Safe haven flows, the push for transparency and the rise of the US buyer

Your international property and economics update tracking, analysing and forecasting trends from around the world.

4 minutes to read

Global economy

Faced with higher energy prices – Brent crude oil surged to almost $140 per barrel this week – and slower economic growth, central banks are likely to find it harder to engineer a soft landing from the pandemic.

The scale and pace of interest rate rises will be lower than anticipated. Inflationary pressures won’t go unchecked, but neither will rate setters have them in a vice-like grip like many had envisaged just a few weeks ago.

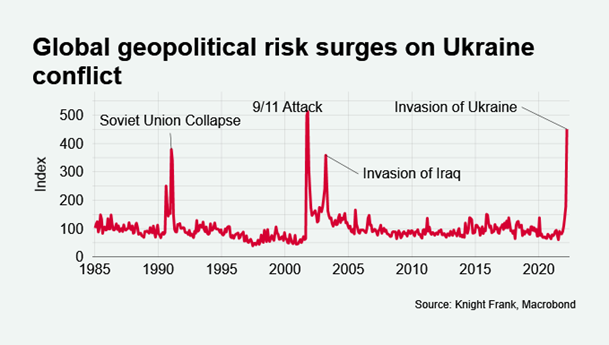

The global economic outlook is more uncertain since the Ukraine crisis started, pushing global geopolitical risk to a 20-year high.

For prime housing markets, safe haven flows may strengthen as we see heightened volatility in alternative assets such as stock markets. But the cost-of-living squeeze may also weaken buyer sentiment. What does this mean for prime sellers in international markets? For the first time since the pandemic-induced surge in demand took off, those looking to move may need to display some flexibility on price.

Prime prices

Dubai saw prime prices jump 44% in 2021 as the government’s response to the pandemic, its vaccine programme, the city’s relative value and innovative visa initiatives came into focus.

Although an outlier, Dubai wasn’t alone in seeing a surge in double-digit prime price growth in 2021. Thirty-five of the 100 markets tracked in our Prime International Residential Index registered price growth above 10% in 2021.

Our new interactive tool allows you to view the price performance of all 100 markets over the past five years, with the option to select and compare the movement of individual locations. Take a look.

Transparency

The push for transparency will be a key theme in global property markets in the coming years, a theme we highlighted in The Wealth Report 2022. This week the UK passed a new Economic Crime Bill with the aim of creating a register of overseas ownership of UK land and property and an overhaul of Unexplained Wealth Orders (UWOs). First included in a draft Bill in 2018, Russia’s invasion of Ukraine has propelled the issue up the Government’s to do list.

This follows the sudden closure of the Tier 1 visa programme, which was one of the world’s most expensive – with a £2 million threshold.

But the UK isn’t alone. Governments around the world want a paper trail to understand who is buying what and where. This move by the UK may be one of the first, but it is the tip of the iceberg of what’s to come.

Portugal, Greece and Malta have halted new Golden Visas to Russian applicants and as Flora Harley points out leaders of the European Commission, France, Germany, Italy, the United Kingdom, Canada, and the United States also pledged to limit the sale of citizenship. The challenge will be policing and enforcing such measures.

For governments it is likely to be a fine balancing act. The push for transparency and greater stringency around visa rules comes at a time when governments want to attract, not deter, investment to fill the gaping holes in their public finances left by the pandemic.

US buyers

US buyers look set to expand their market share in global prime markets. The US dollar index is now at its highest level since June 2020 as investors look to the dollar as a refuge in times of global uncertainty.

With four potential rate rises still on the cards in 2022, some analysts have hinted rates will end the year at 2%. This is the so-called neutral rate in monetary policy - a theoretical level that neither speeds up or slows down the economy. But four increments of 0.25% will push the dollar higher, with some of the biggest gains likely to be against the euro.

What does this mean for global property markets? With travel rules easing and US households estimated to have accrued $28 trillion during the pandemic according to Oxford Economics, US buyers are likely to be a key source of demand in prime residential markets in 2022.

In other news

Wall Street’s return to the office takes hold but London still leads The Pret Index (Bloomberg), Macron looks set to win a second presidential term on 24th April (The Times) and courts rule that Britons with homes in France can pay a reduced tax, plus China faces dual shock from oil spike and virus spread (Bloomberg).