The allure of waterfront property

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Inflation

Wednesday's US inflation report came in hot. Consumer prices rose 9.1% in the year to June, the highest reading since 1981. The surge was broad-based, with indexes for gasoline, shelter and food contributing the majority.

Is that the last bad number? Wells Fargo thinks it might be. The price of gasoline has eased a little over the course of July, but who knows if that will last. The core index that strips out food and fuel rose 5.9%, on par with last month.

One Fed official opened the door to a percentage point hike in interest rates at the end of the month. Mortgage rates are already rising again after a brief decline and the number of homes for sale has started to rise for the first time in three years.

Meanwhile, are there signs inflation might soon ease closer to home?

UK housing

More signs of cooling from the latest RICS Residential Market Survey. The net balance of new buyer interest shrank for the third consecutive month. The volume of sales has now fallen for two months. Here is Tom Bill on what happens next:

“Mortgage offers made on more favourable terms earlier this year will begin to expire in coming months, meaning buyers may have to reassess their plans. Combined with economic news that is going to get worse before it gets better and the fact supply is rebuilding, downwards pressure on house prices will intensify after the summer. In the unlikely event of a general election this year, both activity and price growth would slow further.”

Indeed, responses from lenders to a Bank of England survey points to a fairly sizable drop off in mortgage lending during the second quarter (see chart). Banks expect some further softening over the next three months - see the orange diamond. A reminder that you can find our latest forecasts here.

Seniors housing

We talked on Wednesday about the UN's latest population projections, which fleshed out the degree to which the global population is ageing.

Ollie Knight takes a closer look at seniors housing delivery in the UK. Nearly 80,000 new units have been delivered over the past decade at an average of nearly 7,700 per annum. That takes the total number of complete and operational seniors housing units across the UK to 756,529.

