What impact will Covid-19 have on student numbers?

Universities, as well as student accommodation providers are keeping a watchful eye on student numbers.

4 minutes to read

The majority of UK university applicants are still planning to start university in the autumn despite ongoing uncertainty around term times and course administration.

Almost nine out of every ten undergraduate applicants surveyed by UCAS, whose role is to operate the application process for British universities, said they still plan to head to university in September or October.

For universities, as well as student accommodation providers, question marks over student numbers (both domestic and international) have been near the top of their list of concerns for some time. Universities are worried about the financial implications of less students this year, with Universities UK suggesting a potential maximum shortfall of £7bn from international students alone.

For PBSA operators income is also a key concern. Many have offered existing tenants refunds and discounts on their accommodation - but there are other costs to factor in, including the liabilities many may have for Council Tax payable on vacant rooms.

The UCAS survey results, which were shared with Knight Frank, will provide some comfort that demand, from domestic students at least, is likely to hold up for the start of the new academic cycle in September.

But what of international students? Nearly 85,000 applications were made by students from outside of the UK to study at university this year, up 12% from 76,000 last year. The Chinese market dominates, accounting for 18% of all international applicants, followed by India and Hong Kong at around 5% each.

UCAS notes that currently (as of Monday 1st June) the live cycle data it is processing on applications does not show any red-flags for international students withdrawing or deferring, though that’s not to say there won’t be a drop off in numbers.

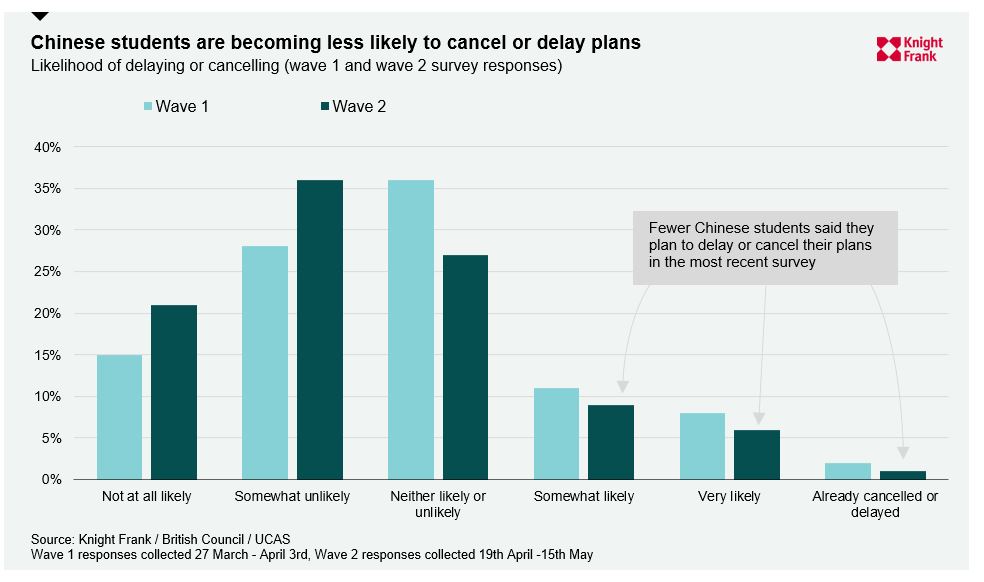

Indeed, the latest in a series of separate surveys by the British Council and UCAS of Chinese students indicates that just 16% of prospective undergraduate students would be either ‘very likely’ or ‘somewhat likely’ to cancel or delay their plans.

Positively, this represents a shift in opinion from a first wave survey conducted at the end of March, where 29% indicated that they were either very or somewhat likely to cancel or delay their plans. Only 1% of respondents have indicated that they had already cancelled or deferred.

Using the response from their surveys, the British Council estimates, as a baseline scenario, that international student enrolments could be 12% lower this year. This equates to 13,600 fewer students from the 2018/19 cycle.

Unite, the UK's largest owner, manager and developer of purpose-built student accommodation, has noted that enquiries from international students had slowed, though in April overall reservation rates for rooms stood at 80%, compared with 81% at the same time last year.

Longer-term, as student priorities change as a result of covid-19 the PBSA service-driven model may well emerge as offering clear advantages over HMO-style accommodation (houses in multiple occupation) which may help offset any reduction in international student numbers.

This is supported by Knight Frank’s 2020 Student Accommodation Survey, which already shows higher levels of retention for second and third year students. Some 75% of students who lived in private PBSA said in the 2020 survey that they would recommend their accommodation to new first-year students, up from 69% in 2019.

Both university and privately operated PBSA are shown to deliver higher value for money than accommodation in the private rented sector. The survey also showed that some 25% of first year students who currently live in private PBSA planned to stay in the same accommodation the following year. Some 40% of second years living in private PBSA said the same.

One key feature of this cycle is that all applicants (regardless of where they are from) are delaying the decision making process. That’s likely to mean an elongated, or later, lettings cycle than would normally be expected, and PBSA operators will need to factor this in.

Although next year is certain to be challenging, the longer-term future for PBSA landlords looks more encouraging.

The number of 18-year-olds in the UK is growing and, alongside record entry rates, this could bring an estimated additional 135,000 home students over the next ten years. Immigration rules are favourable (including changes to the post study work visa), and more people tend to going to university during recessions, as job numbers shrink and students look to ‘up-skill’.