Friday property news update - 23 April

Lower for longer, Biden targets the wealthy and UK housebuilders predict life after the pandemic

4 minutes to read

Lower for longer

UK economic forecasts collected by the Treasury this month now anticipate GDP growth of 5.7% this year, a big jump from the average of 4.7% in March. If correct, that would be the fastest expansion in 33 years.

As we've discussed in the previous two notes, forecasters expect the recovery to be consumer-led, driven by an excess savings splurge. Inflation is already edging up. The Bank of England forecast in February that inflation would reach 1.9% by the end of 2021 but many economists now expect it will exceed its 2% target before then.

That makes forecasts of no interest rate rises until at least 2026 all the more remarkable, as Flora Harley notes this morning. If that turns out to be correct, interest rates will have been close to zero for 17 years before the next hike. Before the 2008 Global Financial Crisis, the base rate had never been below 2%. Since then, UK house prices have climbed 34%.

As the recovery takes hold, the debate among policymakers over how to address the relationship between asset prices, low interest rates and inequality will come further to the fore - see New Zealand and Australia. It is a truly global theme; as Flora says, UK house price gains of 8.6% in the year to February might sound unusual during the worst recession in 300 years, but they look decidedly tame alongside gains of 15% in Turkey or 10.3% in Portugal.

Biden's tax plan

US President Joe Biden has put wealth inequality at the centre of his policy plans. Bloomberg reports the president will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6%.

That would reverse a long standing policy whereby investments are taxed at a lower rate than labour. Biden campaigned on levelling the capital gains and income tax rates for wealthy individuals, saying it’s unfair that many of them pay lower rates than middle-class workers.

Biden's proposal follows new or proposed plans in Argentina, Canada and South Korea and is likely to be replicated elsewhere. For The Wealth Report we surveyed more than 600 private bankers, wealth advisors and family offices across 50 countries and territories, representing combined wealth of more than US$3.3 trillion - nearly half expect the growth in wealth inequality to fuel demand for wealth taxes aimed at curbing the imbalance.

The UK housing surge

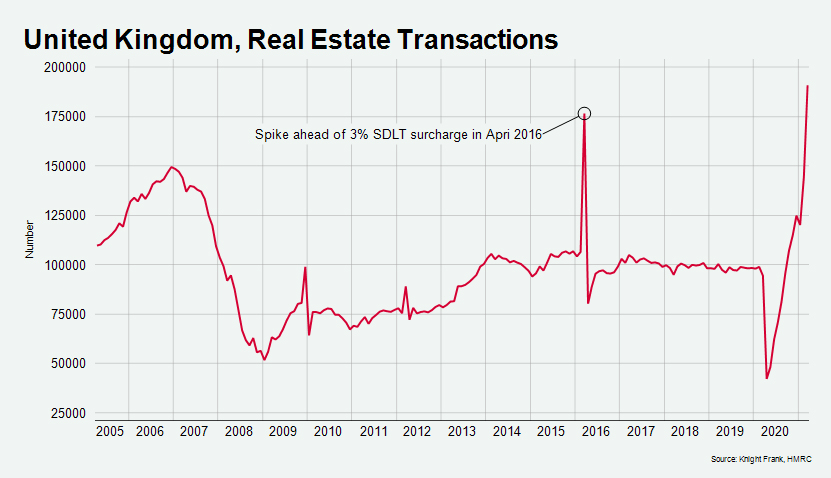

There were 180,690 UK property sales in March, the most since records began in 2005 (see chart below), according to official figures. A separate release from the ONS shows UK average house prices increased by 8.6% in the year to February 2021, up from 8.0% in January 2021.

For more on what's underpinning this, it's worth revisiting this piece from Tom Bill. Sellers who hesitated in the first two months of the year because they were home-schooling or had concerns about missing the stamp duty deadline began listing their properties. Meanwhile, the Stamp Duty Holiday, the strengthening economy and gradual return to normality played key roles driving sentiment.

According to this morning's FT, the GfK UK consumer confidence index, a closely watched measure of how people view the state of their personal finances and wider economic prospects, rose one point to minus 15 in April - that's the highest level since February 2020, before the first Covid-19 restrictions started.

The housebuilding challenge

Pete Redfern, chief executive of Taylor Wimpey, tells the FT that demand for homes is at its highest level in two decades. The results suggest a significant amount of demand is being driven by people making their second home move as homeseekers reassess their housing priorities in light of pandemic-related shifts in working habits.

In a new episode of the Intelligence Talks podcast, out this morning, Patrick Gower quizzes Oliver Knight and Anna Ward on the challenges faced by homebuilders trying to predict what post-pandemic life looks like. They cover London's changing skyline, London boroughs facing big housing targets, and look at how housebuilders are reacting to a shortage of land emerging.

They also discuss how developers are reacting to green targets, the impact of big corporate and public sector moves to regional cities and manage to find a property angle to the European Super League. Listen here, or wherever you get your podcasts.

In other news...

The Knight Frank guide to European cities.

Plus, inflation forces the Bank of Canada's hand ahead of the Fed and ECB, ECB dismisses tapering talk as recovery ‘has a long way to go’, global economy to stage vigorous recovery, UK factories revel in big boost to optimism, Sales at biggest luxury groups set to recover as early as this year, and finally, US airlines say ‘worst behind us’ as vaccines fuel recovery.

Photo by Dmitry Vechorko on Unsplash