Mini budget, U-turns, environmental revolt

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

10 minutes to read

Kaboom! Nobody could accuse new Prime Minister Liz Truss and her Chancellor Kwasi Kwarteng of playing it safe. In a week of U-turns last Friday’s supposed mini-budget turned out to be an explosive mix of tax cuts – the biggest in 50 years – and a radical shift in policymaking that effectively showed the finger to 12 years of previous Conservative government and will have environmentalists reaching for a stiff drink. Agriculture got a welcome mention in Mr Kwarteng’s statement with a promise to boost productivity and review regulation, but rumours have also started circulating that Defra may be losing enthusiasm for its Environmental Land Management Scheme (Elms) and is even reconsidering the post-Brexit move away from area-based subsidies.

As I have constantly advocated in this bulletin, there is a middle way that balances protecting the environment with sustainable food production. Let’s hope we don’t go from one extreme to another and end up stifling productivity and innovation with a return to the worst elements of the Common Agricultural Policy. With a General Election due in 2024, Truss and Kwarteng are playing a high stakes game of political poker.

Do get in touch if we can help you navigate through these interesting times

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Mobilisation sends wheat marching up

• Mini budget – Planning restrictions to be eased

• Energy 1 – Use cap period to plan ahead

• Energy 2 – Onshore wind and fracking back

• Energy 3 – Solar farm backtrack

• Politics – Goldsmith out of Defra

• Net zero – Government reviews 2050 target

• Farm support – Elms under threat, area payments back?

• On the market – Surrey farm for sale

• International news – Europe piles pressure on livestock

Commodity markets – Mobilisation sends wheat marching up

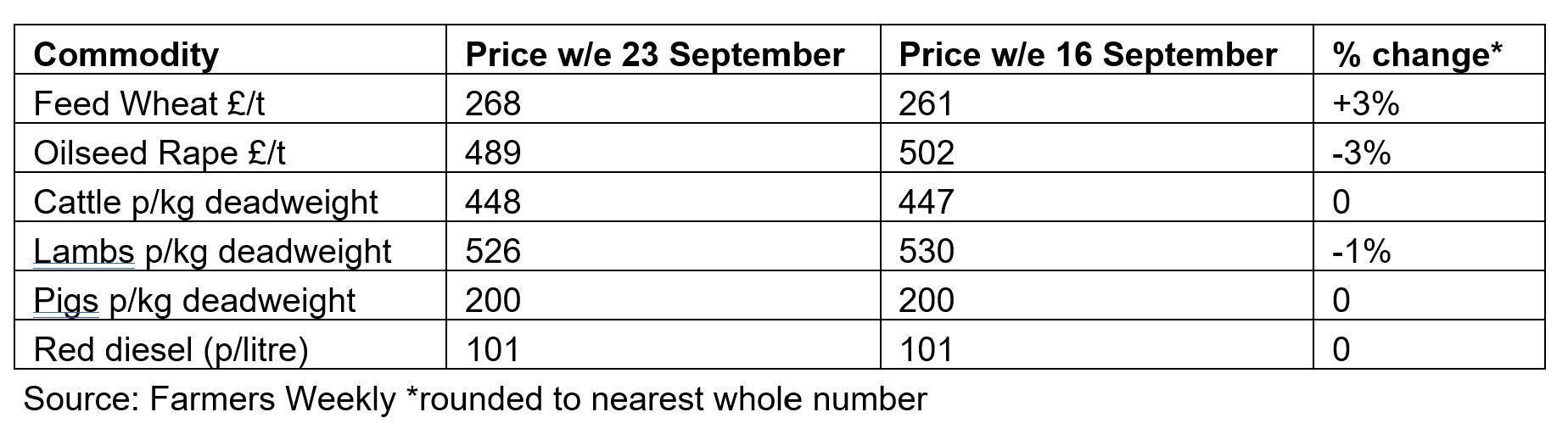

Vladimir Putin’s decision to officially mobilise 300,000 Russian troops to bolster his failing invasion of Ukraine spooked grain markets last week. Feed wheat values jumped 3% showing just how volatile the market is at the moment. Although a foregone conclusion, the results of the ongoing referenda in the occupied Ukrainian provinces of Luhansk, Donetsk, Kherson and Zaporizhzhia on re-joining Russia could further unsettle the market when they are announced shortly. Despite this, Andrew Martin of our Agri-consultancy team says forward wheat prices of £250 for harvest 2023 and £230 for harvest 2024 could be worth locking into.

