Track mortgage market not house price data to get timing right in 2023

Reading the small print in a mortgage offer may prove more beneficial than waiting for house prices to bottom out.

4 minutes to read

For anyone attempting to time a house purchase correctly in 2023, phoning your mortgage broker could prove more valuable than analysing the latest house price data.

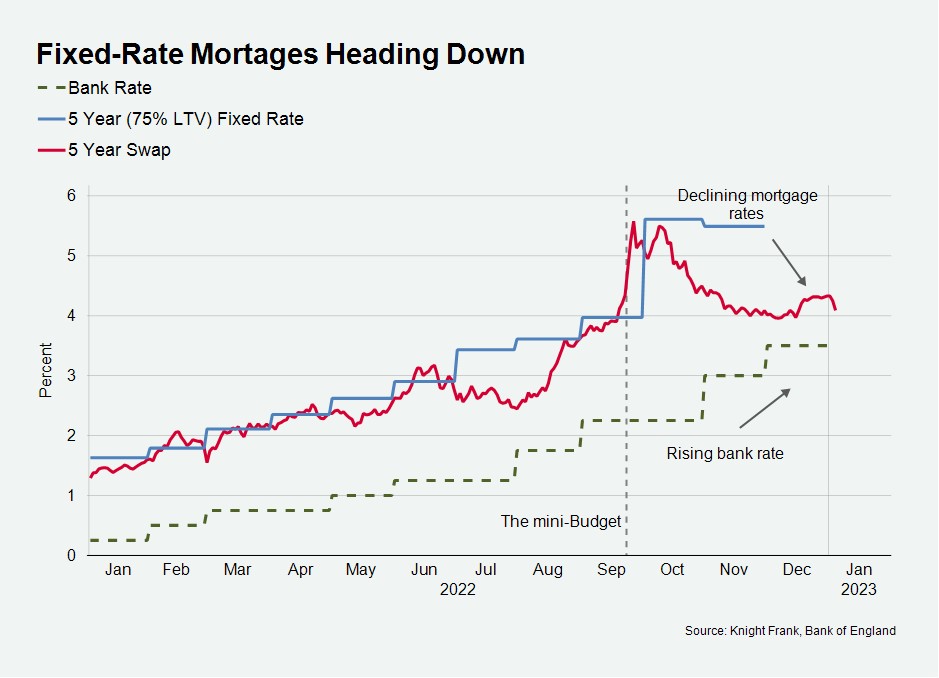

Mortgage rates are edging back down after September’s mini-Budget prompted a spike of more than 150 basis points.

Meanwhile, the bank rate is heading in the opposite direction after UK inflation reached double digits for the first time in 40 years, as the chart shows. It marks the end of 13 years of cheap debt following the financial crisis.

Against this confusing backdrop, taking the right mortgage at the right time could prove more fruitful than waiting for prices to bottom out.

Patience may pay

A five-year fixed-rate mortgage is currently priced at around 4.5% compared to more than 6% in October.

Rates will continue to drift downwards as the effects of the mini-Budget work their way through the system, though we are unlikely to see a five-year rate starting with a ‘3’ any time soon.

That said, buyers can agree an improved mortgage offer any time before the completion date, provided they allow a fortnight or more for the paperwork.

“It’s not widely-known, but buyers can switch mortgage products even after they exchange contracts,” said Ben Sherriff, head of London at Knight Frank Finance. “We have customers who missed out on lower rates before the mini-Budget, need to do something in March, have a back-up plan in place but will see how late they can wait for improved terms.”

Cheapest isn’t always best though, adds Ben. “A broker will know whether the terms and conditions are suitable for a particular buyer and which banks can move quickly.”

Fixed or variable?

Buyers may also want to look at a wider range of options than last year. Tracker rates, for example, have gone from 75 to 100 basis points over the bank rate to 25 to 35 points as demand has risen, said Ben.

If a buyer wants a mortgage rate starting with a ‘3’ that may be the best option for now, though some may still prefer the certainty of a fixed rate, especially with the Bank of England likely to continue raising rates in 2023.

Some tracker products are penalty-free and certain lenders will be able to switch to a fixed-rate more readily than others. The message again: stay close to your broker.

For those thinking longer term, it’s worth bearing in mind that while the Bank of England isn’t expected to start lowering rates in the short-term, the US Federal Reserve may do so later this year, with the UK possibly following suit next year, a theme explored in more detail by my colleague Flora Harley here.

Calling the bottom for prices

Timing your mortgage offer correctly may be more rewarding than attempting to call the bottom for prices.

Anyone trying to predict the trajectory for house prices in 2023 should start by ignoring any data from 2022.

Last week, we learned there was a sharp drop in mortgage approvals in November. Data from Halifax showed that monthly price declines following the mini-Budget had narrowed but an annual drop in house prices is imminent.

However, the fact many buyers and sellers pressed the Christmas pause button early last year due to the mini-Budget doesn’t tell us much about what will happen this year.

The great recalculation

Price declines will become more widespread, and sales volumes will come under pressure later this year as more buyers recalculate their financial position, but the downwards trajectory will be gentler than anything seen in the chaotic final quarter of 2022, as explored here.

For context, it should also be remembered that more homes were owned outright in England and Wales (8.1 million) in 2021 than with a mortgage (7.4 million), according to census data released last week. A third (32.8%) of homes were owned outright in 2021 compared to 30.8% a decade earlier.

It means downsizers and cash buyers will be in a stronger position this year, as we explore here.

The readjustment to the new rate environment will continue into 2024 as more people come off fixed-rate deals and we expect price declines to last into next year, which means picking your moment this year is not straightforward. That said, an overall 10% decline would mean prices only revert to where they were in summer 2021.

Irrespective of what may happen to prices, many will need to move for personal and professional reasons and the scope for altering the timing of their purchase will be limited.

Which is another reason to stay close to your broker in 2023.