Monday property news update - 5th July

Employers turn to automation, John Lewis the landlord and surging urban housing markets

4 minutes to read

Global house prices

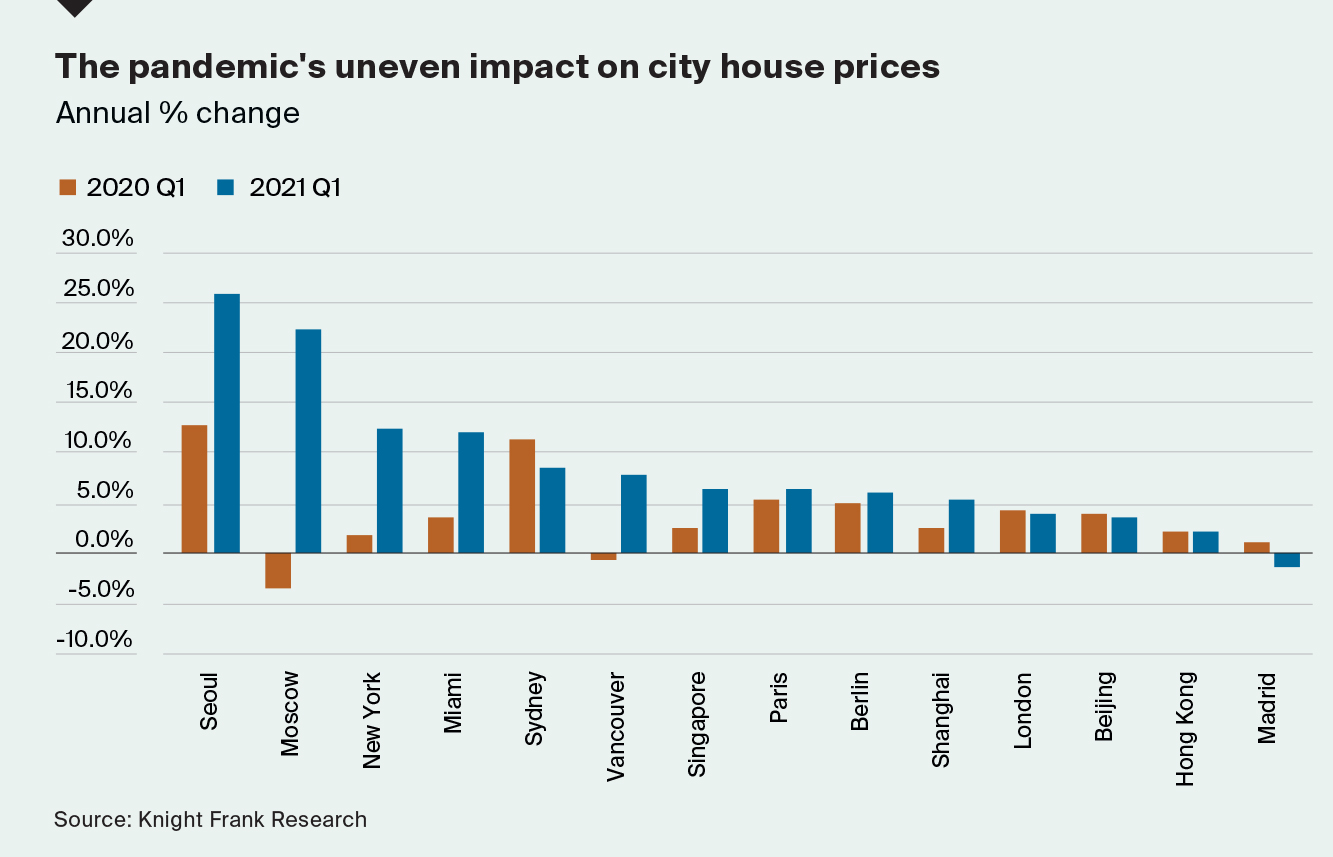

Urban house prices are rising at their fastest rate since 2007 and, of the 150 cities we track, 43 are now registering annual price growth above 10%.

A combination of powerful forces are driving house price growth; a severe undersupply of housing in many locations has been exacerbated by the slowdown in construction during the pandemic and significant numbers of buyers are locking in ultra-low mortgage rates while they can. Fear of missing out (FOMO) is also driving sales and with borders closed investors are looking closer to home to take advantage of rising prices, writes Kate Everett-Allen.

Governments in New Zealand, Canada, China, South Korea and Ireland have all taken steps to curb price inflation during the first half of this year to differing degrees of success. There are now signs, however, that some markets are cooling as the distortive effects of the pandemic ease. Canada has reported two straight months of moderating sales and Capital Economics reports that mortgage applications for US home purchases have fallen back to pre-Covid levels.

Jobs

Another positive US jobs report on Friday raises as many questions as it answers. Though employers added 850,000 new workers in June, the labor market participation rate - those in work or looking for work - remained unchanged at 61.6%. That rate has been largely flat for several months and is down slightly since the onset of the pandemic.

Why exactly some workers aren't eager to return and whether the trend will ease over coming weeks is one of several urgent questions facing policymakers across the US and Western Europe. The CEO of one major French manufacturer told Reuters last week that the pandemic appeared to have "anaesthetised people's relationship to work."

Economists at the more optimistic end of the spectrum are betting the issue will right itself as the impact of the pandemic wanes. Further progress with the vaccine roll out and the full reopening of schools may be the deciding factors.

There are signs, however, that the adoption of digital tools will have a lasting impact on the global jobs market. Today's Times reports Deloitte executives will now manage more of their administrative tasks using online and digital platforms, rather than via secretarial staff. Meanwhile a wave of automation is underway, particularly in the US services industry.

Prime London

Demand continues to build in prime lettings markets in London and the Home Counties as lockdown restrictions are relaxed and the next academic year approaches.

The number of new prospective tenants registering reached the highest level on record in June, as did the number of viewings. In a further sign that workers are returning to offices, the weekly number of enquiries from corporate relocation agents has just reached its highest level since September. As a result, rental declines narrowed to 1.6% in the three months to June, the smallest drop since the onset of the pandemic.

The prime central London sales market is showing similar stamp duty-related distortions to the UK market - see Friday's note. Here, a period of price growth is long overdue, according to analysis from Tom Bill. The number of new prospective buyers registering in June was 42% above the five-year average, suggesting there is a significant well of pent-up demand likely to be released as travel restrictions ease.

John Lewis

The Sunday Times reports that John Lewis plans to build 10,000 homes over the next decade as the high-street giant looks to revive its fortunes by becoming a residential landlord.

The piece reveals the retailer has already identified sites for 7,000 homes which will be a mixture of studio flats and family homes. Staff may be offered discounted rates.

Surging house prices, declining homeownership and the rationalisation of the rental sector are showing few signs of abating, which leaves a significant pool of demand for quality rental homes. We talked last week about new research from Nottingham Building Society that revealed almost a million UK landlords - more than a third of the total - will review their property portfolios in the next year and the number planning to sell homes outnumbers those planning to buy new ones.

In other news...

A new Rural Market update from Andrew Shirley unpicks plans for payments to encourage farmers to boost their soil carbon levels.

As editor of The Wealth Report, Andrew was joined last week by a special panel of guests to discuss key trends in selected luxury investment markets including the demand for NFTs, plus the latest findings from the unique Knight Frank Luxury Investment Index (KFLII). You can watch on demand here.

Elsewhere - Corporate travel rebound signals first signs of recovery, get workers back to offices ‘to save cities’, and finally, Boris Johnson to call for common sense after Covid rules ease.