Meanwhile, the UK’s pig breeding herd has dropped to its lowest level in 20 years with warnings that there could be a pork shortage this Christmas. Although average pig prices have risen to 200p/kg deadweight, the cost of production for august was around 225p/kg.

Mini budget – Planning restrictions to be eased

Along with his well-trailed cuts to personal and business taxes, some of which could benefit farms and estates, particularly those that pay corporation tax and are planning to invest in new plant and machinery (the planned rise in corporation tax to 25% has been nixed, while the annual investment allowance has been fixed permanently at £1 million), the new Chancellor Kwasi Kwarteng used last week’s mini budget to set out an ambitious blueprint designed to boost the UK’s growth and productivity

As described in the foreword of the blue pamphlet the Chancellor clutched throughout his speech, “The Growth Plan 2022 makes growth the government’s central economic mission, setting a target of reaching a 2.5% trend rate. Sustainable growth will lead to higher wages, greater opportunities and provide sustainable funding for public services.”

Getting more houses and infrastructure built quicker is a key part of the plan and this will in part be achieved through a new piece of legislation, the Planning and Infrastructure Bill. Whether it can deliver remains to be seen – previous attempts at planning reform have largely failed - but environmentalists will certainly be on high alert, given the bill’s aims include reducing the burden of environmental assessments and reforming habitats and species regulations.

A number of Investment Zones will also be created around the country. In addition to tax incentives to encourage more business investment, the zones will also benefit from further liberalised planning rules to release more land for housing and commercial development, and reforms to increase the speed of delivering development.

Read more from our research team on what the budget means for the housing market. For help with any planning issues please get in contact with Roland Brass, our rural specialist.

Energy 1 – Use cap period to plan ahead

Farms and estates will also be lauding the government’s commitment to ramping up the country’s debt burden following the announcement last week that energy prices for business users will be capped from the beginning of October until the end of March 2023. Electricity will cost a maximum of 21.1p/kWh and gas 7.5p/kWh, well under half the respective peak wholesale rates of around 60 and 18p/kWh predicted for this winter.

However, rural businesses shouldn’t use the hiatus as an excuse for inaction, urges Robert Blake of our Renewable Energy team. “The government can’t afford to cut bills for ever and who knows where the real price of energy will be in six months. Now is the time to work out what fundamental changes you can make to cut your long-term energy costs.”

Incorporated rural business can, for example, take advantage of a bulk energy-buying scheme run by Knight Frank to reduce electricity bills, or look at on-site renewable energy production through rooftop or ground mounted solar. Businesses with room for at least 1,500 sq m of roof or ground can also have them installed free of charge under a scheme run in conjunction with energy provider Octopus. In return, they benefit from heavily discounted electricity prices. “This can be a particularly good option for tenants who don’t know how long they will remain in their current property,” points out Robert.

As part of his mini-budget on Friday the Chancellor also announced a new Energy Supply Taskforce that will seek to negotiate long-term agreements with major gas producers. The government is also working with electricity generators to reform the market structure where gas sets the price for all electricity.

Energy 2 – Onshore Wind and fracking back

In yet another policy swing the new government is lifting the moratorium on onshore windfarm developments and fracking, in addition to becoming decidedly more enthusiastic about exploiting North Sea oil and gas reserves. No onshore wind developments of any scale have been given the go ahead in England since 2015 when David Cameron bowed to public pressure and made it much harder to achieve planning consent. Now the Treasury says the planning regime for turbines will be brought in line with other infrastructure projects.

