How green buildings add value

Do ‘green’ buildings really produce either a rental or value uplift vs ‘brown’ buildings?

1 minute to read

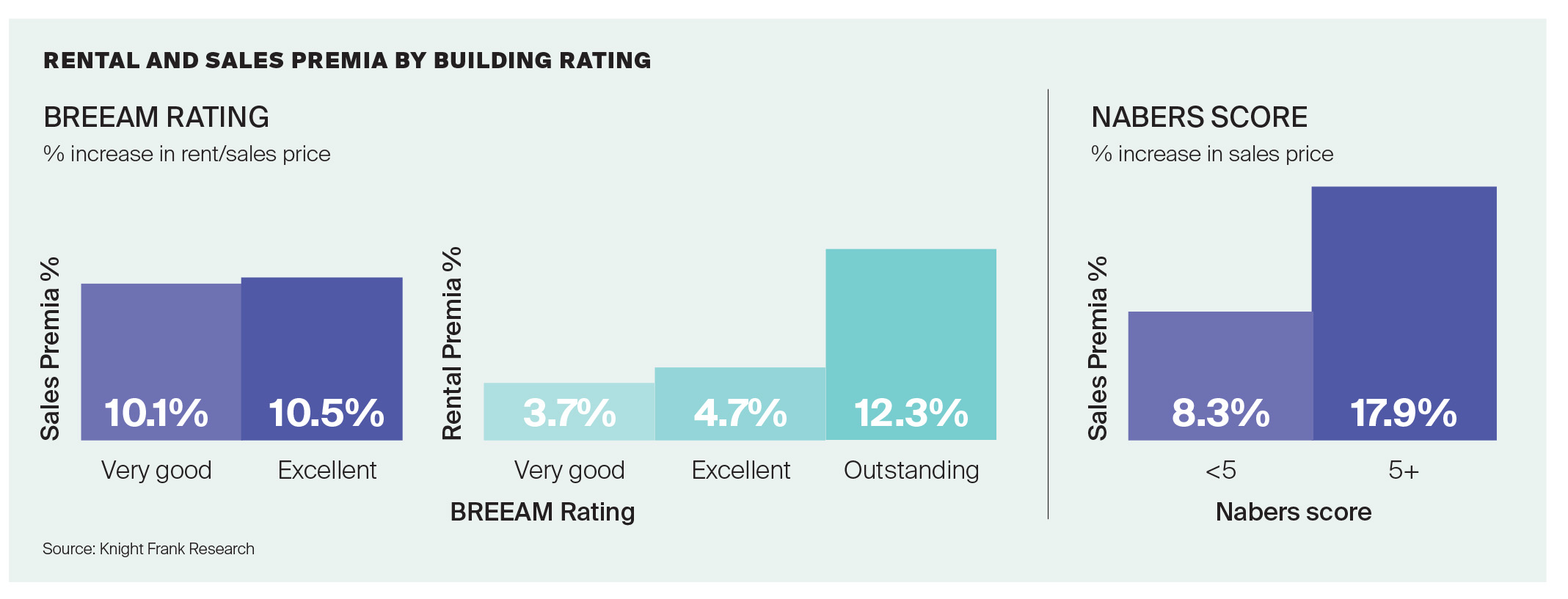

It’s a key question for investors and developers: can they expect a monetary benefit from green-rated buildings and if so, how much? In ground-breaking research using one of the long-established green ratings, BREEAM, our capital markets research team showed that yes, green-rated buildings do indeed offer both rental and sales value uplift compared with non-rated buildings. That premium can reach 12.3% with a significant step-up in prime Central London office rents for the very highest green-rated buildings. The sales price premium is even higher with the based NABERS rated buildings in Australia reaching up to 18% higher on average than an equivalent ‘brown’ building.

Quantifying the link between green buildings and rental or sales value is complex as green-rated buildings are often newer, of a better quality construction or in a more premium location than a typical ‘brown’ building.

We used BRE data in combination with their own dataset to successfully isolate the effect of green certifications on rentals and sales prices in the London office market. How Green Buildings Add Value explains the forward-thinking, robust methodology employed, outlines the results and considers what they mean for investors and developers.

The research highlights the impact BREEAM has on prime central London rents and explains how sustainability adds value. A BREEAM rating is a way of differentiating a building from the rest of the market, and for investors focused on income and risk mitigation, the research shows the value in aiming for best-in-class green ratings. For developers, the value of the research lies in understanding how targeting BREEAM-rated buildings could lift their development value. As London seeks to be the centre for green finance and green-rated buildings, How Green Buildings Add Value predicts heightened future demand for green-rated buildings.

Download the ESG Report 2022