A pulse on the global economy

Across Europe, the virus has now been slowing since early April, according to Johns Hopkins University. Africa, Asia, and South America now represent an increasing proportion of the global Covid-19 cases—currently about 4.5%, 20%, and 16%, respectively, the research organisation said on Tuesday.

1 minute to read

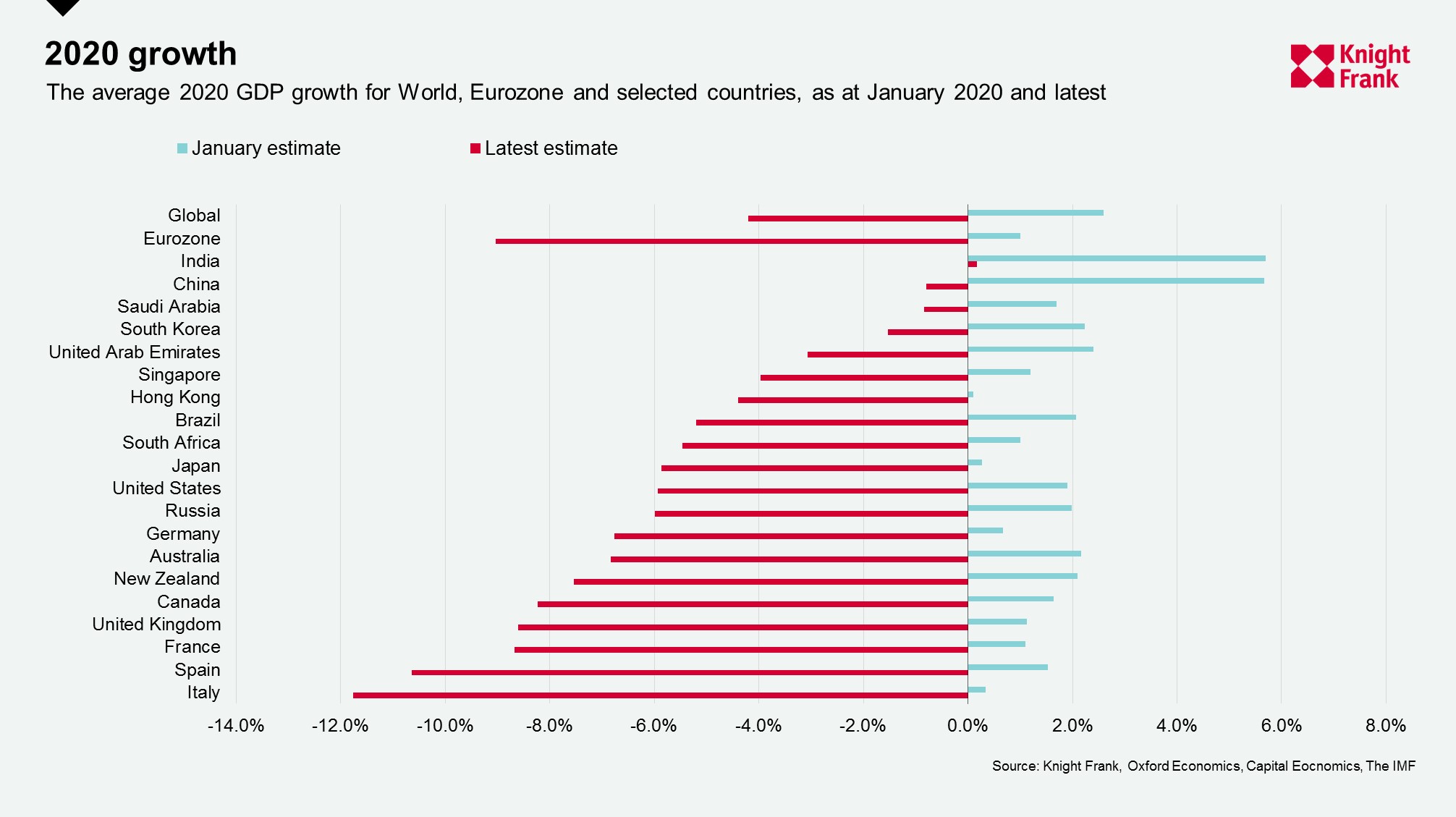

As lockdowns persist so too are the expectations of forecasters. Looking at the World, Eurozone and 20 selected countries the average 2020 GDP revision has shifted downwards by over 7%, and as more Q1 GDP figures emerge these look to be revised downwards again.

Oxford Economics most recent Global Risk Survey, published 4 May, found that 39% expect a global recession to last three quarters, with 31% expecting the global recession to last longer and 15% expecting the recession to last into 2021. Just two months earlier a survey of economists, conducted by Oxford Economics, found that 58% of respondents expected the global recession to last just two quarters. Only 8% predict a “V” shaped recover, compared to 44% in March with 47% anticipating a “U” shaped and 29% predicting a “W”.

Despite the IMF putting out new forecasts in mid-April they will be releasing a downward revision next month. On Tuesday IMF Managing Director Kristalina Georgieva said that “with the crisis still spreading, the outlook is worse than our already pessimistic projection.”

The downgrading and lengthier recession forecasts are likely to be attributed to longer lockdowns and the emerging picture of unemployment. In the US, the official unemployment rate rose from a historic low of 3.5% in February to a depression-era 14.7% in April. The International Labour Organisation estimate that in the second quarter of 2020 there was a global reduction in working hours of 10.5%, equivalent to 305 million full-time employees.

The bigger the fall, the bigger the resurgence. In 2021, the average revision to GDP has been upward of 5%. As more economies emerge from lockdown, the speed in which we see production and consumption return will be one to watch as an indicator for how quick and how big the recovery may be.