Global Residential Outlook – 7 Aug 2020

A roundup of the latest data and insight across key global residential markets

7 minutes to read

Key takeaway:

Continued outbreaks of the disease are impacting sales volumes in some markets, but prices remain largely resilient. Aggressive monetary policy and low interest rates continues to support demand, but a weaker dollar and government investment incentives will influence wealth flows once travel restrictions ease.

Residential Digest

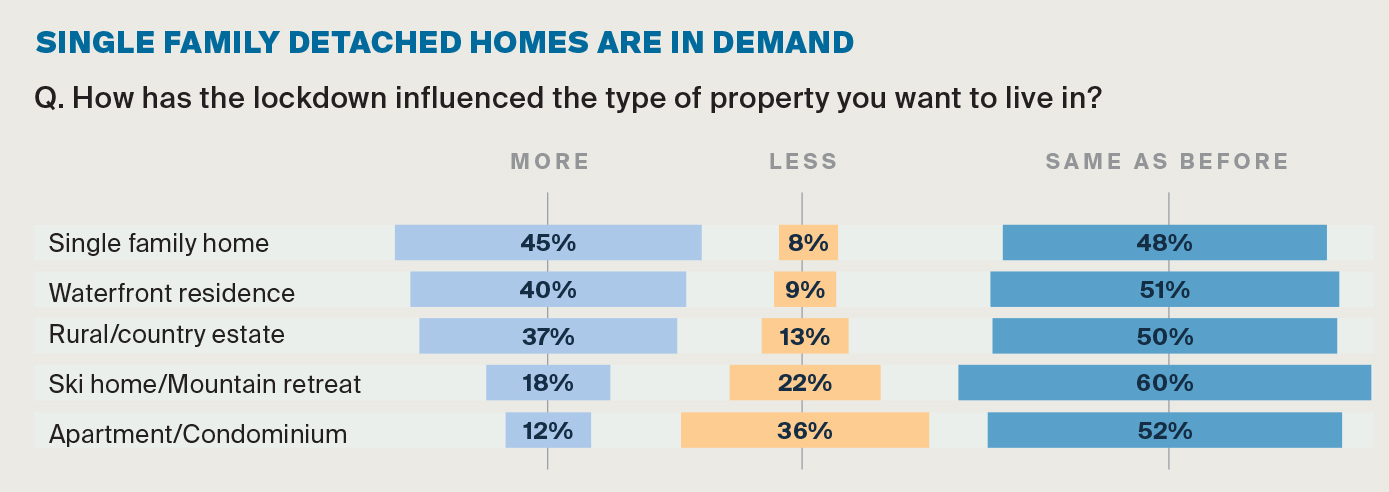

Our newly-released Global Buyer Survey explores what impact Covid-19 has had on buyer attitudes around the world and finds that 45% of respondents are more likely to purchase a detached home post the pandemic.

Need to know

- Globally there are now more than 18.2m cases confirmed of Covid-19 with Latin America accounting for 44% of all deaths. In the last week localised outbreaks have been recorded in parts of Spain, eastern Europe and the Balkans, and in key Australian cities. In the US, the spread of the virus appears to be easing in some of the US states hit hardest in recent weeks. California reported the fewest new coronavirus cases since June, while Florida and Arizona also saw their infections slow.

- July represented the dollar’s worst month in a decade, declining against most major currencies. The pound has climbed to $1.31 against the dollar, nearly 14% above its low point of $1.15 in March. The euro is close to $1.20, up from a low of $1.07 in March.

- Knight Frank’s Prime Global Cities Index which tracks the movement in prime residential prices across 45 cities around the world, recorded its weakest rate of annual growth since Q4 2009. Manila, Tokyo and Seoul were Asia's top performers year-on-year, with Stockholm, Geneva and Paris leading Europe's rankings.

- Travel news is mixed this week with the Trans-Tasman travel bubble now on hold due to Australia’s rise in cases. However, in the UK, EasyJet is increasing its flights over the summer following higher passenger demand, despite concerns over a new surge of coronavirus infections across Europe. The low-cost airline plans to increase its capacity from 30% to 40% in the three months to the end of September.

- Boris Johnson delayed relaxing remaining leisure restrictions on Saturday, hours after imposing new curbs in north-west England.

- In the US, additional unemployment benefits in the US ended last week and policymakers are still trying to agree the next round of stimulus measures to support the economy.

Europe

- In the UK, demand remains strong and offers are getting close to the asking price. The number of new prospective buyer registrations was 94% higher than the five-year average in the week ending 25 July. The equivalent increase in supply was 54%. In UK on average offers were accepted at 98% of the asking price in July, which is a percentage point higher than the same month last year.