Whether fracking really has a significant role to play in making the UK more energy self sufficient is debatable, but given wind turbines can be deployed relatively quickly this switch in policy could make a big difference to renewable generation.

Energy 3 – Solar farm backtrack

Ground-mounted solar schemes have also been given a bit of a boost. A formal correction has been made to the Parliamentary record in relation to comments made by former DEFRA secretary George Eustice that contradicted planning policy with regards to what constitutes 'best and most versatile' (BMV) agricultural land.

Mr Eustice claimed that land classed as 3b (described as capable of producing moderate yields of a narrow range of crops (mainly cereals and grass) or lower yields of a wider range of crops, or high yields of grass for grazing/harvesting) was considered BMW and therefore unsuitable for solar farm developments. Solar developers were worried the inaccurate claim could influence local planners and further hamper a sector already singled out for criticism by the new Prime Minister.

For help with any of the above renewable energy issues please get in touch with Robert Blake

Politics – Goldsmith out of Defra

Zac Goldsmith, an environmentalist and close friend of former Prime Minister Boris Johnson, has lost his ministerial role at Defra following the July departure of his brother Ben as a non-executive advisor at the ministry. Much of the media response to his sacking has focused around the implications for the animal welfare bill that he championed and whose progress through parliament is currently stalled; although Defra insists it will still go ahead. However, he was also Defra’s tree champion in chief, a position that didn’t sit well with some commercial foresters who felt too much emphasis was being placed on the environment than timber production. Whether his ambitious tree-planting targets remain in place will be extremely interesting, given the government net zero review discussed below.

Net zero – Government reviews 2050 target

Liz Truss has commissioned an independent review of the government’s pledge to hit net zero by 2050 to ensure the delivery of the legally binding climate goal is pro-growth and pro-business. The review will scrutinise the “green transition” to make sure investment continues to boost economic growth and create jobs as well as increase energy security. While such a review makes absolute sense – no country can deliver a green revolution if its economy is in the red – environmental campaigners will be feeling a little nervous.

Farm support – Elms under threat, area payments back?

If all of the above wasn’t enough for environmentalists to worry about, a media firestorm has erupted following a tweet by the aforementioned Ben Goldsmith that alleged Defra is reportedly planning to review its three-tiered Environmental Land Management Scheme (Elms), which is due to replace the pre-Brexit system of support for farmers based around the EU’s Common Agricultural Policy, and is even considering reverting to an area-based payment of £80/acre to every farmer.

Although Defra has conceded a review is underway, my colleague Ross Murray, a former President of the CLA, says this is par for the course when a new administration takes power. It hasn’t, however, prevented environmental groups from getting their punches in early. Craig Bennett, Chief Executive of the Wildlife Trusts, went so far as to claim: “It seems there is an all-out attack on the environment under Liz Truss’s government.”

A little premature perhaps, but what is clear though is that farmers are fed up of uncertainty and whatever approach the government is planning to take it should be revealed soon. The potential uptake of Elms has already been lacklustre due to a lack of clarity and uninspiring payment rates, further delays will only alienate the food and farming sector further.

For advice on support payments and stewardship schemes please contact Henry Clemons.

On the market – Surrey farm for sale

Our Farms & Estates team has just launched 264-acre Pockford House and Farm (pictured) near Chiddingfold in Surrey. With 140 acres of organic pastureland and 114 acres of mature woodland there is excellent potential for income through new environmental schemes and satisfying personal or corporate carbon or biodiversity net gain requirements, says agent Alice Keith. The guide price is £9.75 million.

International news – Europe piles pressure on livestock

As if the rise in energy and feed costs wasn’t enough, a couple of articles have caught my eye in recent editions of Farmers Weekly that highlight the additional pressures livestock businesses are coming under from environmental campaigners. Last week it was reported that the Dutch city of Harlem, in a bid to cut carbon emissions, is to ban adverts for meat products on the likes of bus shelters and public buildings from 2024. And yesterday (25 September) Swiss citizens voted on whether the country, which often puts issues to public referenda, should ban intensive livestock farming.