Why vineyards are more than just the wine

Andrew Shirley meets Knight Frank’s new Head of Viticulture to quiz him about the burgeoning market for UK vineyards and how prospective winemakers can add value to their enterprises.

4 minutes to read

Ed Mansel Lewis has been at the heart of the UK’s wine industry for over a decade and has been involved with some of the sector’s landmark sales.

“The price of land suitable for establishing vines has been growing steadily for over 10 years and now commands a significant premium above its traditional agricultural value,” he says. When I ask what kicked off the trend, he explains there were two sales that really laid the foundations.

“Around 2010, we were dealing with the sale of a farm in Kent whose owner was very keen to achieve more than he’d get from selling it as straight farmland. A colleague thought it might be suitable for vines and advertised it in a specialist publication. That attracted an English couple who had a vineyard in France and paid a 10% premium.”

This sale established that a vineyard premium existed. But what really kickstarted the market was when four years later Pierre- Emmanuel Taittinger of the iconic French champagne house bought another farm in Kent to plant grapes.

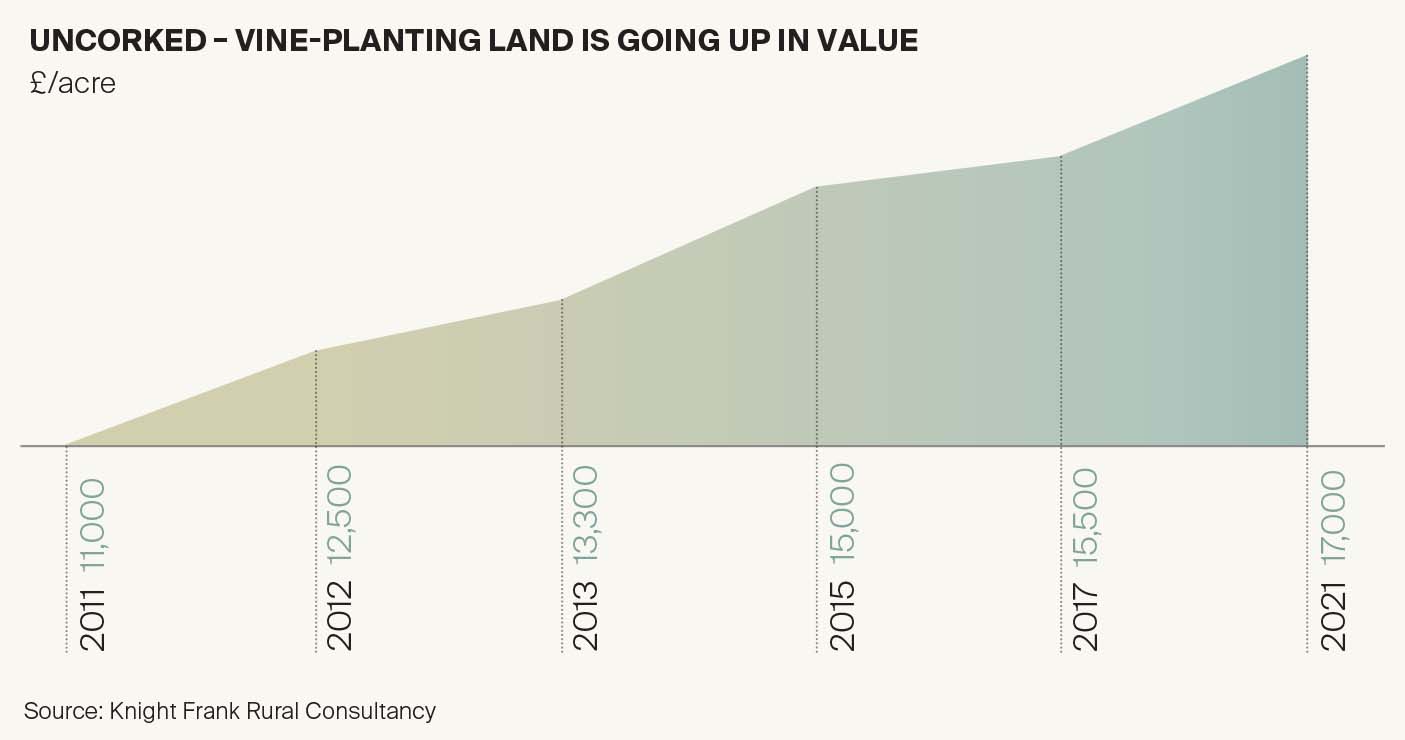

“It was a pivotal moment when people suddenly twigged that English sparkling wine might actually be really good and the press were all over it. After that we saw sales achieving £15,000/acre for the first time.”

The chart below, based on deals Ed has been involved with, shows how values have grown. But will this upwards trajectory continue? “I wouldn’t be surprised to see land trading at £20,000/acre within two years. Since the Covid-19 pandemic wine consumption in the UK has risen sharply and producers are suddenly realising they can’t produce enough of the stuff. I know of five significant businesses that are looking to each acquire plots of a minimum of 80 acres.”

That may not sound much compared with a viable arable farm, but Ed quickly puts it into context. “Thirty acres will give you around 100,000 bottles a year, so 80 acres of extra domestic wine production in an emerging market is pretty significant.”

And has climate change played as significant a role in boosting the market for English wine as some are claiming? “Definitely,” says Ed. “Sparkling wine (which still accounts for 64% of UK production) needs an average growing season temperature (GST) of at least 13 degrees between April 1 and October 1. GST in parts of the UK has been consistently above that since 2010.”

Given this means wine can now be produced all over the country, I ask if the locations that can command premium values are expanding beyond the south-east.

“I think we will see a two-tier market, with prime land continuing to grow in scarcity and value, and then more compromised land seeing slower growth, particularly if the sugar and acid levels of adjoining or nearby vineyards have performed poorly. Data shows that Kent, Essex, Sussex and Hampshire are still the best counties for growing vines, but having said that it’s not just about what goes into the bottle.”

I’m intrigued. “Vineyards in the right location (see our case study over the page) can sit at the heart of a successful diversified rural business so you don’t need to be producing critically acclaimed vintages every year to create a viable wine business,” he explains.

I’m also curious about the market for existing vineyards. Have they too seen a sharp rise in value? “This market is more opaque as even more of the deals are struck privately”, reveals Ed. “If customers know a business is being sold it can really hurt sales.”

Successful vineyards are often sold based on the value of the wider wine brand they have created, rather than the value of the underlying assets. But in general there are three factors that sensible buyers need to take into account, Ed notes.

1. Is the vineyard suitable to be a vineyard?

“Many vineyards were planted on land that was already owned without much consideration for the factors that produce good wine.”

2. How old are the vines?

“Seven to 15 is considered the sweet spot as you can’t tell if vines are producing the right levels of sugar and acidity until they are five years old. They they generally have a lifespan of about 30.”

3. What varieties of grapes are being grown?

“You want vines that can produce the wines that are most popular with consumers.” Vineyards that tick all the boxes can fetch around £30,000 to £40,000/acre, says Ed, but there are only “a handful” of any scale sold each year.

But if demand for home-produced wine continues to build and more vines are planted that could soon change. “It’s a really exciting time to be involved with the sector here as we see more innovative and sometimes disruptive winemakers emerge.”