Uganda

The residential and prime office markets have been the quickest to recover in Uganda, with demand and lease rates rapidly climbing to pre-Covid levels.

3 minutes to read

Prime office demand ramping up

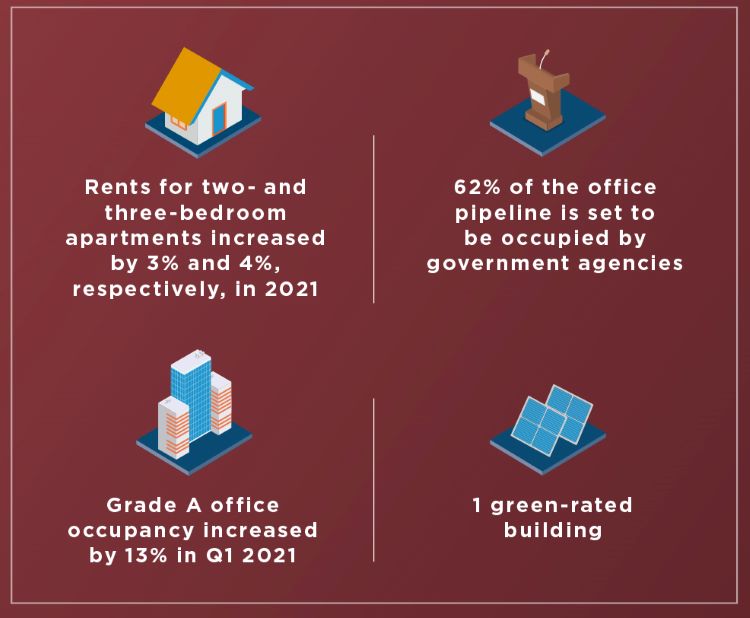

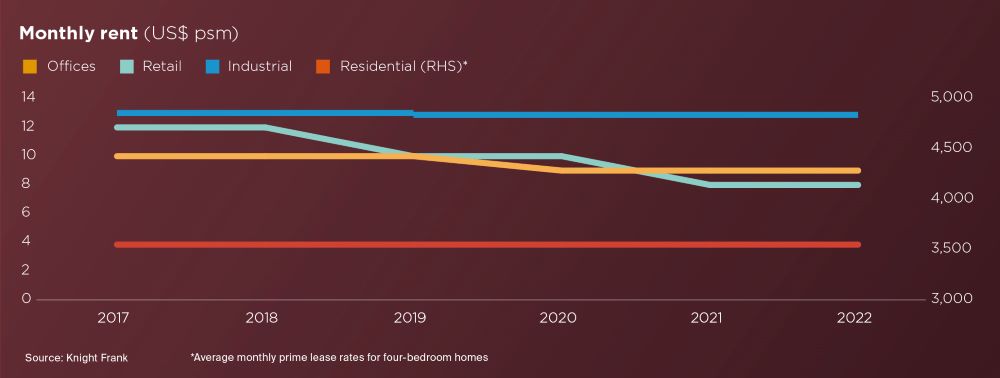

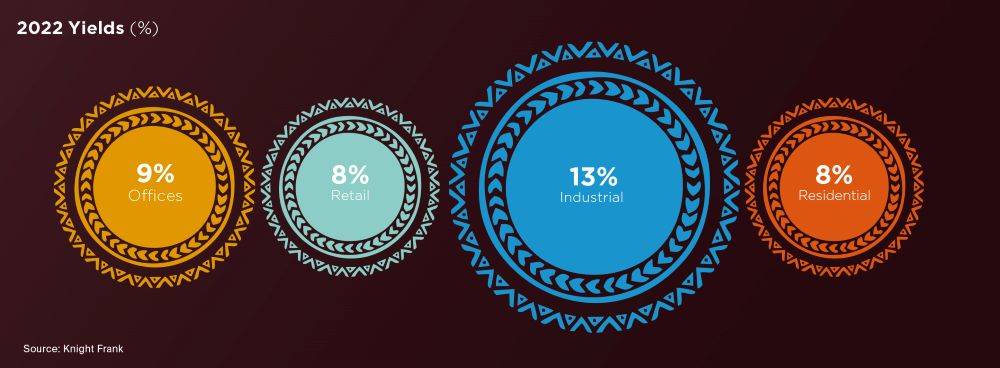

Office leasing and investment activity continue to rise steadily, resulting in an improvement in take-up and lease rates. Average prime office rents in Kampala increased by 3.6% last year and have remained unchanged in 2022 thus far. Grade A office occupancy levels have increased by 13% between Q1 2021 and Q1 2022.

The rising demand for offices is driving a dearth of prime space for immediate occupation. This shortage will likely be eased with an expected 100,000 sqm supply pipeline in the next 12 to 24 months, although 2% of this is earmarked for owner-occupation by various government agencies.

"As prime-office occupancy levels climb, we expect prime rents to also continue rising, at least until such time as there is a meaningful injection of high-quality space into the market."

- Judy Kyanda Rugasira, Managing Director, Knight Frank Uganda

Elsewhere, we anticipate increased downward pressure on Grade B and Grade C office rents in the medium to long term as demand for high quality offices rises and intensifies. This will be particularly challenging for landlords of older office buildings who are losing public sector linked occupiers to newer, more modern buildings. Furthermore, tenant covenant strength and occupancy levels have become focus areas for investors and will continue to impact investment decisions, leaving landlords without public sector tenants no choice but to refurbish to entice high calibre occupiers, should they wish to sell well.

Residential sector recovery underway

The residential market is firmly in recovery mode, as evidenced by demand and rent indicators. Catalysts for demand in the residential sector include the return of expatriates to the country after travel restrictions due to COVID-19 were lifted, and renewed demand from oil and gas sector professionals following the signing of key oil agreements in April 2021 and the Final Investment Decision in February 2022.

As a result, average occupancy levels in prime residential suburbs increased by 12% in 2021 and have held steady so far this year.

Subdued retail sector

The retail market remains subdued. Two lockdowns and curfew restrictions in 2020 and 2021 have left the sector struggling, with turnover falling away sharply. By Q1 2022, average earnings for general grocery retail outlets were still about 11% below 2019 figures, although incomes are now 4% higher than 2021.

Rents have remained stable, and with footfall steadily improving, the outlook for the sector is getting brighter. Indeed, footfall across all retail is up 14% year on year and has grown by 15% between February and March 2022.

Industrial sector poised for growth

Rental rates in Kampala’s prime industrial areas stand at between US$ 5-7 psm for warehouse/storage space.

We believe there is still scope for higher rents. Purely from a demand-supply perspective, there are widespread warehouse shortages in the agricultural sector. This, combined with increasing demand from the Fast-Moving Consumer Goods (FMCG), logistics, and e-commerce sectors and a very limited supply pipeline of international-grade warehouses strongly suggests higher rents are inevitable.

Asset Class to Watch

With improved road networks and increased access to utilities, the suburbs have experienced growing demand for housing. Tenants are partial to these areas because of the slightly lower rents, coupled with the higher quality of available stock when compared to some prime residential neighbourhoods.

Developers are also providing more affordable housing options in Kampala’s suburbs in response to the increasing demand, but the demand-supply imbalance looks set to persist.