Covid-19 Daily Dashboard - 24 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 24 September 2020.

Equities: Globally, stocks are mostly lower. Declines in Europe have been led by the STOXX 600 which has contracted -0.5% over the morning, with the FTSE 250 (-0.3%) and the CAC 40 (-0.2%) also down. However, the Dax is flat over the morning. In Asia, the Kospi was -2.6% lower on close, as was the CSI 300 (-1.9%), Hang Seng (-1.8%), Topix (-1.1%) and the S&P / ASX 200 (-0.8%). In the US, futures for the S&P 500 are flat.

VIX: After increasing +6.4% yesterday, the CBOE market volatility index has gained a further +1.7% this morning to 29.1. The Euro Stoxx 50 vix is also higher, up +1.9% at 27.7. Both indices remain elevated compared to their long term averages of 19.8 and 23.9.

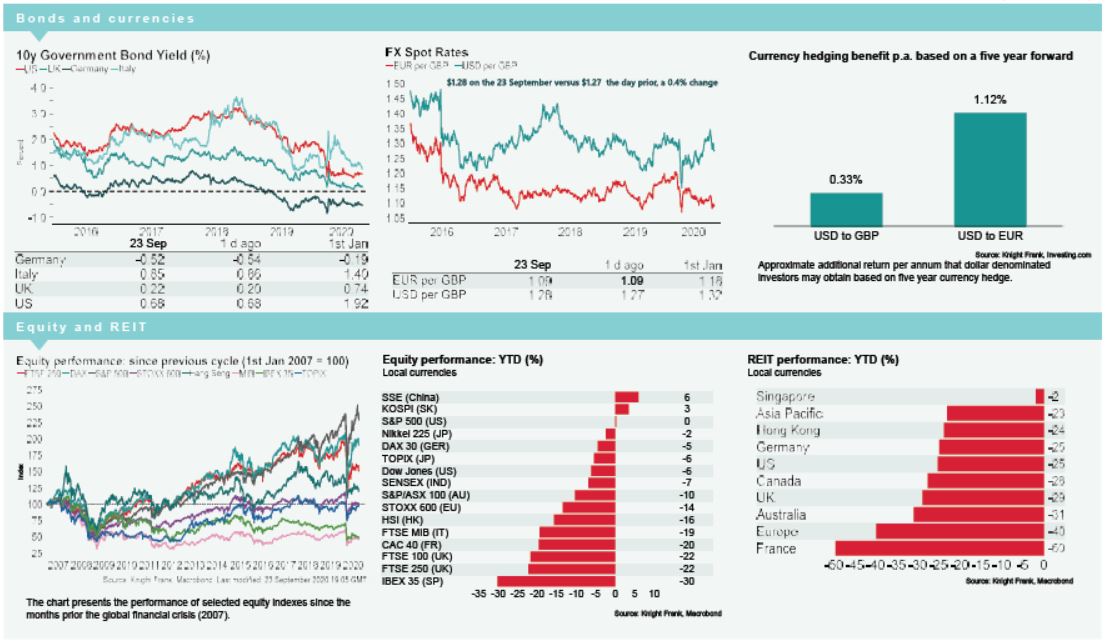

Bonds: The UK 10-year gilt yield and the US 10-year treasury yield have compressed -1bp to 0.21% and 0.66%, while the German 10-year bund yield has declined -2bps to -0.53%. The Italian 10-year bond yield has softened +2bps to 0.87%.

Currency: Sterling has appreciated to $1.28, while the euro has depreciated to $1.16, Its lowest level since July. Hedging benefits for US dollar denominated investors into the UK and the eurozone remains at 0.33% and 1.12% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the fifth consecutive session yesterday, up +4.5% to 1,426. This is index’s largest daily increase in over a month, which was predominantly driven by a +7.9% increase in capesize rates.

UK Job Support Scheme: The Chancellor of the Exchequer has confirmed that a new ‘Job Support Scheme’ will commence on 1st November, in place of the Job Retention Scheme and will last six months. This will be accessible to SME’s. Large firms with a proven decline in turnover over the pandemic will also be eligible.

UK Loan support: A ‘pay as you grow” scheme, extends bounce back loans and government guarantees on business interruption loans to 10 years, with a new guarantee programme to be announced in January. Firms will be able to move to interest only or suspend payments for six months if in “real trouble”, without credit ratings being impacted.

UK VAT: 5% VAT for the leisure and hospitality sectors will be extended to 31 March 2021.