Knight Frank Asia-Pacific: Residential

Where next for Asian residential investors?

1 minute to read

Real estate markets have struggled to cope over the past four months with the fallout from the COVID-19 pandemic. But with the easing of lockdowns, markets are seeing a strong uptick in enquiries and activity. In recent years Asian buyers and investors have played a key role both in domestic and overseas markets, it is therefore worth considering whether the pandemic will alter where they are likely to go for their residential purchases.

In the face of COVID-19 and global economic uncertainty, more Asian investors are looking to markets which offer safety, diversity and stable income; examples of these include Singapore, Australia and the UK. In our latest residential report, we delve into these markets and why they provide interesting buying opportunities.

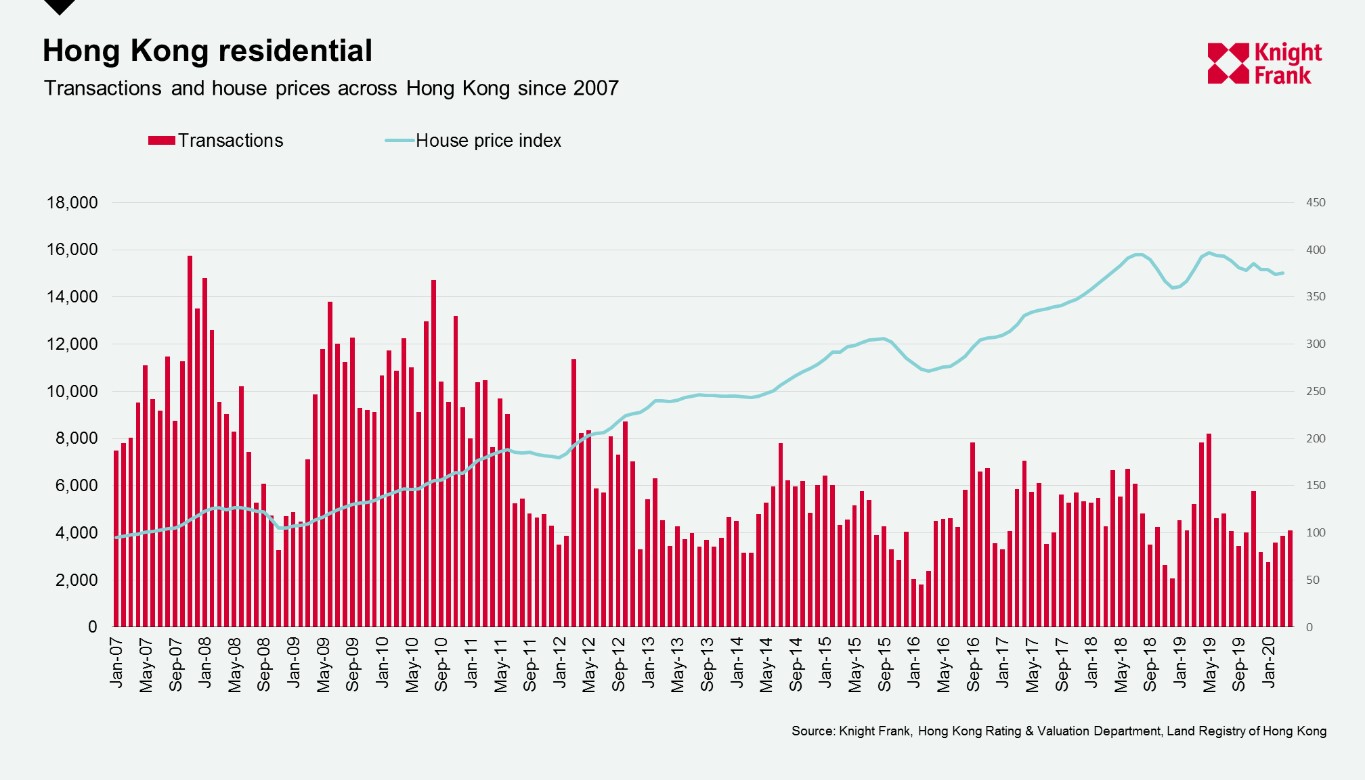

Looking at Hong Kong, the market has experienced a challenging 12 months with the ongoing social unrest that began in 2019, followed by the COVID-19 outbreak. However, the residential market has remained resilient so far, as demonstrated in the chart below.

Over in Singapore, underlying demand remains resilient, prices have not fallen significantly unlike during the Global Financial Crisis (GFC), this is despite a weaker economic outlook due to the US-China trade tensions which has been compounded by COVID-19.

Another two favourite markets for the Asian investors are Australia and London. The report assesses how these markets have performed during COVID-19, compared to post-GFC and what the prospects for growth are going forward.

For more information please see our latest Asia Pacific Residential Highlights - June.