Normal Trading Returns in Higher-Value London Lettings Markets

November 2023 PCL lettings index: 218.8

November 2023 POL lettings index: 220.0

2 minutes to read

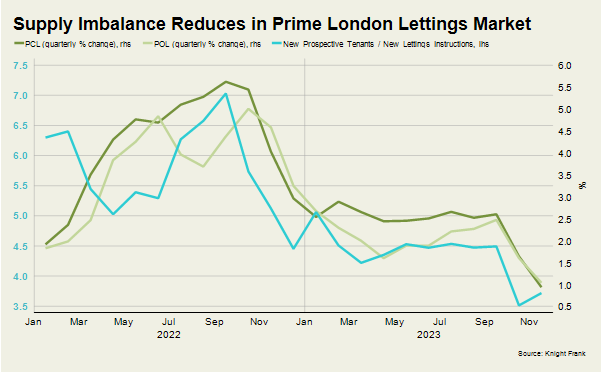

There were 3.7 new prospective tenants for every rental property listed in prime London postcodes last month.

The figure, which shows the strength of demand versus supply, was 5.1 in November 2022.

As supply recovers and demand becomes less intense, that figure should get lower and reduce upwards pressure on rents.

A number of landlords have left the sector in recent years due to extra red tape and taxes, which accelerated as many took advantage of the stamp duty holiday between July 2020 and September 2021. However, supply is recovering as more sellers become landlords in a weak sales market.

New rental listings were 8% below the five-year average in October in prime central and outer London, Rightmove data shows. That has narrowed significantly from a decline of more than a third throughout most of 2022.

As supply has risen, more demand has been absorbed. The number of new prospective tenants fell to 4% below the five-year average in November, a figure that was more than a third higher for most of 2022.

Demand has also been weaker from corporate tenants this year as companies face fast-rising interest rates, although sentiment has improved recently. Business confidence rose to its highest level since early 2022, Lloyds Bank reported last week.

Although more normal trading conditions are returning slowly to most areas, the process is quicker in higher-value markets.

Greater levels of affluence and housing equity means owners are typically more discretionary, particularly in a sales market where prices are largely flat or gently declining.

Under £1,000 per week, the ratio of new prospective tenants to listed properties was 4.7 in November, while it was 2.7 above that level. Meanwhile, the overall ratio for prime central London (PCL) was 3.5 last month, while it was 4.6 in prime outer London (POL).

“We are there or thereabouts in terms of normal trading conditions for markets above £1,000 a week in prime central London,” said David Mumby, head of prime central London lettings at Knight Frank. “It takes 10% to 15% more viewings for a property to let compared to six months ago and although that is putting downwards pressure on asking rents, achieved rents are still breaking records.”

As demand falls in relation to supply, the meteoric rental value growth seen in recent years has calmed down, as the chart shows.

Quarterly growth in prime central and outer London has fallen to 1% from more than 2.5% throughout most of 2023.

Annual rental value growth was 9.1% in PCL in November, while it was 7.7% in POL. In a sign of how far things have calmed down, the six-month percentage change recorded in November 2022 was higher in both markets.