UK Logistics Market Outlook 2022: Inflationary Pressures For Developers

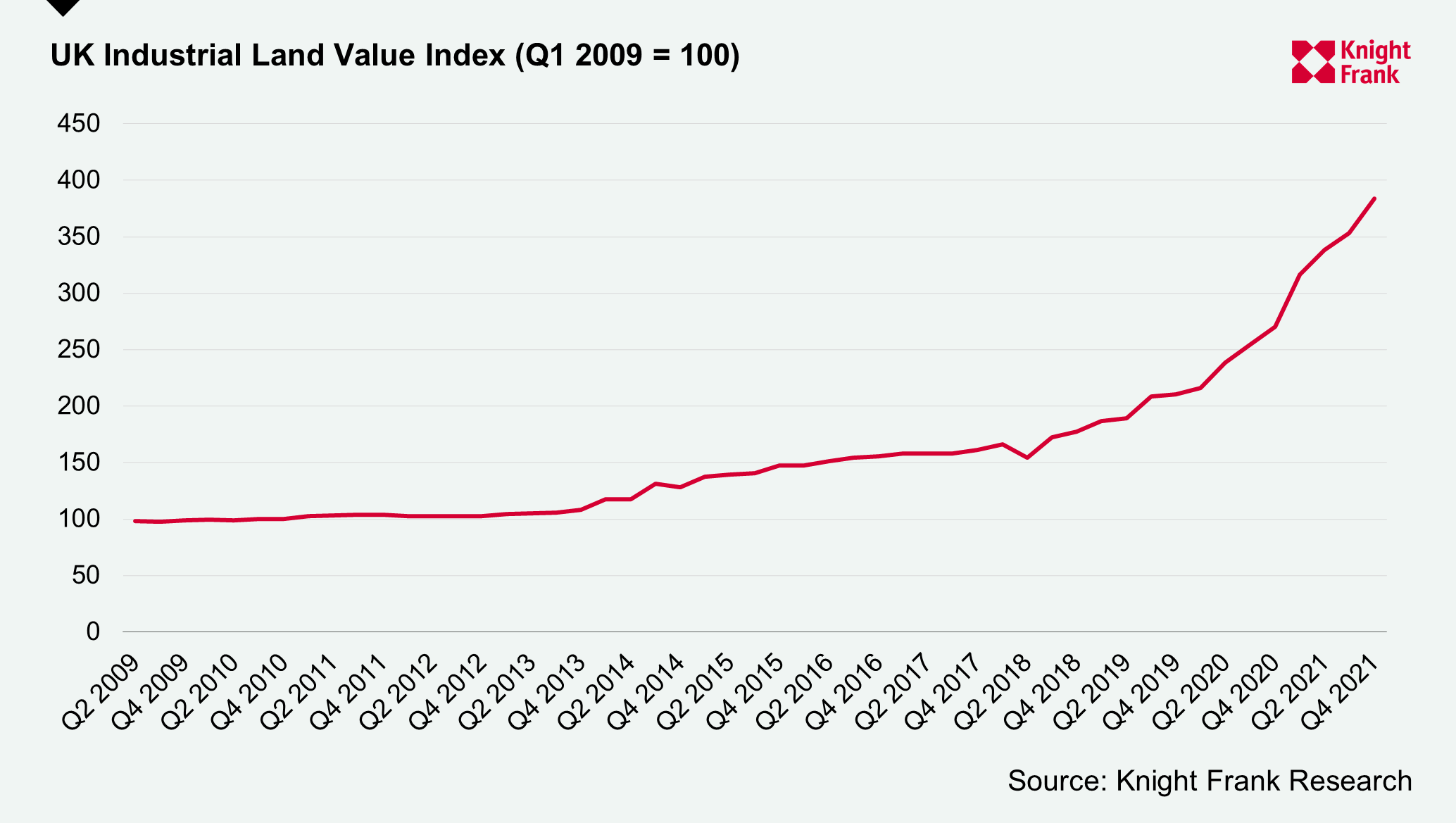

Industrial land values have risen 42% across the UK over the past year and doubled in the past two and a half years. Pressure on land pricing is set to continue in 2022.

We expect inflationary pressures for construction materials to persist. The war in Ukraine is likely to push up costs and delivery times, with overland Asia-Europe trade routes disrupted and elevated costs for alternatives.

2 minutes to read

Rising land values

Our UK land values index shows land values have risen 42% over the past year (based on data collected quarterly for c.35 markets), from an average of £1.3 million in Q4 2020 to an average of £1.8 million per acre in Q4 2021. Over the past two and a half years, UK industrial land values have more than doubled (Q2 2019 – Q4 2021).

We expect further growth in land values in 2022.

Materials & labour costs remain elevated

Construction materials have been in short supply over the past year, with long lead time impacting on build schedules. Supply chain issues were beginning to show signs of easing in early 2022. However, the Russian attack on Ukraine is likely to push up costs and delivery times for construction materials, with Asia-Europe trade via the New Silk Road likely to be disrupted. Though there were signs of price stabilisation in early 2022, we expect inflationary pressures to persist with bottlenecks and elevated costs for shipping and air freight.