- Despite more UK retirement homes in the pipeline, demand will outpace supply. The number of retirement housing units across the UK is to grow by 10% over the next five years, taking total stock to more than 800,000. Despite this growth, the number of retirement homes per 1,000 individuals aged 75+ is expected to drop to 120 by 2024, down from 129 today.

- In Italy, residential sales are forecast to decline by 18% in 2020 year-on-year. Nomisma, the Italian real estate institute, is forecasting that residential sales nationally will reach 494,000 in 2020, down from 603,000 sales in 2019. Italy’s prime market segment is now seeing enquiries and sales strengthen with prices in areas in high demand such as Lake Como estimated to have increased by 5% since May.

- In Spain banks have approved 1.3 million of mortgage and consumer loan moratoriums. Some 1.1 million mortgage holidays had been granted by the end of June with a further 200,000 approved in July according to BrainsRE and data from the Bank of Spain.

Asia Pacific

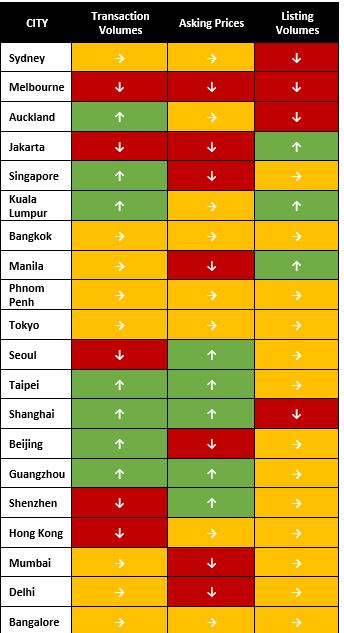

- Residential sales activity across Asia Pacific remains resilient. Seven of the 20 cities we track are seeing an increase in sales activity whilst eight are reporting activity remains the same. Hong Kong and Melbourne, along with three other cities, have seen activity slow as a result of further outbreaks.

How are residential markets across Asia Pacific performing?

- Taiwan has opened an office to help Hong Kongers resettle. Between January and May 2020, there were 3,352 Hong Kong applicants for permanent residence in Taiwan, double the figure in the same period for 2019 according to The Economist.

- Capital Economics stands by its house price forecast for Australia despite rising case numbers. Four months ago, Capital Economics estimated that Australian house prices would fall by 5-10% from their peak. The firm believes this forecast remains accurate for two reasons. First, the recent downturn was very deep, but it was also very short. Outside of Victoria, consumer spending is now on the mend. Secondly, the government’s JobKeeper scheme has limited the damage to the labour market.

- New South Wales has introduced two new initiatives - a temporary stamp duty holiday for first time buyers and a discount in land taxes for build-to rent units. The stamp duty exemption applies to first-home buyers of new homes up to AU$800,000 from 1 August (up from $650,000 currently). Stamp duty relief will also apply, on a scaled basis, to newly-built homes above this threshold. The land tax discount will be the equivalent of at least a 50% reduction in land tax and applies until 2040. To be eligible for the discount, a build to rent development in metropolitan areas must be at least 50 units.

- In India, housing sales in the key eight cities fell by 54% year-on-year to a decade low of 59,538 units during H1 2020. New launches also fell by a sharp 46% to 60,489 units. Knight Frank’s new India Real Estate Report provides a summary of market conditions across both the major cities’ office and residential sectors. India is seeing over 40,000 new cases per day and accounts for nearly 17% of all new infections recorded globally each day.

US & Canada

- In the US, mortgage applications for home purchases slipped in July, despite the 30-year mortgage rate reaching a record low of 3.14%. Tighter lending conditions, shrinking inventories and higher unemployment explain the slowdown. New home sales are one bright spot, they reached a 13-year high in June and continue to outpace resales by some margin. According to Capital Economics, however, the pace of new home sales will start to slow due to delays to housing starts and a surge in timber prices, with the result that new homes sales will close to their current level of 776,000 annualised and reach 780,000 by end-2021.

- Second home markets see a surge in demand in the US. New data shows rental and sales interest in second home hotspots has increased in areas such as The Hamptons, Aspen and Miami since the start of the pandemic. However, interest is also spilling over into less traditional hotspots such as Telluride in Colorado, Fort Lauderdale in Florida and Long Island’s Gold Coast.