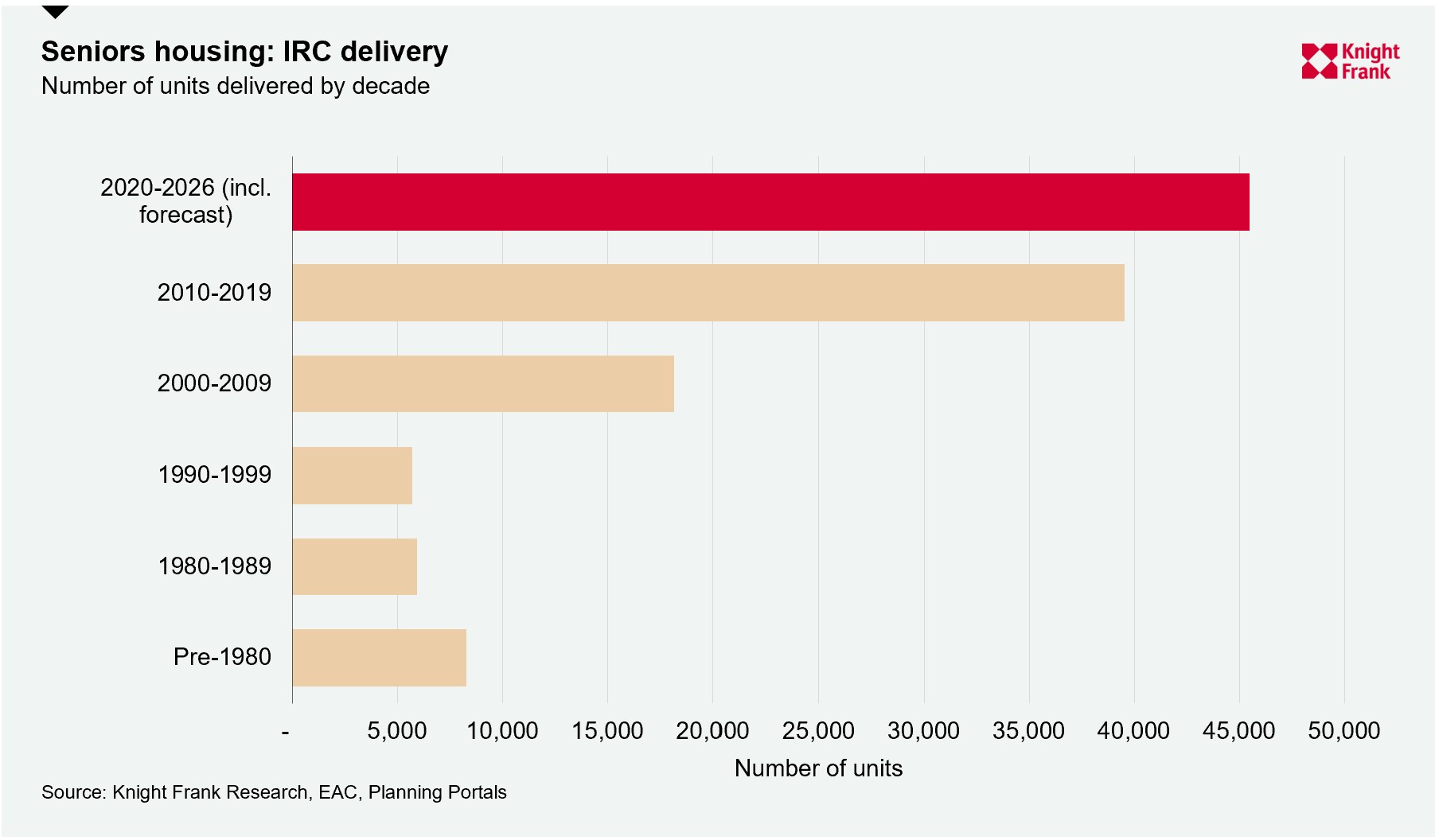

New delivery has been underpinned by an increase in the number of units located within Integrated Retirement Community (IRC) schemes (also known as Housing with Care), which provide higher levels of services and support. Analysis of the planning pipeline suggests we'll see a significant uptick in delivery, driven by rising institutional backing. IRC supply is forecast to increase by 46% (or 38,700 units) over the next five years (see chart). This compares with 4% (or 24,590 units) growth in age-restricted retirement housing stock.

Even so, the rate of delivery will still be overshadowed by the UK’s ageing population, deepening the existing mismatch between supply and demand. In real terms, the number of seniors housing units per 1,000 individuals aged 75+ is expected to drop to 120 by 2025, down from 137 in 2010 and 128 currently.

Waterfront homes

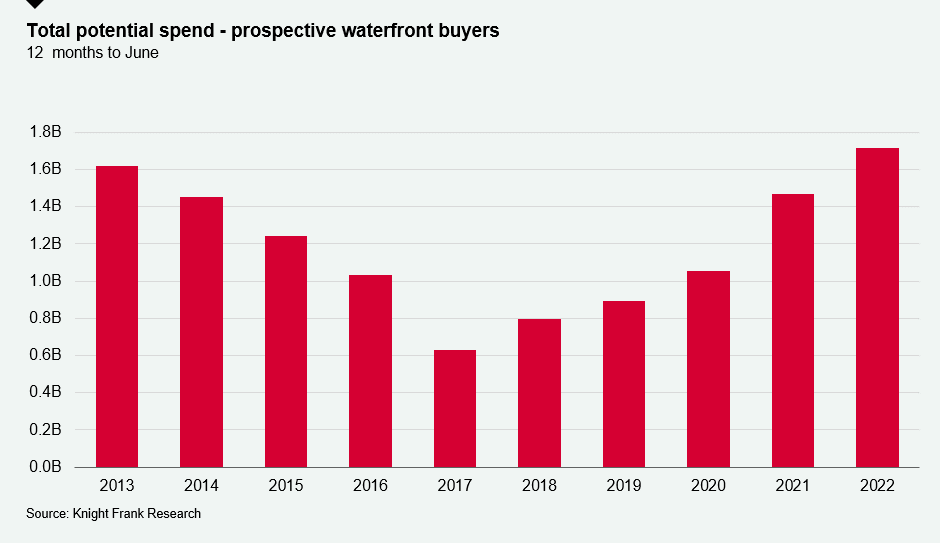

The pandemic prompted a surge in demand for waterfront property and the buying power of potential purchasers is now the highest it's been for a decade (see chart).

New prospective buyers were looking to spend up to £1.7bn in the 12 months to June, an increase of 13% compared to a year earlier. The average spend increased by 38% to £5.1m in the same period, another decade-long high. Here is Chris Druce:

“With the pandemic causing a reset in what people want from a property, and waterside living providing the space and greenery that’s been so popular, buyers are keen to secure their preferred property in a sector characterised by limited supply."

In other news...

Chinese banks book $312 million in bad loans following mortgage boycott (Bloomberg), China narrowly misses second-quarter contraction as zero-Covid batters economy (FT), and finally, builders worst hit by hiring crisis (Times).