Private wealth remains focused on London

Against the backdrop of the Covid-19 pandemic, private wealth continues to grow and so too investor interest in both residential and commercial property, with “safe haven” locations, such as London, exerting a strong pull in these uncertain times.

5 minutes to read

- Post-pandemic, private capital will be a bigger force in commercial markets

- At a city level, London is the world’s number one recipient of cross-border private property investment

- The buoyancy of the residential super-prime market in London throughout the pandemic is a testament to its safe haven appeal

Imminent economic cycle heralds new opportunities

Over the past 15 years we have charted the rise of global wealth and its increasingly larger role in global real estate markets though our annual Wealth Report. Even in the face of the Covid-19 pandemic, this course will not shift.

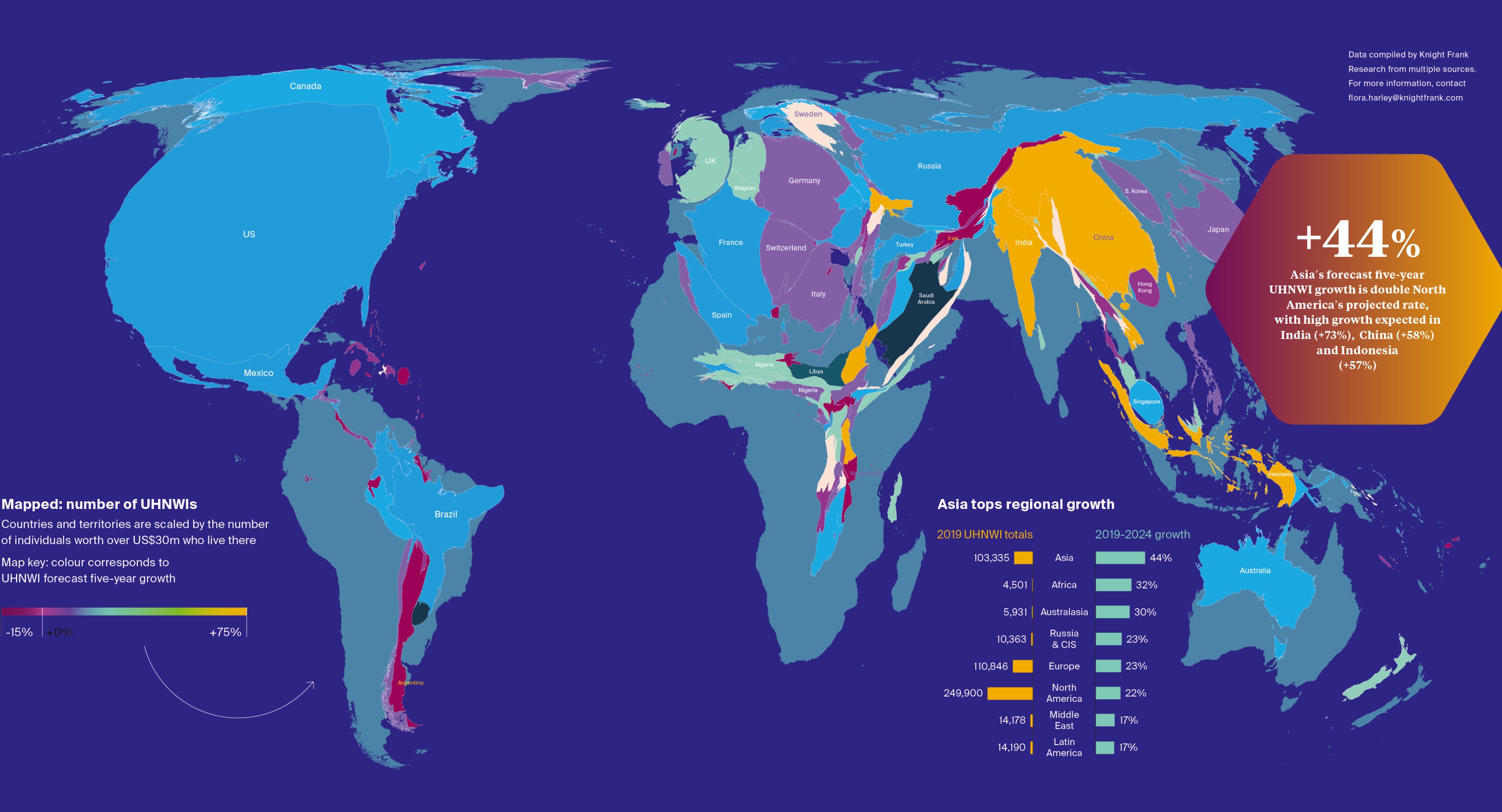

2019 saw an additional 31,000 people become ultra-high-net-worth individuals (UHNWIs), defined as having a net worth of US$30 million+, including their primary residence. Prior to the pandemic we forecast that the number of UHNWIs would rise by a further 27% by 2024. This was led regionally by 44% growth in Asia which is closing the gap on the dominance of North America. To put this in context, the US is currently home to more UHNWIs than Europe and Asia combined.

View The Wealth Report

While we will be revising our forecasts in the upcoming Wealth Report 2021, one thing is clear: we remain optimistic about the prospects for wealth creation and growth, especially in Asian markets where a recovery is well under way. As we enter a new economic cycle with a changing landscape there are opportunities aplenty. We have already had a glimpse of the resilience of wealth in 2020, something else we will be exploring in the upcoming report.

“A record US$333 billion in private capital was invested in commercial real estate markets globally in 2019.”

Click to view image

So why is this important and where will this capital be focused? Private capital targeting real estate is not a new thing but there has been a huge amount of growth in this area. In 2019, a record US$333 billion of private capital was invested in commercial real estate markets globally. This is more than triple the amount of a decade ago and a third of the total market.

Click to view image

The growth coincides with the rising popularity of family offices and their increasing sophistication which allows them to compete with institutions for real estate assets, including commercial property.

Private wealth can be more reactive and agile, as was evidenced in London during the first lockdown, and often has different investment time horizons to that of traditional investors. This, combined with the lower cost of capital which is set to persist, will see more private capital entering the market over the coming years.

As an asset class, real estate is increasingly seen as offering opportunities to gain exposure to different geographies and sectors without relying solely on volatile equity markets.

The favoured asset class has traditionally been the private rented sector, but there is mounting interest in other asset classes, such as logistics and alternative residential, be it student housing or senior living.

