Indonesia Insights by Willson Kalip

Indonesia market outlook 2023 | Willson Kalip, Knight Frank Indonesia

2 minutes to read

In this article, Willson Kalip, Country Head of Knight Frank Indonesia, shares his perspective on the outlook for 2023 and offers advice on how to capitalise on opportunities.

Supply chain disruption caused by geopolitical issues, inflationary pressures, and the ongoing pandemic is beginning to have a negative impact on other parts of the world. In Indonesia, the upcoming election in 2024 and the development of a new capital city will also affect the property market. However, easing pandemic restrictions and domestic consumption will help keep the economy moving.

We anticipate three bright sparks, largely contributed by landlords and investors, who are looking to expand or restructure their businesses and are therefore looking for worthwhile and favourable opportunities.

Valuations

Government-supported initiatives for banks will come to an end by December 2023. Depending on the state of the economy, additional restructuring may be possible, making valuation services a continued necessity for the overall economy.

Data Centres

Rapid growth of the e-economy is expected to continue driving the need for data centres, particularly in locations towards the inner city of Jakarta from the traditional eastern of Jakarta area. Over the next two years, large capital expenditures from major industry players will likely lead to a dynamic capital market.

Logistics and warehouse

Demand for logistics and warehouse spaces has been very active in the past year and is expected to continue, as this is a long-term investment. Strong domestic consumption will positively drive the need for such spaces if inflation is kept in check.

Advice

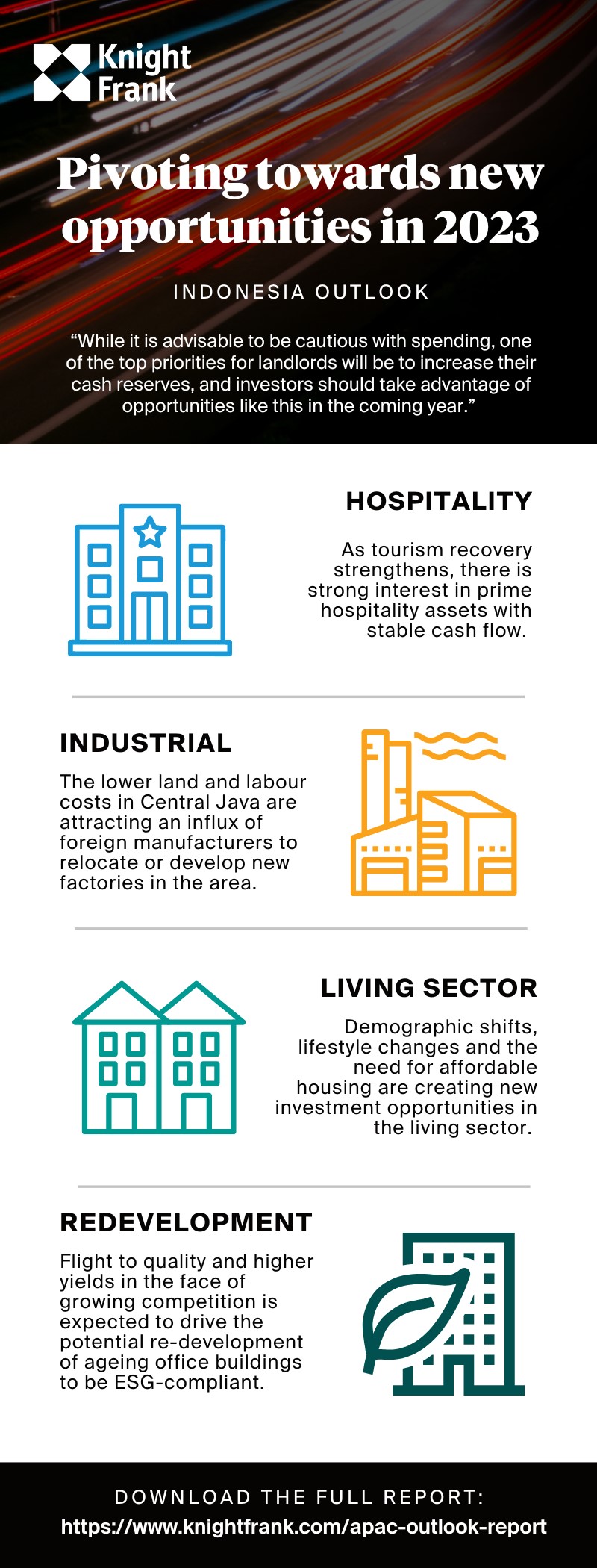

Despite the easing of pandemic restrictions, the upcoming election in 2024 may cause investors to be hesitant in making certain decisions in 2023. While it is advisable to be cautious with spending, one of the top priorities for landlords will be to increase their cash reserves, and investors should take advantage of opportunities like this in the coming year.