London's changing skyline

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

New towers

Ten new towers are being planned in the City of London, including eight that are at pre-application phase, the Evening Standard revealed last week. “They are all substantial buildings that will change the skyline of the City once more – or add to it,” Shravan Joshi, chairman of the City’s planning and transportation committee told the paper.

That might sound counter-intuitive given the macro-economic climate, the uncertainty as to where office occupancy levels will settle long-term, and the revaluation of office buildings underway, however, these projects will likely be delivering the kind of high quality, green space that occupiers increasingly desire.

London-wide, just over 11 million square feet of office space was being built out speculatively as of the end of Q2 last year, about 4 million sq ft below long run averages, according to Knight Frank data. Should take up reach this long-run norm, that would leave a shortfall of best-in-class space of about 8.9 million sq ft.

Evidence suggests global occupiers are increasingly moving towards an "office first" approach - see Disney's announcement yesterday. Indeed, we are now getting to the sharper end of the discussion around future workstyles amid a softening jobs market, as Lee Elliott wrote last month. We expect occupancy rates to shift steadily upwards from their current global rates of circa 40% and back towards pre-pandemic levels of around 65%.

Sticky inflation

“I’ve spent enough time around Wall Street to know that they are culturally, institutionally, optimistic."

So says Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, when asked by the New York Times about financial markets pricing in rate cuts by the end of the year. Indeed, from Europe to the UK to the US, optimism is growing that the great inflationary period may not play out as badly as we all feared. Positive signs are everywhere - see my colleague Will Matthew's note on the decline in natural gas prices that will ease inflation in both the UK and Eurozone, or last month's cooler-than-expected reading from the US. Consumer expectations about the path for prices in Europe have largely receded back to their long-term trend already, according to official figures.

Are we getting ahead of ourselves? Some of the world’s largest asset managers including BlackRock, Fidelity and Carmignac think so. Carmignac believes we're entering a cycle more akin to that seen between 1966 and 1980, when two energy shocks fuelled double digit inflation in the US. Central bankers at the Fed and the ECB have sought to calm expectations this week. The UK, too, faces particular challenges:

"The distinctive context that prevails in the UK – of higher natural gas prices with a tight labour market, adverse labour supply developments and goods market bottlenecks – creates the potential for inflation to prove more persistent," the Bank of England's Huw Pill said on Monday.

Anyway, we'll know a lot more later today when we get the latest inflation reading from the US Bureau of Labor Statistics. Stocks rose yesterday, so Wall Street is feeling optimistic.

Lending

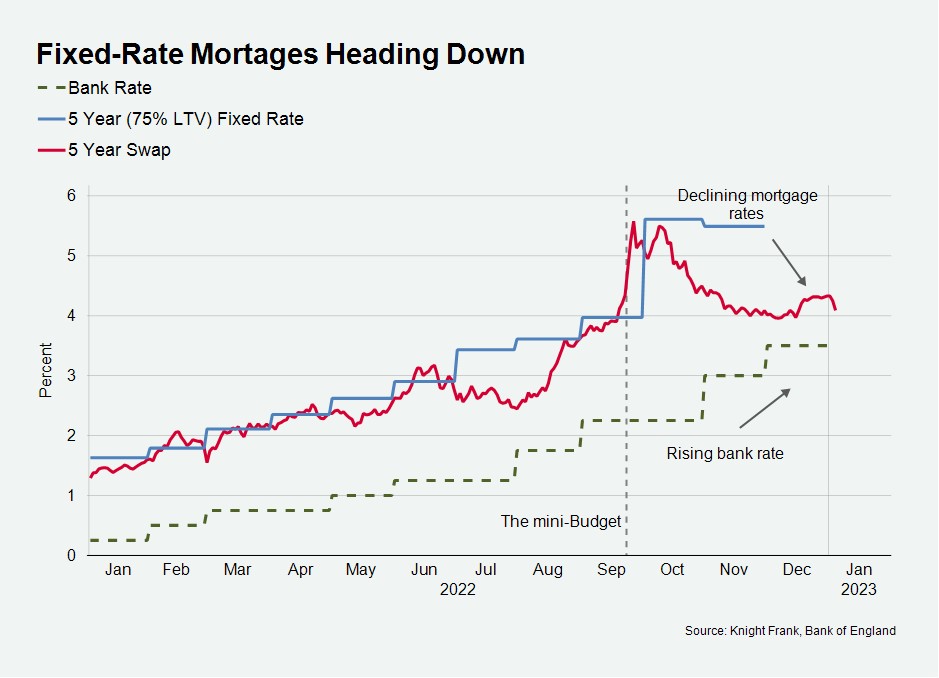

Mortgage rates are likely to continue easing through January (see chart) - we touched on the first lenders to cut rates last week. Speaking with colleagues at Knight Frank Finance yesterday, the best two year trackers were available at 3.99%, while the best five year fixed products were available at 4.36%.

Borrowers navigating the market today may feel like they are trying to hit a moving target. Tom Bill considers a few strategies in his note this week.

The regulatory arm of the Bank of England warned lenders in a letter to be vigilant this week, singling out retail credit card portfolios, unsecured personal loans, leveraged lending, commercial real estate, buy-to-let, and lending to SMEs as particular causes for concern:

“The impact of increasing interest rates, inflation and high cost of living, geopolitical uncertainty and supply chain disruptions is expected to pose challenges to firms’ credit portfolios...Firms need to be ready for a prolonged period of stress.”

Hotels

Hotels have had a tough few years. Some £3 billion of hotel transactions took place in the UK during 2022, according to Knight Frank data. While that’s about 30% below the five-year average - future indicators look more positive.

Subdued investor sentiment contrasts with the strong growth and recovery of hotel trading performance in 2022. The pandemic has been an accelerant of structural change - more than 19,000 rooms permanently closing during the past two years. Combined with slower growth in the hotel development pipeline, that's created a favourable backdrop for future investment.

"We have seen an uptick in investor activity at the end of 2022 and purchasers who are proactively seeking out opportunities now are well placed to move quickly when new stock becomes available," says Henry Jackson, Partner and Head of Hotel Agency at Knight Frank. "Investors are showing renewed signs of confidence in the London hotel market, with overseas purchasers benefitting from currency plays".

In other news..

World Bank predicts eurozone growth of 0% in 2023 amid global slowdown (Times), and finally, leave climate change to the politicians, says Fed chief Jerome Powell (Times).