Black Sea grain, Vine values, Country houses

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership.

3 minutes to read

Given the geo-political chaos brought about by the spike in grain prices caused by Russia’s invasion of Ukraine it’s very good news that agreement has finally been reached on allowing Ukrainian grain shipments to leave the country’s Black Sea ports. But the resulting downwards pressure on commodity prices highlights just how volatile markets are at the moment. As the combines roll, all the focus will be on getting this year’s harvest safely in, but tough decisions about what to plant next year will soon need to be taken.

Do get in touch if we can help in any way.

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Black Sea deal hits grains

• Country houses – Price growth peaks

• Rural investment – New portfolio on the market

• Vineyards – Vine values on the up

• Tourist accommodation – Registration scheme mooted

• Overseas news – Swedish food insights

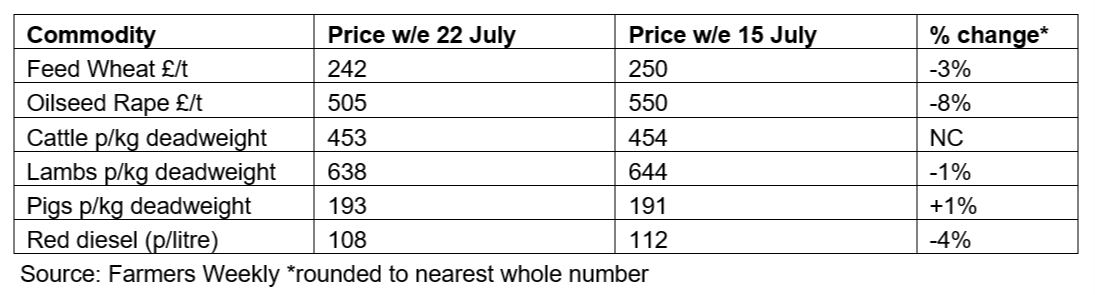

Commodity markets – Black Sea deal hits grains

Grain markets reacted quickly to the deal brokered by the UN and Turkey that will see Black Sea exports resume. Tens of millions of tonnes of Ukrainian wheat and oilseeds have been stuck in ships or stores due to Russia’s blockade of the country’s ports. However, markets will likely remain jittery as the agreement was swiftly followed by a Russian missile strike on Odesa. Oilseed rape prices are under additional pressure from a good European harvest – Germany has hit a five-year high – and weak demand from China where vegetable oil consumption hit a seven-year low in June.

Country houses – Price growth peaks

After a stellar two years, the rise in the value of the most desirable country homes seems to have peaked. Prices increased by just 0.7% in the second quarter of the year, compared with growth of 3.5% in the first three months, according to the latest results from the Knight Frank Prime Country House Index. The pandemic-led “race for space” has seen rural property rise by 20% since the beginning of 2020. For more insight and data please see the full report compiled by my colleague Chris Druce.

Rural investment – New portfolio on the market

A diverse rural investment opportunity has just been launched by my colleagues from our Farms & Estates sales team. Golden Manor Farm Estate in Oxfordshire includes 17 houses, planning consent for two further dwellings, a pub and over 600 acres of farmland and woods let under an FBT. The guide price is £25 million. Please contact Alice Huxley for more details.

Vineyards – Vine values on the up

The latest edition of The Rural Report includes the first index tracking the value of land suitable for vineyard planting. The burgeoning reputation of English and Welsh wine combined with a warmer climate has seen demand for viticultural land rocket, according to Ed Mansel Lewis, our new Head of Viticulture.

Tourist accommodation – Registration scheme mooted

Farms and Estates renting out holiday accommodation may want to contribute to a new government consultation on regulating the market for short-term lets. Nigel Huddleston, Minister for Sport, Tourism, Heritage and Civil Society, said: “Some countries and cities — including Scotland and Northern Ireland — have introduced measures in recent years to respond to concerns about short-term lettings, such as registration and licensing schemes. The government would like to better understand the impact of such schemes before deciding whether further regulation is necessary in England.”

Huge choice of lactose free products in Sweden

Overseas news – Swedish food insights

It’s always fascinating to walk around supermarkets in different countries while you are on holiday. I’m currently writing this from Sweden and when browsing the shelves, or more particularly the chiller cabinets, some clear differences emerge. Firstly, when it comes to the dairy sector the number of lactose-free products is far, far higher than we see in the UK. Secondly, the price of red meat is also much, much, higher. The message could be that the British dairy industry is not taking advantage of the growing demand for lactose-free products, while the livestock sector needs to do more to persuade shoppers that beef is a premium product.