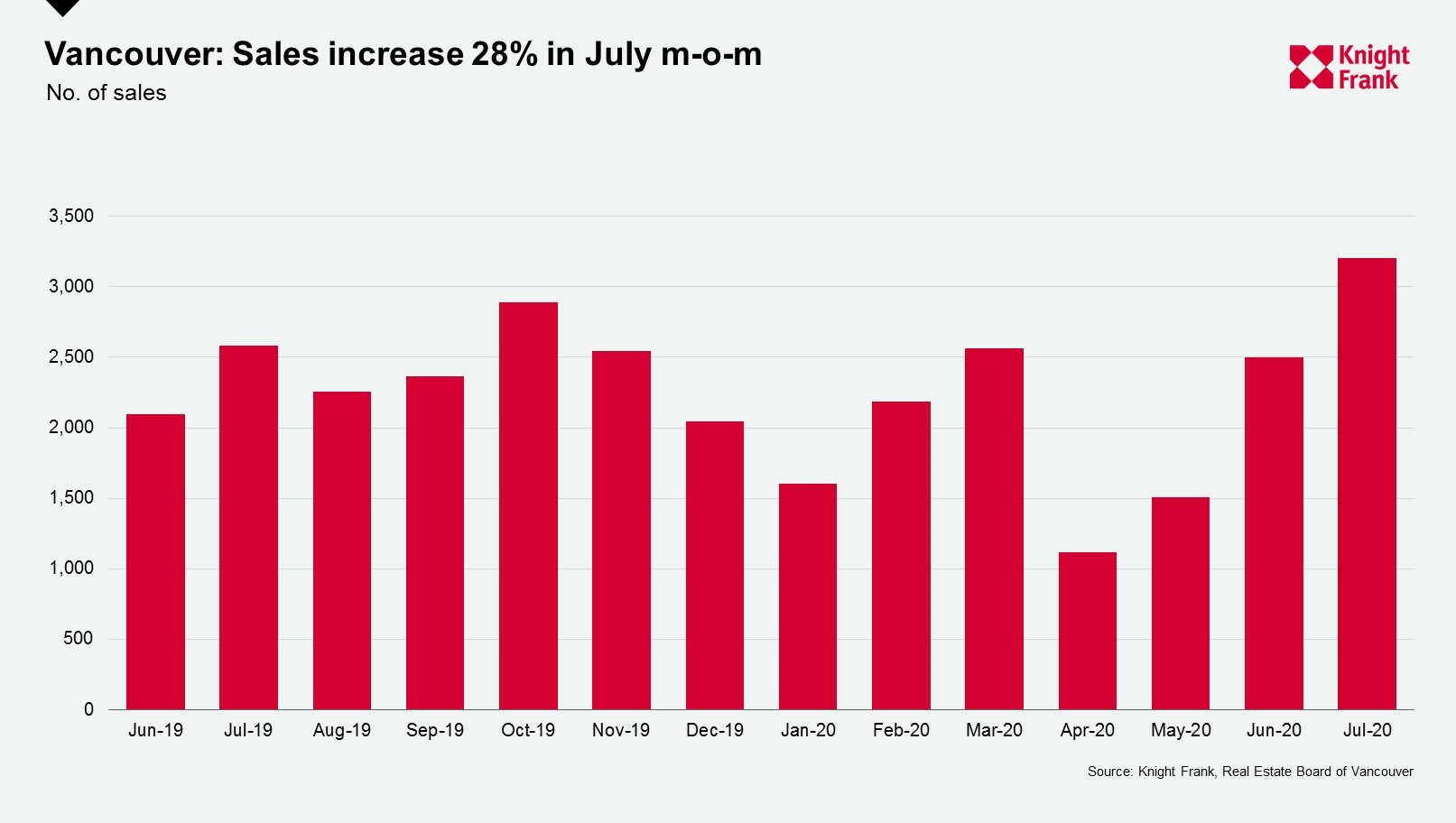

- In Vancouver, sales in July totalled 3,202, the highest monthly sales figure since June 2017. This represents an increase of 28% month-on-month. Low interest rates and limited inventory levels in areas such as East Vancouver, North Vancouver, New Westminster, and Coquitlam are resulting in increased competition. The pent-up demand emerging is not solely due to Covid-19 but from almost three years of the market reacting to new taxes and buyer restrictions.

Middle East & Africa

- Kenya saw prime residential prices and rents decline in the second quarter of 2020 by 5.1% and 7.6% respectively year-on-year. Continued oversupply of residential developments, an unfavourable economic climate, low liquidity and expatriates returning to their home countries are behind the declines.

This week’s recommended listening

Knight Frank’s global Intelligence Talks podcast this week explores how Covid-19 has impacted home buyers around the world, following the release of its 2020 Global Buyer Survey. The episode looks at why US suburban and second home markets are having a moment, what’s driving Hong Kong buyers to acquire homes overseas and the biggest questions affecting UK residential property markets. Listen on Spotify, Acast and Apple.