A late autumn boost for the prime London sales market

November 2023 PCL sales index: 5,354.1

November 2023 POL sales index: 272.8

2 minutes to read

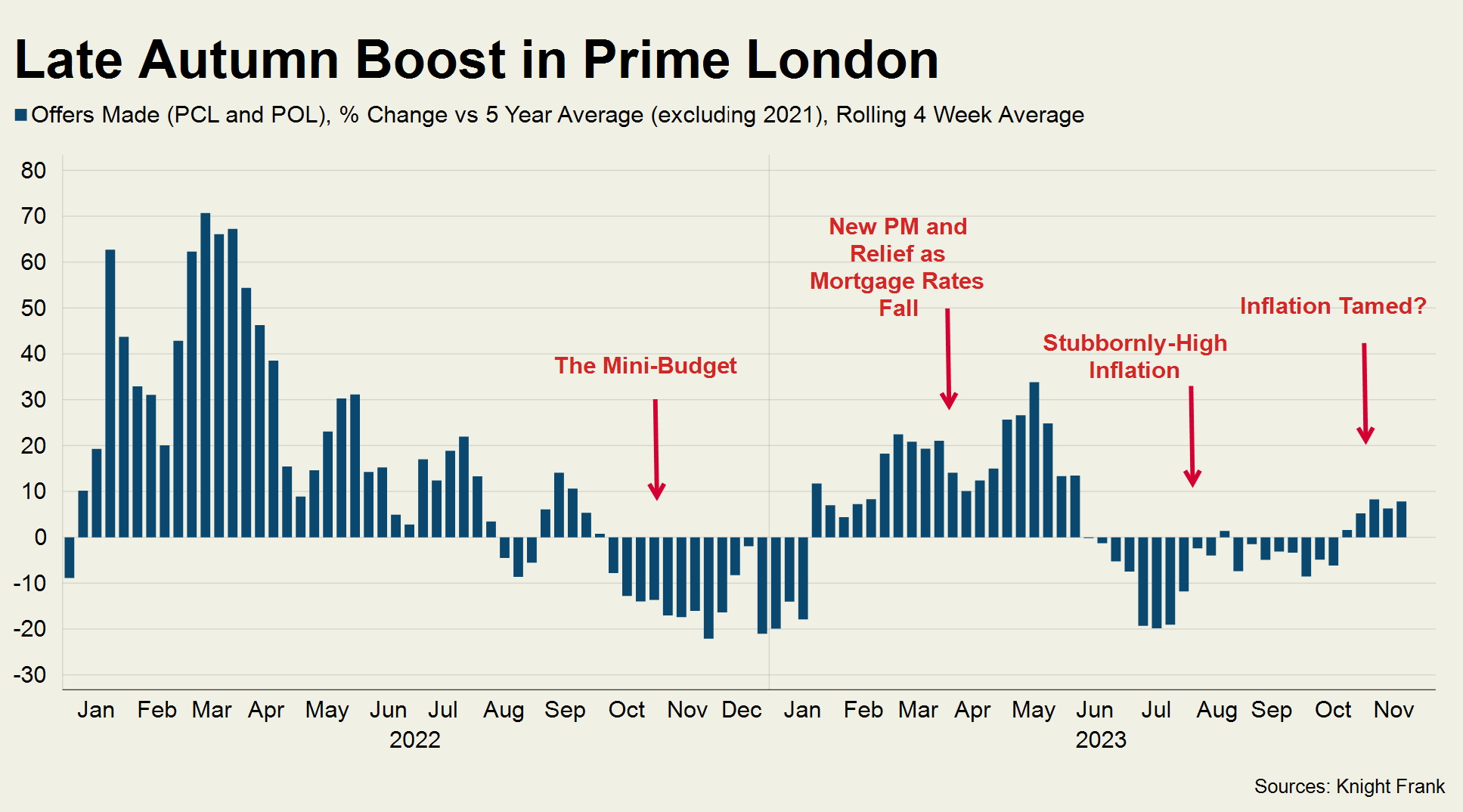

It’s not often you can say the property market was stronger in November than in September, but it was this year.

The reason is simple; the economic outlook has improved over the last three months.

Inflation has fallen to less than 5%, the best five-year fixed-rate mortgage is now under 4.5% and speculation around the bank rate increasingly relates to the timing of the next cut rather than the size of the next rise.

Buyer sentiment has been lifted and produced a very belated autumn market. The signs increasingly point to a bounce next spring, provided a general election is not called in the first half of 2024.

The Nationwide reported the third consecutive monthly increase in UK house prices in November, tallying with data from the Halifax. Numbers can jump around in a thin market like this, but if we are not at the bottom of this particular downturn, we must be close. Even mortgage approvals beat expectations in October to reach a three-month high.

The early Christmas cheer has also been felt in London’s prime postcodes, as the chart shows.

The number of offers made is a good indicator of buyer sentiment and it has been more than 5% above the five-year average in recent weeks, removing the effects of various stamp duty holiday deadlines in 2021.

Meanwhile, London continues to outperform the rest of the UK, largely because prices grew by relatively less during the pandemic. Average prices in prime central London are 17% below their last peak in mid-2015 while prices in prime outer London are down by 8% compared to mid-2016. At the same time, the Nationwide UK index is 19% higher than it was before the pandemic in February 2020.

As a result, the number of new prospective buyers was 7% higher than the five-year average in the three months to November in London, which compared to a decline of 10% across the UK.

Furthermore, the number of exchanges was up 5% in the capital during the same period but 16% down across the UK, Knight Frank data shows.

Price declines remain limited as sellers have hesitated during the recent period of economic uncertainty. Average prices in PCL fell by 1.8% in the year to November, while there was a 1.5% decline in POL.

While the appetite of buyers and sellers should increase in 2024, at some stage this will be interrupted when Rishi Sunak calls the general election. The big question is when.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here