Monday property news update - 14 June

The recovery quickens, retail's pain points and what next for the housing market

5 minutes to read

Tracking the recovery

Official figures reveal the UK recovery is on track. GDP expanded 2.3% in April, led by the services sector, according to the ONS. That leaves the economy 3.7% smaller than it was at the outset of the pandemic.

Construction output dipped 2% to settle at levels last seen in January 2019. However, the infrastructure and housing repair, maintenance and improvements subsectors, remain well above their pre-crisis norms.

Leading indicators point to a further pick up in the rate of growth. Make UK, which represents 20,000 companies across engineering, manufacturing and industrials, said that last quarter's output volumes were the highest level since its research began 30 years ago. The group upgraded its growth forecast for manufacturing from 3.9% to 7.8%.

The ONS data also reveals output steadily improved through the first quarter, despite the prevailing restrictions. That suggests many businesses are well placed to absorb what this morning's Times reports will be a four-week delay to the easing of lockdown restrictions, due to be announced this evening.

Pain points

The delay to the full reopening will lead to another extension of the moratorium on commercial property evictions over unpaid rent, according to the Sunday Times. That would delay what Stephen Springham notes are three significant pain points for the retail sector; the end of the business rate holiday, the lifting of the moratorium on forfeiture (both currently slated for 30 June) and quarterly rent day (24 June).

Half of the rent due to 36 landlords across 16,320 retail, leisure and hospitality leases since March 2020 has now been paid, according to the British Property Federation. Landlords and tenants have reached agreements on managing a further 27% through new payments plans, waivers, rent holidays and deferrals. This means 3% of total rents owed since March last year remain unresolved, amounting to about £667m.

Stephen's piece weighs up how the end of the moratorium is likely to play out.

The stamp duty taper

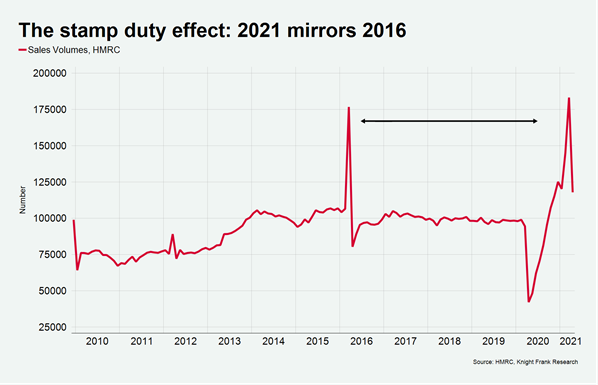

The maximum residential stamp duty holiday saving of £15,000 will taper from the end of this month to £2,500, with this lower saving remaining in place until September.

So far, the impact of the holiday has been substantial (see chart). UK transaction numbers reached a record level in March, before the first deadline was deferred, taking the total annual spend in the housing market to levels not seen since before the global financial crisis. Ahead of the stamp duty holiday expiring on 30 June, there is every reason to believe there will be a second large spike in transactions this month, writes Tom Bill.

We know from previous tax changes that deadlines can put off prospective sellers, some of whom will opt to wait until market conditions normalise. In the ten years between 2009 and 2019, the number of market appraisals only fell once between February and March - in 2016 before the introduction of the additional rate of stamp duty.

This hesitation partly explains the imbalance between supply and demand that has been a feature of the UK property market this year, as highlighted in last week's RICS survey. The end of the stamp duty holiday is one reason that supply could start to build later this year and house price inflation return to single digits.

Green building

A letter from 100 business leaders co-ordinated by the UK Green Building Council and sent to the Prime Minister on Friday issues various criticisms of the government's reforms of the planning system.

The letter (not yet online), issues a warning that the emphasis on speeding up planning "could come at the expense of net zero, biodiversity or community involvement", according to the FT write up.

Ireland's tax dilemma

G7 leaders last week came to an agreement on global corporate tax that, if adopted, could see a 15% minimum corporate tax level applied to multinationals. Flora Harley weighs up the likely impact for Ireland, which has benefitted from a favourable tax regime like few others.

Investment from large multinational corporations over recent decades has been “central to Ireland’s recovery from the financial crisis,” according to a recent OECD report. The top technology, media and telecommunications (TMT) companies now occupy a total of 4.8 million square feet in Dublin, according to Knight Frank Ireland’s Q1 2021 Investment Market Report.

But while potential tax hikes pose some risk to Ireland’s TMT dominance, the risks are offset by how embedded these multinationals have become since establishing themselves as many as thirty years ago, according to Joan Henry, Chief Economist and Head of Research Knight Frank Ireland.

“While Ireland’s favourable tax regime may have been a reason for companies to originally invest here 20 to 30 years ago it is not the only reason and is not why they continue to operate and expand in Ireland,” she adds. “Considerable investment in Research & Development and in education has made Dublin an attractive location to source the level of talent required to attract high value adding companies.”

In other news...

In a new Rural Market Update, Andrew Shirley analyses the disagreement between UK and the EU over the Northern Ireland Protocol, and unpicks its impact on rural trade.

Elsewhere - 'worst' of US inflation likely this summer before easing during Autumn, US consumer sentiment rebounds, oil demand to surge in the second half, ministers weigh up hospitality rescue over billions in unpaid rent, continental Europeans dash to book holidays, one in four bosses demand staff on premises have double jab, ban on home gas boilers threatened by heat pump shortfalls, and finally, WFH is a fad says Canary Wharf’s Sir George Iacobescu.