In addition to land values, building materials and labour costs have risen over the past year. The BCIS Materials Cost Index shows that prices have risen 20% over the last year. Structural steel prices have risen a massive 59% y/y (BEIS). However, Oxford Economics is now forecasting the cost of steel will fall by 28% in 2022.

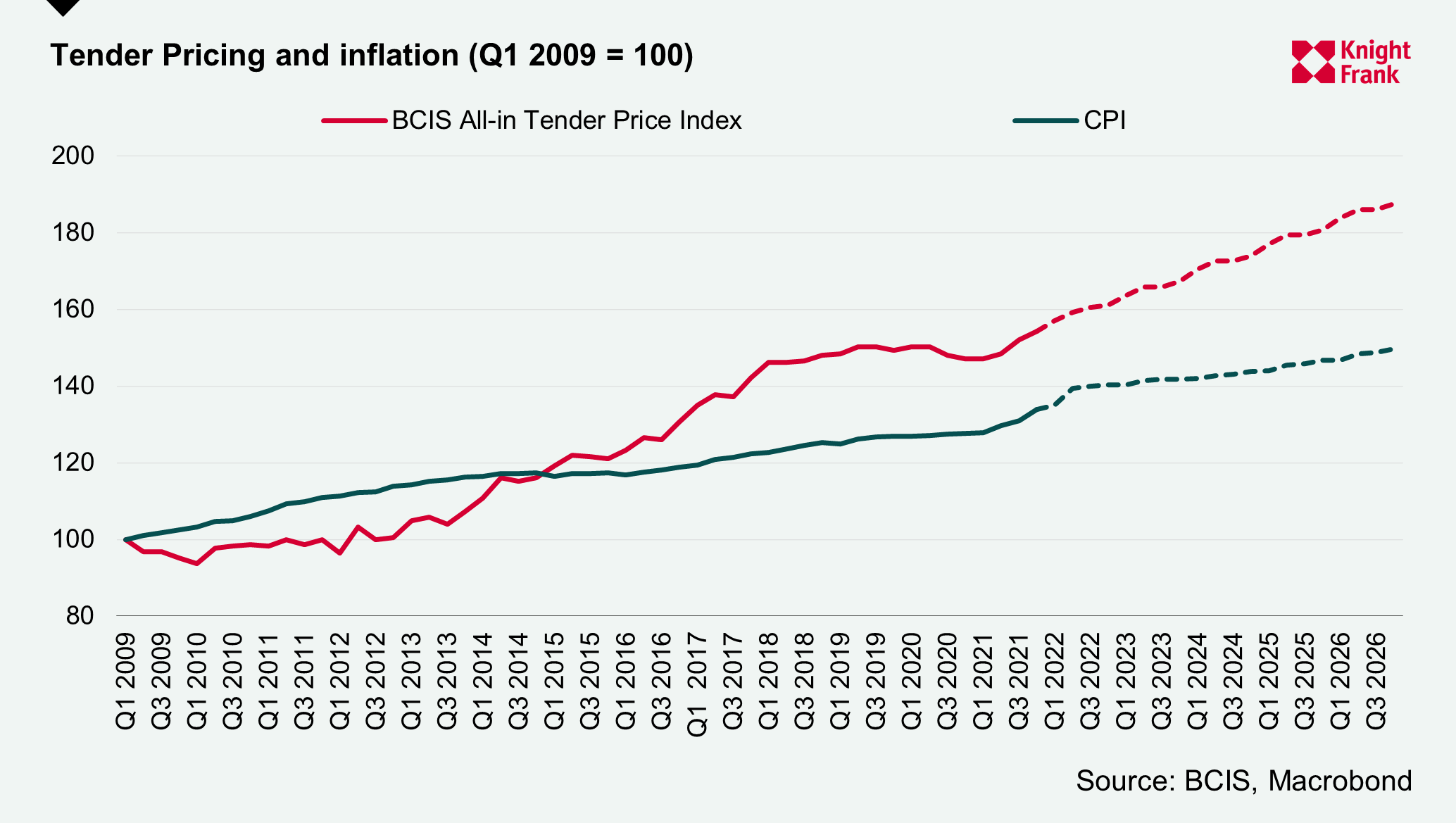

Labour shortages and wage pressures are also impacting build costs and tender pricing. Tender pricing rose 4.9% during 2021 and is expected to rise 4.4% in 2022 (BCIS). It is expected to continue outpacing the rate of inflation over the next five years. This will impact the cost of bringing developments to practical completion.

Rising fuel costs

The price of diesel has increased significantly and prices are expected to rise further in 2022. The removal of the Red Diesel Rebate from April 2022 will have an effect on the cost of running on-site construction plant. Although Red Diesel only represents a small proportion of the BCIS General Building Cost Index, it will put upward pressure on tender pricing.