Overseas Property: Where are People Investing?

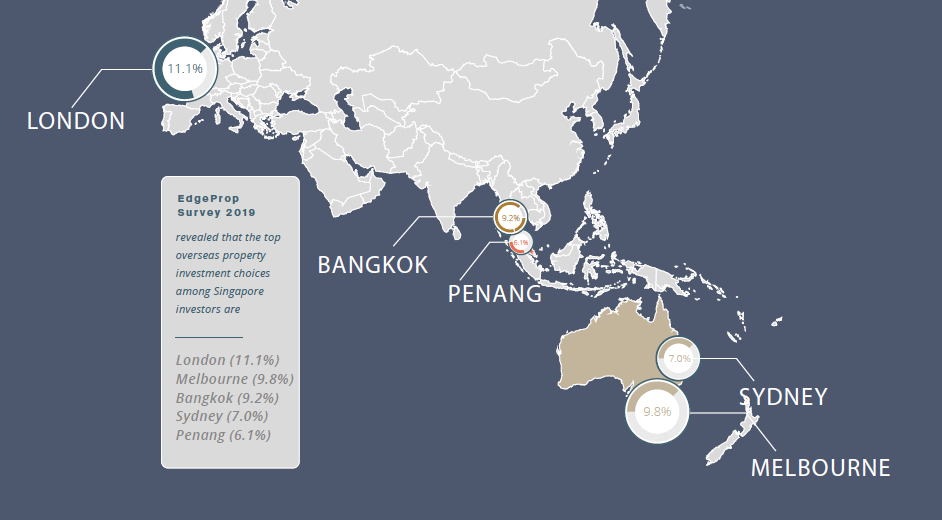

The top five choices among Singaporean investors.

1 minute to read

Real estate is a hard asset, often gaining from the growth and development of economies and experiencing price appreciation during periods of high inflation. Rental income helps to lessen the impact of inflation as rental rates generally rise with the market.

Choosing the right location is crucial. Melbourne and London are popular cities of choice among parents looking to send their children for overseas education. The cost benefits of owning an overseas property versus renting one are multiplied with low interest rates. Parents familiar with local property laws and have lived overseas previously are likely to send their children to the same destinations.

UK home prices have declined due to political uncertainty and higher taxes on non-residents. Prime properties in London continue to generate increased interest as expats consider returning home and possibly purchase a second property. The expected rental yield of 3.5% to 5% in London makes it an enticing city for Singaporean investors to enter into as they weigh between lesser cash outlay versus the additional buyer stamp duty imposed when purchasing a second property in Singapore.

Top Five Choices Among Singapore Investors