 and 2021.

NIKE, the undisputed leader in the sector, has seen its revenues increase by almost 40% in five years. LULULEMON, which has seen its revenues increase sixfold since 2010, aims to double them by 2025. This will be achieved through international expansion, notably in Paris, where in December 2022 the brand opened a flagship store of more than 500 square meters on the Champs-Élysées, presenting, for the first time in France, its entire range.

China sports retail market

Markets other than the US and Europe are also surfing the sportswear wave. In China, where sales of sportswear items could grow by 55% between 2021 and 2025 according to iiMedia Research, new national leaders have emerged, adapting their products to the tastes and body types of local customers, such as ANTA, 361°, LI NING and MAIA ACTIVE.

The growth of multi-brand retailers also continues, including JD SPORTS, whose network has more than 3,400 stores worldwide, and FOOT LOCKER, which operates just under 3,000 stores.

Risks and new strategies

In the short term, the pressures currently weighing on households (rising inflation, etc.) could impact consumer behaviours as households cut their spending in favour of essential items such as food and energy.

As in other sectors, the sports industry is also facing supply difficulties. These are particularly problematic for sportswear brands, whose success depends on their reactivity and the constant renewal of their collections.

Environmental issues also impact sports brands as they endeavour to limit emissions.

Faced with the growing number of risks, several major sports brands are prioritising the direct distribution of their products more than ever before, to better control their supply and image, and benefit sustainably from the growth of the sport.

While ADIDAS' own distribution will represent 38% of its revenues in 2021, the brand aims to increase this share to 50% by 2025.

For NIKE, the goal is to go from 39% to 60% over the same period, with a focus on online sales, a limited number of third party distributors (such as DICKS SPORTING GOODS in the US) and its own stores.

The flagship store

In an increasingly competitive market context, the physical retail store is an essential tool for building loyalty and differentiating the brand from its rivals, showcasing the brand and its history, tailoring the collections to a variety of tastes and consumer profiles, and providing an experience that goes far beyond a mere transaction.

The new flagships have become destinations in their own right. The flagship stores offer the retailer the chance to connect with their customers in a number of ways including:

- Shopping experience/storytelling

- Innovation & interactive experiences

- ESG & educational spaces

- Service & repairs

Multi-channel customers

Targeting multi-channel customers through physical stores and online sales is key.

According to McKinsey, the amount of money spent by this clientele is 34% higher than that of customers who buy exclusively in-store and 7% higher than consumers purchasing only online.

This highlights the importance of building and maintaining a closer relationship with this customer base, notably through loyalty programs including exclusive offers, workshops or invitations to events.