London is the world’s number one city for cross-border investment

In terms of the biggest beneficiary of private investments, the US is the top destination overall for domestic and cross-border private investment (US$224 billion), which is unsurprising given the size of the economy and the wealth of the population. When looking just at cross-border, however, the UK sees the second highest volumes at US$5 billion, compared with US$9 billion for the US.

At a city level, it is London. The city has long been top of the target list for private investment and attracts the widest pool of private investors globally as we chart in our City Wealth Index, despite the uncertainty created by Brexit.

Click to view image

When entering the commercial space for the first time or diversifying through times of uncertainty, it is markets that are most familiar and understood where private capital will feel most confident in deploying funds – this often follows where private investors have homes.

“The UK, and London in particular, have long been preferred destinations for second homes by private investors.”

The UK, and London in particular, have long been preferred destinations for second homes by private investors. In The Wealth Report 2020 the UK was most often cited as the number one choice for UHNWIs looking to purchase a home in 2020. This was reiterated in our Global Buyers’ Survey, undertaken in June 2020, where the UK again was the preferred destination.

Click to view image

Resilience of London residential

Many of the factors we look at in our City Wealth Index, such as education and connectivity, are underlying draws for investment. London and the UK remain top contenders in this arena. The buoyancy of the residential super-prime market in London throughout a tumultuous year is testament to that.

Click to view image

There are some important distinctions to note. Private capital can be more reactive to opportunities in the market due to the lower cost of capital and the ability to move without investment committee approval. Furthermore, wealthy investors often have different time horizons to those of traditional real estate investors – broadening the lens of value.

“Private capital will be a bigger force in commercial markets.”

Prime, core, income assets are the target

Private wealth often behaves very differently to institutional buyers and these differences will therefore become increasingly important. The private buyer is drawn towards prime, core, income assets. They are well seasoned investors, but their buying decisions are at times more emotional, driven by personal perceptions of a location, a building’s visual appeal and the tenant profile. This will continue to have a profound impact on core asset pricing.

But as private capital continues to grow in size, it is also gaining in experience and confidence in London. Investors with established portfolios are moving up the risk curve, seeking more value add opportunities. This promises a further shift in pricing for the best of these assets, and one that institutional investors will need to note carefully in the new economic and post-pandemic environment.