Netflix changes script, $100 oil barrels and global collaboration

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Pandemic stocks – end of season 2?

An announcement from Netflix that subscriber growth will slow substantially was held to be partly responsible for last week’s tech-led global equity sell-off. Investors are moving out of stocks seen to have benefited from the pandemic through trends such as working from home, as Covid-related restrictions begin to ease in a number of countries.

Headwinds could push oil above $100 per barrel

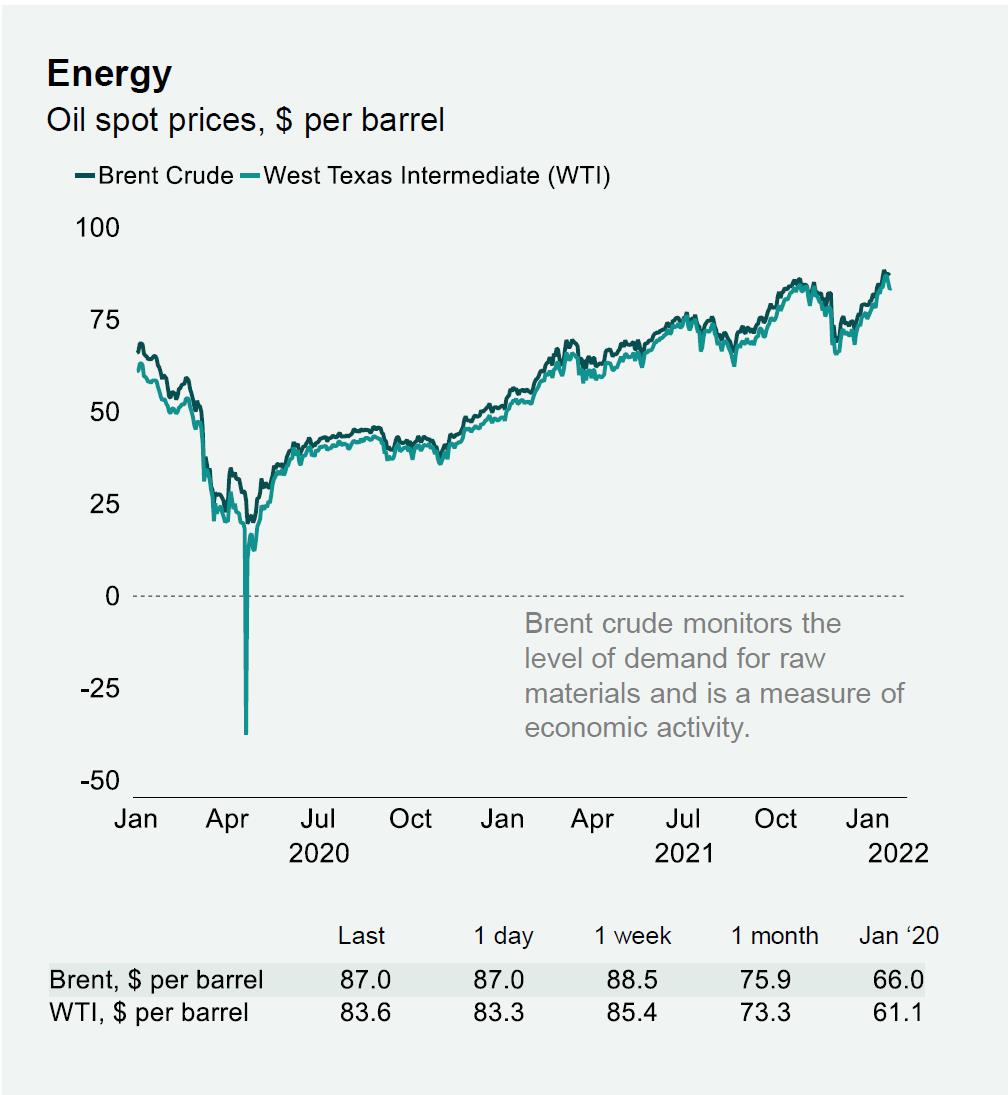

Brent Crude is currently above $87 per barrel, a new seven-year high. Geopolitical tensions between Russia and Ukraine are adding to expectations that prices could surpass $100 per barrel over the coming months, as the potential for disruption to energy exports grows.

Globalisation on the rebound

The ‘Davos Agenda 2022’, which concluded last week, reaffirmed that today’s most pressing issues could only be managed effectively through global collaboration, while policy makers acknowledged that there needs to be a more resilient and geographically balanced trade system.

This comes as figures released today show global trade increased by 14% in the year to November 2021, while our Active Capital research predicts a record level of cross-border real estate investment in 2022.

Download the latest dashboard here